Elon Musk has triggered the most significant correction in Bitcoin since the 2021 bull run. The fall is accentuated by the panic of new investors.

Tesla boss Elon Musk is currently making a splash in the cryptocurrency market. And this is probably not to the liking of investors. His tweets about Bitcoin’s energy consumption are causing a sharp correction in the asset’s price.

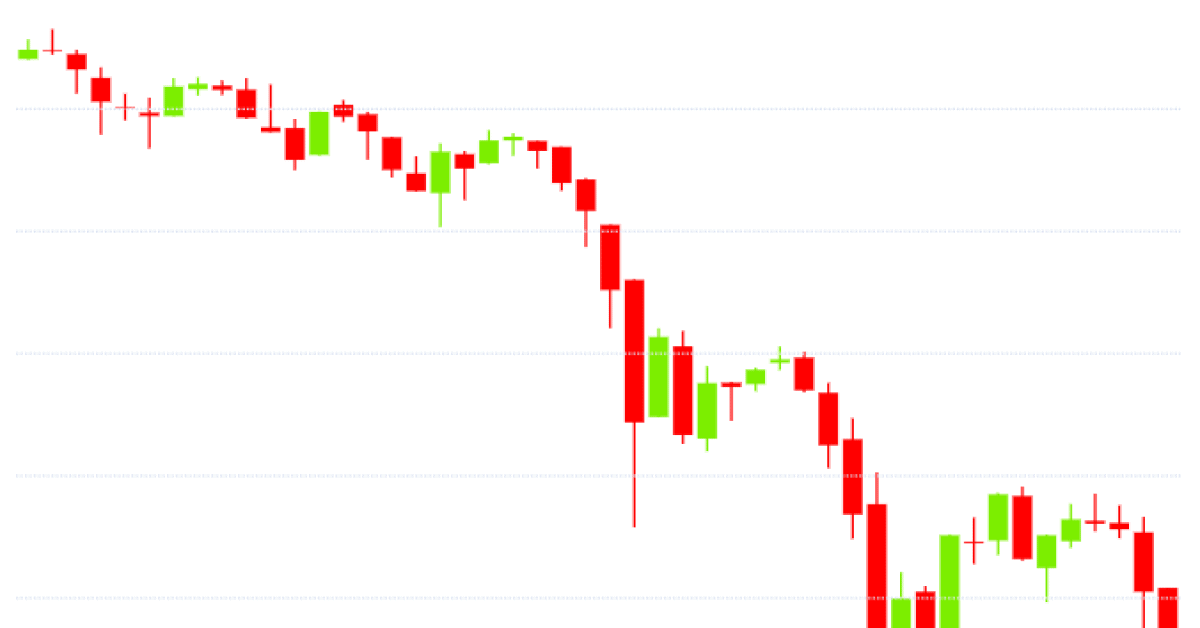

During week 20, BTC was losing 26.1% according to Glassnode. The first cryptocurrency started the week at $59,463 and ended it at around $43,900. This fall undermines the bull market of 2021, which had lasted for about 200 days.

Is this drop comparable to the one in 2017? Not at this point. “This is the deepest correction in the current bull market, but it is consistent with five major pullbacks during the 2017 rally,” comment the experts at Glassnode.

If Elon Musk is the trigger of this correction, he is not the only actor. It is explained above all by the panic that affected new entrants to the market. These investors sold en masse, recording net losses in the process.

Long-term investors, on the other hand, did not take part in the decline. This is reflected in “a notable bifurcation of reactions”. Thus, newcomers to the market are selling in a panic and making losses.

As for long-time holders, they “seem relatively unaffected” by the news and comments from Tesla and its leader. The numbers bear this out and they are impressive. Thus, 1.1 million addresses have liquidated all their bitcoins during the correction.

For Glassnode, this is further evidence “that panic selling is currently underway. This phenomenon had already occurred in 2017, with the consequences that we know. One major difference persists, however.

In 2017, short-term investors held a more significant share of the Bitcoin in circulation. Their sales therefore had a more profound effect on the value of the crypto asset. These holders recently held 28% of the BTC supply, or 5.3 million tokens.

That’s 9% less than in 2017, however. But couldn’t this panic nevertheless affect long-term investors as well? Not necessarily. On the contrary, it can be an opportunity to accumulate more Bitcoin at a lower price.

According to analysis of the flows on Coinbase, the exchange of choice for U.S. institutional investors, “large buyers are actively accumulating during this correction. “In fact, the number of addresses in accumulation has increased by 1.1% since the recent low.