What is DASH?

Like many currency focused altcoins, DASH wants to improve on Bitcoin. While Bitcoin was originally envisioned to be a peer to peer cash system, it has steadily been veering off towards the store of value direction instead. Bitcoin can be slow and expensive to transact with but it has grown in value over the years and is seen as a good hedge for inflation of fiat currencies. This is just like how gold is and why people claim Bitcoin to be digital gold. If this is the case, there currently exists a gap in the market for usable digital cash. DASH, short for Digital Cash, focuses on this day to day payment function.

DASH was launched in 2014 by Evan Duffield. It is a fork of the Bitcoin client and still remains open sourced. It has already rebranded itself twice already. It was originally called Xcoin which was rebranded to Darkcoin before it was finally rebranded to DASH in 2015. Although Evan Duffield is no longer part of the executive team, he plays an advisory role. The current CEO is Ryan Taylot who has an extensive background in the financial industry.

What sets DASH apart?

DASH has a couple of advantages over Bitcoin that are very focused on the payment aspect. It offers faster transactions, much lower fees as well as private transactions.

Transaction Speed.

Bitcoin’s confirmation time per block is on average 10 minutes. Sometimes, exchanges or merchants will require more than 1 confirmation before considering a transaction valid. This can be troublesome for everyday use cases like coffee buying. DASH’s confirmation time is around 2.5 minutes. While this may be fast, it’s still not fast enough. So DASH allows users to send transactions almost instantaneously through a feature called InstantSend. Instead of going through the blockchain, the transactions are processed and validated by Masternodes which is a second layer on top of the proof of work mining mechanism. This novel approach makes DASH function just as like handing over someone cash.

Lower Fees

Using cash should have little to no fee. Imagine paying cash to someone or some coffee shop and getting charged an extra amount just to pay cash. With Bitcoin, the average transaction fee is currently at $0.39 and this can go even higher especially during times of higher network activity. Due to DASH’s architecture, they are able to charge a lower fee. DASH currently charges around 0.000048 DASH which is equivalent to $0.0036 USD.

Private Transactions

While blockchain allows transparency of transactions, not everyone wants the whole world to see what they have been buying or where they have been sending their money to. DASH offers private transactions through their PrivateSend feature. It is done through their 2nd layer masternode network. It is generally a coin mixer feature that grants DASH fungibility meaning the network will not show your transaction history. This means your transactions can’t be tracked by curious 3rd parties or organizations snooping around.

How does DASH Work?

Proof of Work

DASH uses a Proof of Work consensus mechanism, just like Bitcoin. This is the process where miners contribute hashpower to the network in exchange for rewards in the form of the transaction fees and rewards from the network. But on top of it, they added a second layer of masternodes which is where the InstantSend and PrivateSend functions happen.

ASICs (Application specific integrated circuit) are seen as a threat to decentralization for Proof of Work based networks. These are industrial mining machines that can provide orders of magnitude more computing power compared to CPUs and GPUs. The rise of these ASICs removed smaller players that run CPU and GPU systems a chance to help secure the network and also get rewarded. DASH uses a Hash function called X11. Unlike Bitcoin which uses the SHA-256 cryptographic algorithm, the X11 is a combination of 11 different hashing algorithms. DASH hoped that this will fend off ASIC machines. This allowed DASH to remain ASIC free for a few years but has eventually succumbed to ASICs with the rise of X11 ASIC machines. They have not updated their mining algorithm since.

Masternodes

Masternodes are servers that support the network backed by collateral held in DASH. They host full copies of the blockchain and form the second layer to the network. They are designed to provide advanced services (e.g. InstantSend and PrivateSend) and governance functions for the DASH network. To run a DASH masternode, candidates must hold at least 1,000 DASH. This allows them to put skin in the game so their decision will be what’s best. In return, these operators receive regular payment for the services they provide to the network. They can also vote each month on up to 10% of the block reward to fund community projects supporting the Dash ecosystem. There are currently 4,691 masternodes running in the DASH network.

Network Rewards

Since DASH is supported by both miners and Masternodes, rewards are split between them with 10% set aside for the DASH core group which develops and funds projects that support and promote the DASH network. Both miners and Masternodes get 45% each of the total rewards coming from the network.

DASH DAO

A DAO is a decentralized autonomous organization. Like most organizations, a DAO will not work if it has no proper incentive. The Dash DAO uses the 10% it receives from mining to invest as the DAO chooses. This also includes the salary of the developers, staff and executives. Masternodes get to vote on how to allocate this 10 percent of the block reward. Masternode acts like a board of directors deciding who to hire and what to do and where the organization should go. Since they have 1000 DASH in collateral, they have incentive to make sure the organization is properly run.

Key Metrics

| April 2020 | |

| Price of DASH | $73.69 USD |

| Avg. Block time | 2 min 38 sec |

| Reward per block | 3.11 DASH |

| Circulating supply | 9,441,849 DASH |

| Max Supply | 18,921,005 DASH (Assuming full treasury allocation) |

| Total Wallets | 1,372,499 wallets |

| Avg. Transactions per hour | 828 |

| Avg. Transaction size | 12.93 DASH (~$952 USD) |

| Avg. Transaction Fee | 0.000048 DASH ($0.0036 USD) |

| Hash Rate | 5.282 Phash/s |

DASH’s Timeline

Jan 2014 – DASH network goes live as Xcoin

July 2014 – Darksend (later on called PriavteSend) was introduced

Dec 2017 – DASH reaches all time high price of $1,493

Jan 2019 – DASH InstantSend was made default

May 2019 – Chainlock feature was introduced (streamlines on chain information while preventing 51% attacks)

Where can I buy DASH?

Auto generated

How to properly store DASH?

Dash has its own main network. This means that you cannot store your DASH in your Bitcoin or Ethereum wallet. You will have to get or generate DASH’s own wallet. You can identify a DASH wallet address since it always starts with an X followed by 33 alphanumeric characters.

Hardware Wallets – auto generated

Online Wallets – auto generated

Real world use cases (Who’s using it?)

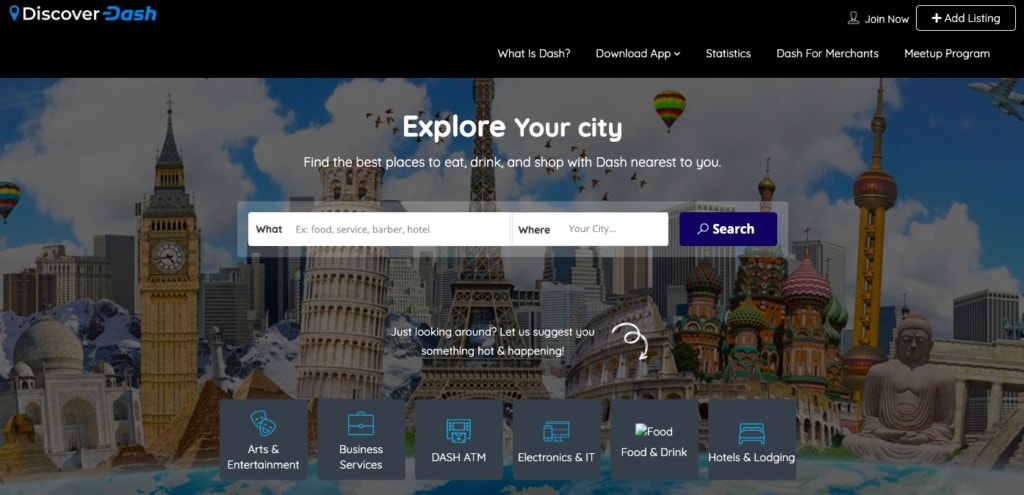

As a form of digital currency, DASH’s lifeblood is based on the number of merchants accepting it. Right now, DASH has over 4000 businesses accepting it, the majority of which are spread across North America and Europe. They have a handy website called Discover Dash – Explore Dash Merchants & Events Near You!. Just enter your city and see what merchants accept DASH.

Pros and Cons

Pros

- It offers privacy sending through their PrivateSend function.

- It offers almost instantaneous (4 seconds) transactions through their InstantPay function.

- Very low transaction fees

- Their governance structure is decentralized and properly rewards supporters.

Cons

- Speculations that there is a significant number of DASH nodes being run by the developers themselves

- Adoption has been slow especially since it’s been one of the oldest cryptocurrencies

FAQ

Confirmation time

2.5 minutes

Transaction Time

4 seconds using InstantPay

Transaction fees

Transaction fees have been consistently below 1 cent with a current average transaction fee of around 0.000048 DASH which is equivalent to $0.0036 USD.

Block Rewards Reduction

DASH network adjusts their rewards every 383 days. Block rewards decrease by 7.14%. The last halving happened in April 2019 and currently distributed 3.11 DASH per block.