In the race to go public, Coinbase has been investing its cash in cryptocurrencies for years. Its balance sheet includes, for example, $230 million in Bitcoin and $53 million in Ether.

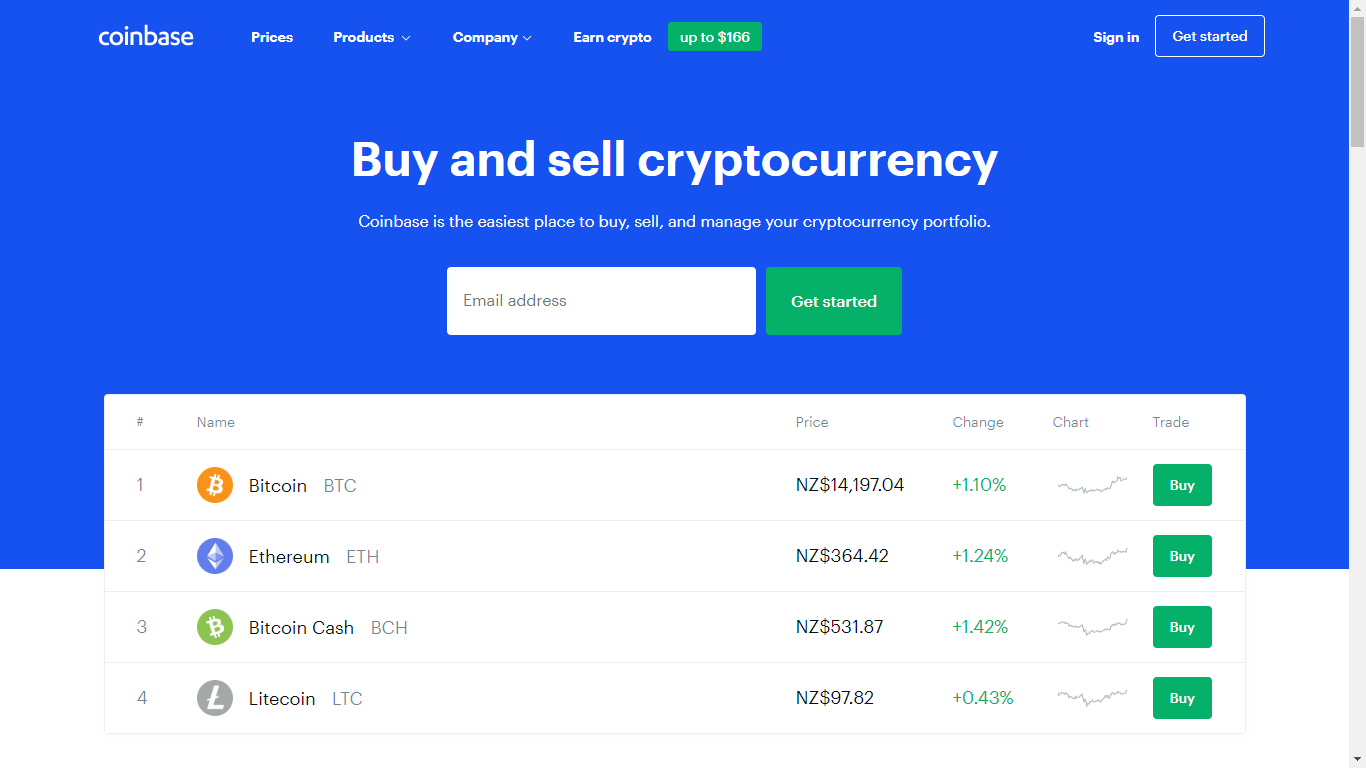

Bitcoin and Ether are no longer the sole preserve of traders. Companies are now also allocating part of their cash to crypto-assets. The most notable case is Tesla with 1.5 billion dollars.

However, companies have been implementing this strategy for many years now. Coinbase is one of them. For a crypto expert exchange, this may seem obvious. However, the firm remained discreet about it until today.

But Coinbase is preparing its IPO. Within this framework, the exchange is publishing its accounts. We discover that the company has had crypto on its balance sheet since 2012. And it intends to use it as a commercial argument.

“Since its creation in 2012, Coinbase has had bitcoin and other crypto-assets on its balance sheet – and we plan to maintain an investment in crypto-assets because we strongly believe in the long-term potential of the crypto-economy,” says Brett Tejpaul, Head of Institutional Sales.

Coinbase plans to use its experience in this area to provide consulting services to companies. Its goal is to offer them “a trusted solution to add crypto to their cash flow. »

And according to the document (S-1) published as part of its IPO, Coinbase therefore has a significant amount of cryptocurrencies in its accounts. In particular, the exchange has 230 million dollars in Bitcoin.

But it also does not neglect the second crypto in terms of capitalization with 53 million dollars in Ether. However, Coinbase is diversifying its portfolio. Thus, it holds multiple cryptocurrencies, including 48.9 million dollars in USDC, and 34 million in other unspecified tokens.

Coinbase thus ranks as one of the leading companies currently holding a portion of their cash in Bitcoin. The two largest are MicroStrategy, with an investment valued at over $4 billion. After a $1.5 billion purchase, Tesla already has $2.6 billion in BTC capital.

The exchange hopes to participate in the democratization of crypto within companies and thus fuel its growth. For institutions, it is a question of protecting themselves against “new risks”. And this includes “a diversified and sufficiently covered balance sheet compared to the traditional capital markets and the weakening of the currency. »