A recent institutional player in Bitcoin, Guggenheim expected a long-term value of $400,000 for crypto-active. But the road ahead will, it seems, be a bumpy one. Its investment director does not believe in a new ATH in 2021.

Bitcoin’s surge in recent months has prompted many predictions about its future value. The hedge fund Pantera Capital estimates that Bitcoin’s trajectory will take it to $115,212 by next August.

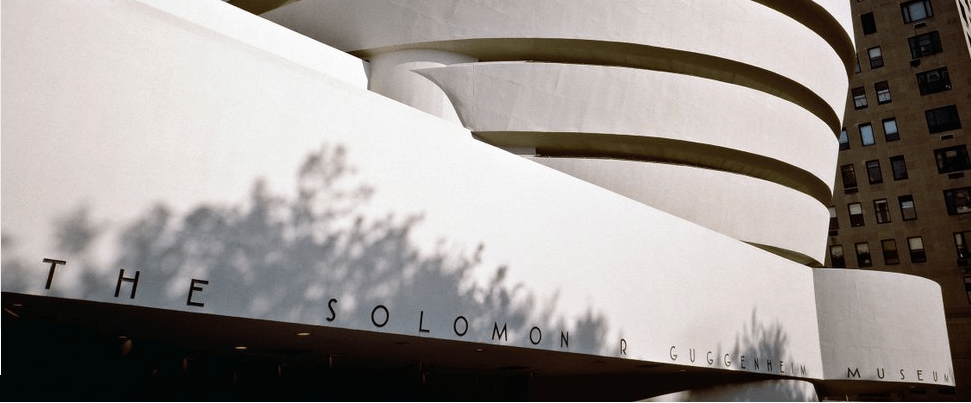

Another institution, Guggenheim Partners, is also enthusiastic. But perhaps it is now time to talk about the past. In mid-December, its investment director Scott Minerd spoke of a realistic price target of around $400,000.

Is Scott Minerd, however, in the process of radically revising his opinion? Asked about CNBC, the investor is indeed much more cautious, even pessimistic. According to him, Bitcoin will not set a new historical record in 2021.

The 42,000 dollars reached by the cryptocurrencies on January 8 should therefore not be crossed again before 2022 at the earliest, Minerd said. “I think we’ve probably reached the peak for Bitcoin for next year or beyond,” he says.

Worse, he doesn’t rule out a sharp downturn in assets. “And we’re likely to see a complete pullback to the 20,000 level,” says Guggenheim Partners’ chief investment officer.

However, this is not a complete reversal of investor opinion. Already on January 10, he issued an initial warning. Scott Minerd predicted a decline in the value of BTC in the short term.

Bitcoin’s “parabolic rise is not sustainable in the short term,” he analyzed. “Let’s admit that the upward euphoria of the first week of January was excessive and it is this ultimate acceleration that was sanctioned. »

The BTC started a lateral pause phase this January, a trading range that takes the form of a triangle configuration. From an academic technical point of view, it is a continuation pattern, so if the market goes out of it at the top, Bitcoin will reach $40,000; invalidated in case of a bearish resolution of the pattern,” he continued this week.

The statements of the Guggenheim Partners executive are in any case causing a reaction within the crypto-sphere. Indeed, it’s difficult to reconcile such opposite predictions as a $400,000 Bitcoin and a second at $20,000.

In any case, Bitcoin is currently down 5% with a value close to $33,000. Over the last 30 days, BTC has remained on an upward trend of 45% according to Coingecko.