A Bitcoin giant with over $1 billion in cash invested in BTC, MicroStrategy hosts a 2-day seminar for 1,400 companies. The objective: to share the keys to an alternative financial strategy.

Not many companies publicly announce that they are investing their cash in Bitcoin. MicroStrategy is probably the most famous of them all. The software publisher even went into debt by hundreds of millions of dollars to acquire more Bitcoin.

Are other companies ready to take the plunge? It’s too early to tell. However, it is now obvious that the subject is of great interest within organizations. The high attendance at MicroStrategy’s webinar can attest to this.

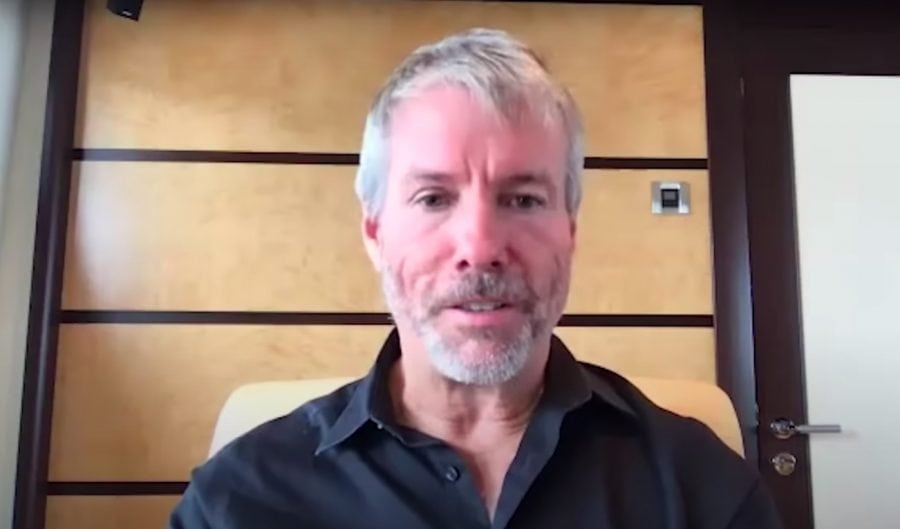

“If you are interested in the legal considerations that companies face when integrating #Bitcoin into their corporate strategy, you are not alone. Professionals from more than 1,400 companies will be joining us,” says its CEO.

This event has been running online since February 3 and will end today, February 4. The topics addressed on this occasion are numerous and diverse. Of course, the discussions will focus on strategies for integrating Bitcoin into cash reserves.

But the discussion also addresses accounting, tax, legal and auditing issues. How many of the participating companies will decide after this webinar to actually invest in Bitcoin?

Impossible to say, of course. The democratization of such a practice, especially among listed companies, would have a direct impact on the price of BTC. For example, in order to grow by about $40,000, Bitcoin would need all S&P 500 companies to allocate 1% of their cash to assets.

Such a goal still seems very far away. However, Michael Saylor’s arguments will no doubt not leave business leaders indifferent.

“There is a strong macroeconomic wind blowing. It will affect $400 trillion in capital. This capital is in devalued fiat instruments,” warns MicroStrategy’s CEO.

“This capital is going to want to be converted into hard money,” adds the boss, quoted by Cointelegraph. And in a context of massive printing of money, Saylor believes that every company is faced with a choice.

It can either decapitalize, a form of self-destruction according to him, or on the contrary recapitalize. How to do this? Thanks to “an asset that will appreciate faster than the rate of expansion of the money supply. This is where Bitcoin comes in. »