For an average price of $59,339 and $15 million, MicroStrategy acquires 253 more bitcoins. The publisher, a benchmark for BTC cash, now holds more than $5 billion worth of cryptocurrencies.

MicroStrategy’s purchases are a further indication of Bitcoin’s future rise. The company is making a new acquisition of tokens on the open market. It is spending an additional $15 million.

In a document to the SEC, MicroStrategy announced the purchase of 253 BTC, for an average price of $59,339 per unit, including fees and other expenses. The company now owns 91,579 bitcoins.

In total, since last August, the American firm has spent $2.23 billion in cash to acquire Bitcoin. The average price paid for these tokens: 24,311 dollars. It is therefore realizing a very substantial capital gain.

Bitcoin is currently around 60,000 dollars. And according to various observers, including JPMorgan, it could end the year at over 100,000 dollars. This is still a forecast though. But this investment is already proving to be profitable.

MicroStrategy’s $2.2 billion is now equivalent to over $5.4 billion in cryptocurrencies. But the value of this investment isn’t the only one seeing growth. The publisher’s stock is also benefiting.

After the announcement of this new BTC purchase, the stock was up over 3%. MicroStrategy’s fate is now closely linked to that of the leading cryptocurrency. To gain exposure to BTC, investors are buying shares in the company.

“We believe that those who invest in the stock should do so with the understanding that their investment is highly correlated to the price of bitcoin,” an analyst at BTIG pointed out. Now, the firm estimates that BTC could reach $95,000 by 2022.

What’s good for Bitcoin is also good for MicroStrategy. And the company’s investments are further evidence of that. Its purchases have already contributed to the asset’s price growth and institutionalization.

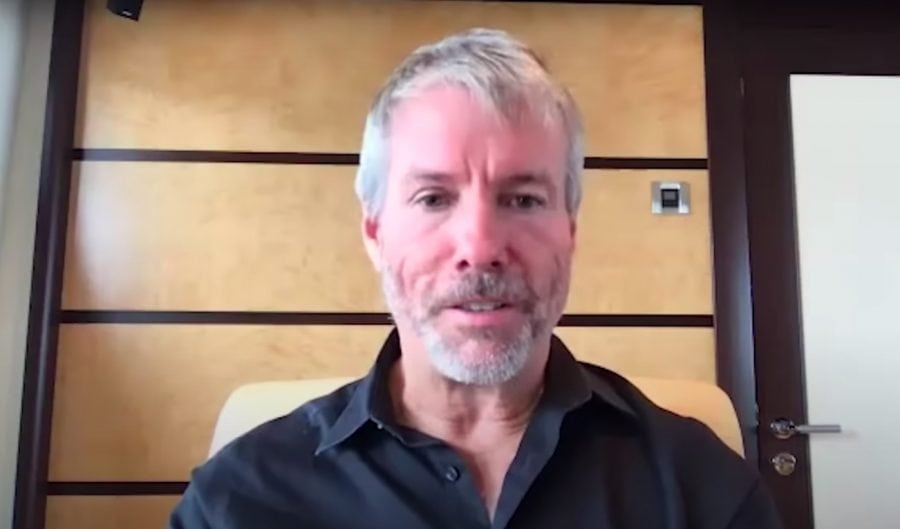

The first investment was made last August. It was in the amount of $250 million. For its CEO, Michael Saylor, Bitcoin is “a reliable store of value and an attractive investment asset with long-term appreciation potential greater than cash. ”