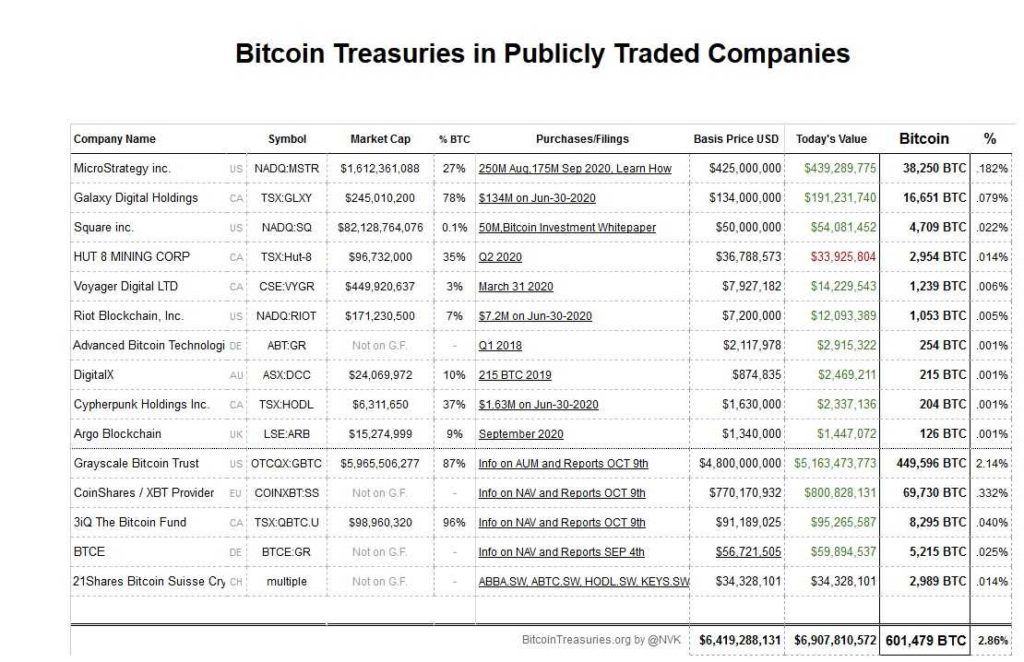

A total of 13 publicly traded companies now have Bitcoin in their financial assets. This amounts to $6.9 billion, although the main investor remains Grayscale.

Would publicly traded companies stop distrusting Bitcoin and cryptocurrencies in a context of devaluation of fiat currencies? It is still too early to say. Nevertheless, the value of these assets in the accounts of these companies is increasing.

Bitcoin Treasuries thus identifies 13 companies whose shares are traded on the stock exchange. They all have in common that they all own Bitcoin. In total, these assets now represent 6.9 billion dollars.

These include MicroStrategy, a software company, Galaxy Digital Asset Manager, and Jack Dorsey’s Fintech Square. The latter recently announced a $50 million investment in Bitcoins.

But more importantly, the payment company is delivering a method to execute this type of cryptocurrency acquisition to other companies. Nearly $7 billion in Bitcoin to the portfolio of listed companies, however, is not much.

First of all, because the most important Bitcoin holder among these 13 players is Grayscale. A specialist in investing in crypto-actives for institutional investors, Grayscale holds 4.9 billion dollars in Bitcoin alone.

However, Grayscale does not own these funds. The company regularly purchases Bitcoin, as well as other cryptocurrencies such as Ether, on behalf of its customers. Grayscale thus has 5.8 billion assets under management.

While companies like MicroStrategy do invest their cash in Bitcoin, they remain exceptions. The publisher now owns 38,250 Bitcoins, with a total value of $425 million (including fees).

But MicroStrategy is an isolated case. The other 12 listed companies on the Bitcoin Treasuries list are all active in the crypto and blockchain markets. Having cryptocurrency is almost a given for them.

Bitcoin is not an ordinary investment product for individuals or companies. However, 64% of the institutional investors are considering a slight increase in their crypto-investments during the next 5 years. 26%, on the other hand, even anticipate a considerable increase in these investments.

While this number may seem frightening, the day has not come yet when major institutional players will take control of the king of cryptocurrency.