One more institutional is preparing to diversify its portfolio in favor of Bitcoin. Through its Macro Opportunities Fund, Guggenheim Funds Trust plans to devote up to 10% of its assets to the Grayscale Bitcoin Trust (GBTC).

64% of institutional investors expect a slight increase in their crypto-investments over the next 5 years. 26% are even more enthusiastic.

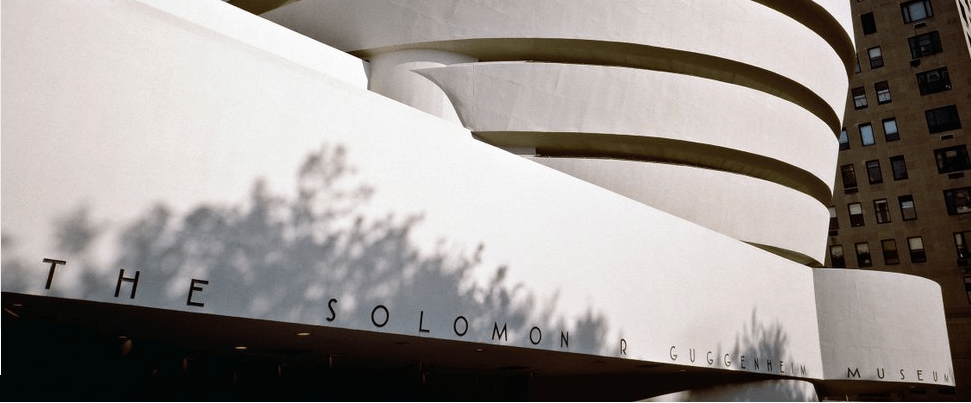

The Guggenheim Funds Trust is expected to be one of these institutional investors. However, it will not buy Bitcoin directly. Through its Macro Opportunities fund, it plans to invest in cryptocurrency through the Grayscale ETF.

It informs the US financial regulator, the SEC, that the Macro Opportunities Fund may devote up to 10% of its net assets to the Grayscale Bitcoin Trust (GBTC). The asset manager will therefore be able to acquire Bitcoin on behalf of its clients.

With assets valued at $4.97 billion according to Fidelity, Macro Opportunities’ entry into GBTC could represent a total investment of up to $497 million.

For the Guggenheim Funds Trust, the investment in Bitcoin could be a first step before further investments. However, the manager and investment advisory specialist is not a lightweight in the sector.

Guggenheim Partners has total assets of more than $233 billion in fixed income, equity and alternative strategies,” said CoinDesk. For Grayscale, this represents a new growth opportunity.

The asset manager continues to amass Bitcoin for its investors. In mid-November, Grayscale acquired an additional 15,114 Bitcoins for $241 million. Its Grayscale Bitcoin Trust (GBTC) then posted a grand total of 506,000 Bitcoin for the impressive sum of $8.2 billion.

According to Grayscale Investments’ Chief Operating Officer, Michael Sonnenshein, the craze for Bitcoin is no longer a fad. The asset now represents a credible option for all investors.

“I think they now understand that buying Bitcoin and storing it in their portfolio is a way to store value, protected against inflation, much like digital gold (…) much more suited to the digital world we live in,” Sonnenshein says.