Overview and History

If there’s one exchange responsible for jumpstarting the whole crypto futures trend, it’s BitMex. BitMEX is a derivatives only trading platform offering leveraged contracts, margin trading and futures trading. BitMEX was built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. It was founded in 2014 by Arthur Hayes, Ben Delo, and Samuel Reed and is operating under HDR Global Trading Limited. They are based in Seychelles but have offices around the world like Hong Kong and USA. Bitmex currently handles around $4B worth of volume daily. They also rank #1 in terms of open interest for derivatives exchanges currently sitting at $1.3B.

Supported countries

BitMex’ service are available in all countries except: United States of America, the province of Québec in Canada, the Hong Kong Special Administrative Region of the People’s Republic of China, the Republic of Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea or Sudan.

KYC

One of the things that draw users to BitMex is that they do not require any KYC. This is a huge plus for investors that would like to stay anonymous. Setting up an account can be fairly quick with very minimal red tape. It takes less than a few minutes to open an account and start trading.

BitMex Products

Bitmex testnet / Sandbox

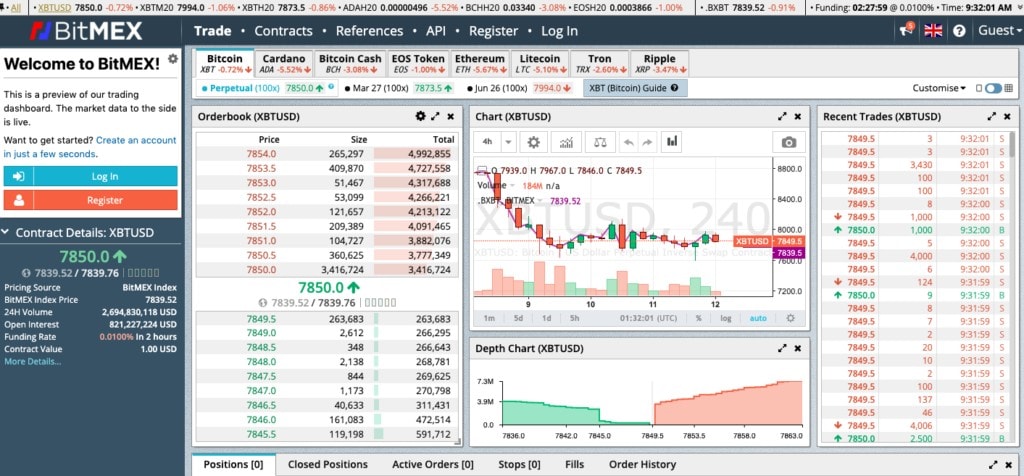

Logging into BitMex and seeing the interface for the first can be daunting. Everything is flashing so fast given the animations and the amount of volume that goes through BitMex. Luckily, beginners can take advantage of the testnet which acts like a simulated trading version of BitMex. Instead of a red and blue logo, the testnet version is green and blue. This helps users easily identify if they are on the real BitMex platform or on the testnet. With the testnet, you can do simulated trading and get a feel for the platform before actually trading with your funds.

Accounts on BitMex testnet are separate from the main BitMex exchange. You will have to register separately. After successfully registering, your wallet will automatically be funded with 0.01 testnet BTC/XBT. You can also receive more testnet tokens by going to the accounts section. Copy your testnet XBT address and click on one of the three links seen right above. You will be redirected to these testnet faucets. Enter your testnet address there and you will receive your tokens afterwards.

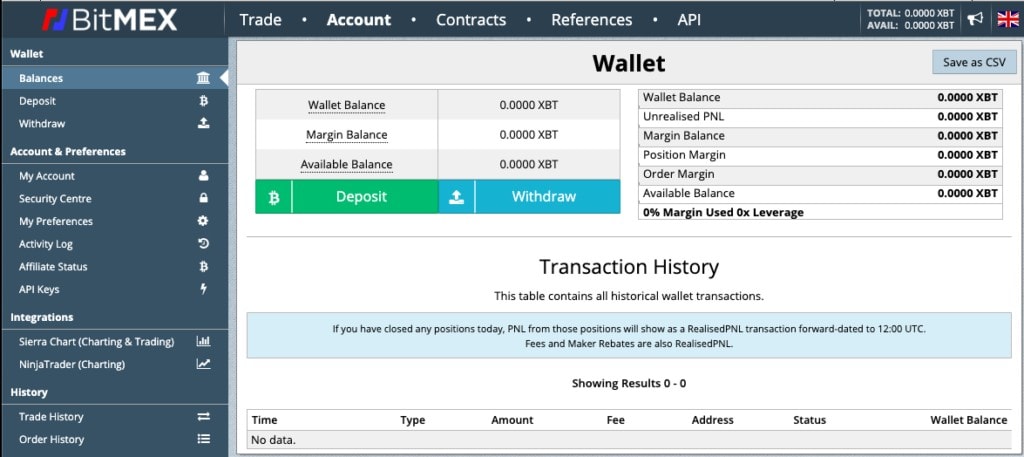

Bitmex Wallet and Mobile App

Currently, BitMex does not offer an official Mobile App. As for the wallet built into the website, note that Bitmex is a BTC settled exchange. All transactions are done in BTC including trading pairs, deposits and withdrawals.

BitMex Main Derivatives Exchange

Unlike most exchanges that offer spot trading, BitMex is a crypto derivatives exchange that offers only leverage trading namely: Perpetual swap contracts and Futures contracts. They do not offer spot trading. You will notice that they have very few pairs available. Right now, they offer 8 different tokens to trade with plus a total of 12 trading pairs since some coins will have perpetual as well as futures contracts.

Derivatives trading allows you to trade derivatives of an underlying asset. You are not buying the asset per se but rather a derivative of that asset. With derivatives, exchanges can offer higher leverage trading for users. You can buy more than your balance allows but with it also carries the risk of possible liquidation. In normal spot trading, your balance will never go to zero unless the underlying asset goes to zero. But with leverage trading offered by derivatives platforms, you can get liquidated depending on the leverage you use. Using a 10x leverage, a 10% move in an asset can either double your holdings or bring it to zero. Bitmex offers upto 100x leverage trading on some of the trading pairs.

Perpetual Swaps

Perpetual Swap is a crypto asset derivative product that mimics the spot market price. There are small price variances but it is often miniscule. Traders can long or short a position to profit from the increase or decline of a coin’s price. This is a useful tool as well for hedging and managing risks.

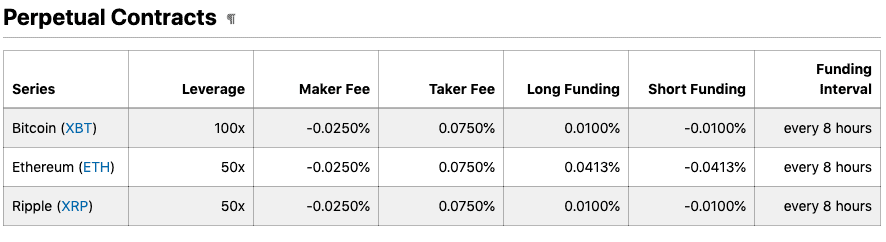

The key difference between Perpetual Swap contracts and Futures contracts is that there is no expiry for Perpetual Swaps contracts. A funding mechanism is used to anchor the Perpetual Swap mark prices to the spot price. Maker and taker fees are at -0.025% and 0.075% respectively.

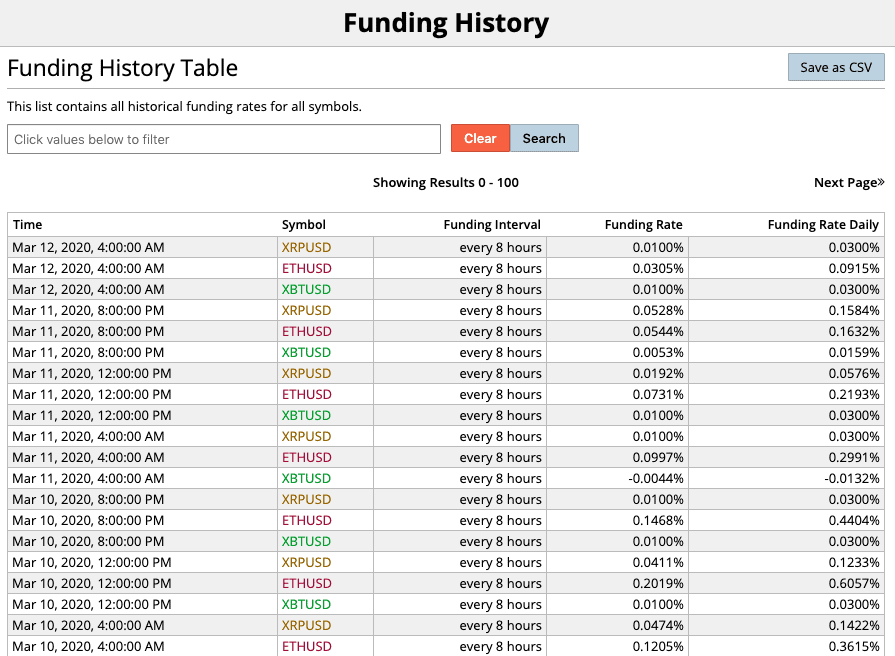

Funding Fees

Funding fee is a fee exclusive for trading Perpetual Swap contracts that is added on top of maker and taker fees. The funding fee essentially works as a mechanism to reach spot price equilibrium. When there are more buyers (long position) than sellers (short position), the funding fee is positive. This means those in a long position will pay the funding fee to short sellers. And if there are more short sellers, the funding fee is negative and short sellers pay those in long. You basically get rewarded for going against the majority. This fee is calculated and deducted every 8 hours. For more details as well as a computation check out this link. Perpetual Contracts Guide: Funding Rate Calculation

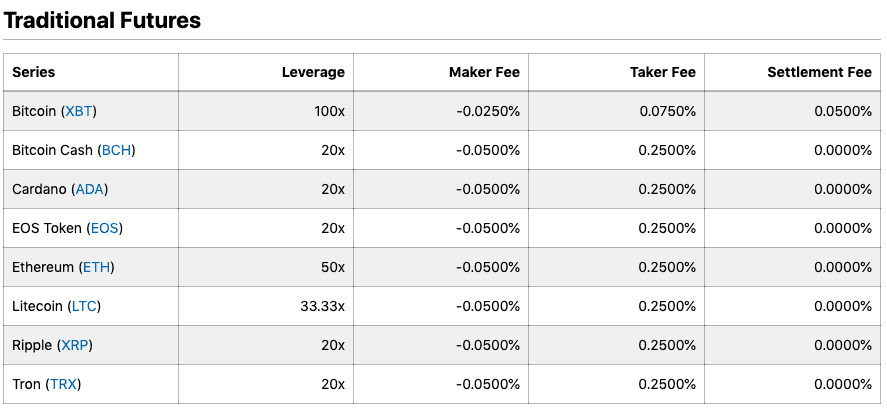

Futures Contracts

Unlike perpetual swap contracts, futures contracts have an expiry date. You can trade up to a max leverage of 100x. In Bitmex, all futures coins are denominated in BTC. BitMex offers quarterly contracts for all coins with a bi-quarterly (half year) contract only for Bitcoin. For example, if you are trading the “March 27 XBTH20” contract, you are trading the BTC contract that will expire on March, 27 of 2020. You will see the amount of time left before settlement date at the top right corner of your screen. If you expect the BTC price to settle at $10,000 by March 27, you can buy it now for $7,800 and receive the BTC upon expiration. For futures contract trading, you will not be charged funding fees which is an advantage against perpetual swap contracts.

Futures trading fees are seen below.

Order Types

Limit Order – The basic order type is the limit order which fills your order after you specify your price and quantity.

Post only – never takes liquidity and makes sure the order is a market maker.

Immediate or Cancel – when placing an order, any amount that is not filled instantly will be canceled.

Fill or Kill – makes sure the buy/sell order is executed or canceled entirely without partial fulfillments.

Market Order – this is a type of order that buys or sells a certain number of cryptocurrency at the market price.

Hidden Order – Hidden orders do not display in the order books.

Stop ̨Market – This is a market order but includes a trigger price. Only when the trigger price is hit will the market order be placed and executed

Deposits and Withdrawal

Unlike most exchanges, BitMex does not charge deposit or withdrawal fees. However, as mentioned above, BitMex only transacts in BTC, meaning you can only deposit or withdraw BTC. For security purposes, BitMex processes withdrawals with a final manual review done once a day. The drawback here is that it takes a long time before you receive your funds. Unlike other exchanges where you can withdraw and receive BTC within a few minutes to an hour, BitMex withdrawal can take upto 24 hours.

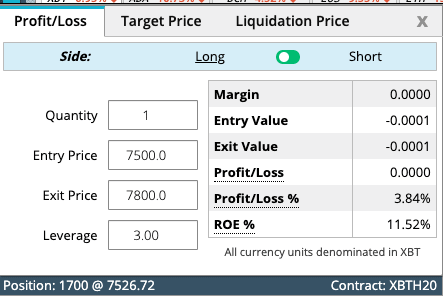

Profit Calculator

The main BitMex interface also includes a calculator. You can compute for profit and loss, target price as well as liquidation price. This is a handy tool especially for risk management. For example, just enter your entry price, exit price and leverage and it will show your expected ROE.

BitMex Customer Support

BitMex offers a few options when it comes to customer support. Their main customer support channel is through a support ticketing system.

Their knowledge base is also very exhaustive. They also put a lot of links to guides and resources throughout the website so it will be very easy to find what you are looking for. For example, you will see a Bitcoin guide just beside the bitcoin trading pairs.

BitMex can also be found in other communications channels like Weibo, Telegram (Russian support group), Wechat, and IRC servers.

Operation Security

BitMEX takes security very seriously. This shows given they have no records of any hacks or security breaches. This is rare in the crypto exchange space, especially given how long they have been in the scene.

Wallets: All BitMEX wallet addresses are multisignature and all storage is kept offline. Even in an extreme case of full compromised systems, servers, trading engine and database, hackers will still not have enough access to the keys necessary to steal funds. All withdrawals are also manually checked by staff with no private wallet keys kept on cloud servers.

System Security: BitMex runs on Amazon Web Services which have world class security.

Communications Security: BitMEX provides optional PGP (Pretty Good Privacy) email encryption for all automated emails for users.

Two-Factor Authentication: This has been a standard form of account protection. This involves using a separate device that generates a unique code or combination every few seconds. You will be asked to enter this upon signing in.

Hot and Cold Wallets: This is a standard procedure that separates revolving funds (hot wallet) and most user funds (cold wallet). The cold wallet is disconnected from the internet so it is less likely to be hacked. It is akin to banks not having all of their money locked in a giant safe. They only hold what they expect to be transacted that day.

IP-Based Access Restriction: This setting automatically closes all sessions if a new IP address is detected. If you trade on a mobile browser this feature is not recommended.

Safe Session Duration

When enabled, the trading session expires 10 minutes after the browser tab is closed. This makes sure other people will not have access in case you leave your logged in device.

Liquidation Fund

BitMex has a liquidation fund set up to avoid auto-deleveraging traders’ position. The fund is used to aggress unfilled liquidation orders before they are taken over by the auto-deleveraging system. Current balance as of March 2020 is over 35,000 BTC. You can find more details about it here: The BitMEX Insurance Fund

Conclusion

Bitmex definitely has a lot of pros and cons. At the end of the day, where people put their money says a lot more than what they say with words. Seeing the high volume that goes through BitMex daily shows people’s trust and how much they like the platform. With impeccable security going along with easy to use and straightforward fees, it surely makes up for the archaic look it has. BitMex is definitely more suited for more experienced traders than for beginners who are just starting their crypto journey.