Table of contents

- Overview and History

- OKEx Products

- OKEx Pool

- OKEx Academy

- OK Jumpstart

- OKEx Wallet and Mobile App

- OKEx Cloud

- OKEx Main Exchange

- User Experience

- Fiat Gateways

- Fees

- Derivatives and Margin Trading

- Margin Trading

- Perpetual Swaps

- Funding Fees

- Futures Contracts

- Options Trading

- OKEx DEX (Decentralized Exchange)

- OKEx Customer Support

- Operation Security

- OKB Token and OKT Token

- Conclusion

Overview and History

OKEx is one of the top exchanges when it comes to volume. They report around $2B in daily volume turnover. In comparison, Binance’s daily volume averages at $1.5B. While OKCoin has been around since 2013, OKEx is relatively younger having been launched in 2017. It was launched by Chinese Bitcoin giant company OKCoin. OKCoin is more tailored for new traders differentiating itself as a fiat to crypto exchange with USD, EUR and SGD pairs. OKEx, on the other hand, is the crypto-to-crypto exchange that offers more sophisticated trading products targeting professional traders with a wide array of advanced financial services like derivatives and more.

OKEx is currently headquartered in Malta although it started out in Hong Kong. Despite Hong Kong being a business friendly environment, its government has lately taken a hard line against Cryptocurrency exchanges and crypto projects especially those doing ICOs prompting OKEx’ move. OKEx is the second major exchange that has moved to Malta, after Binance, because of its more forward thinking government, and crypto friendly regulatory framework. OKEx has a global audience base of over 20 million users reaching 130 different countries.

The current CEO of OKEx is Jay Hao. A seasoned industry leader and tech veteran, Jay has more than 21 years of experience in the tech industry specifically in the semiconductor industry. Prior to OKEx, he focused on blockchain-driven applications for live video streaming and mobile gaming. OKEx currently has over 1,000 employees.

OKEx Products

Right from the beginning, OKEx has already had a full suite of different products for different traders. They were one of the pioneers in launching crypto derivative products. In an interview, this is what their CEO Jay Hao said.

“We pride ourselves in being the swiss knife for trading for any trader. Whether it is fiat through our C2C market, spot, futures, derivatives or lending, we got you covered. Our goal has always been to build a complete all in one ecosystem that traders can depend on.”

OKEx Pool

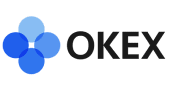

OKEx Pool was launched in October 2018. OKEx pool provides a streamlined miner management system allowing OKEx customers to quickly and easily access its mining services right in the main OKEx platform. This is currently headed by Alina Yao and has been steadily growing in contributing to OKEx’ revenues and bottomline.

OKEx Pool offers PoW mining services of BTC, BCH, BSV, LTC, ETH, ETC, DASH, DCR, and ZEC, GRIN31, XMR, CKB and RVN.

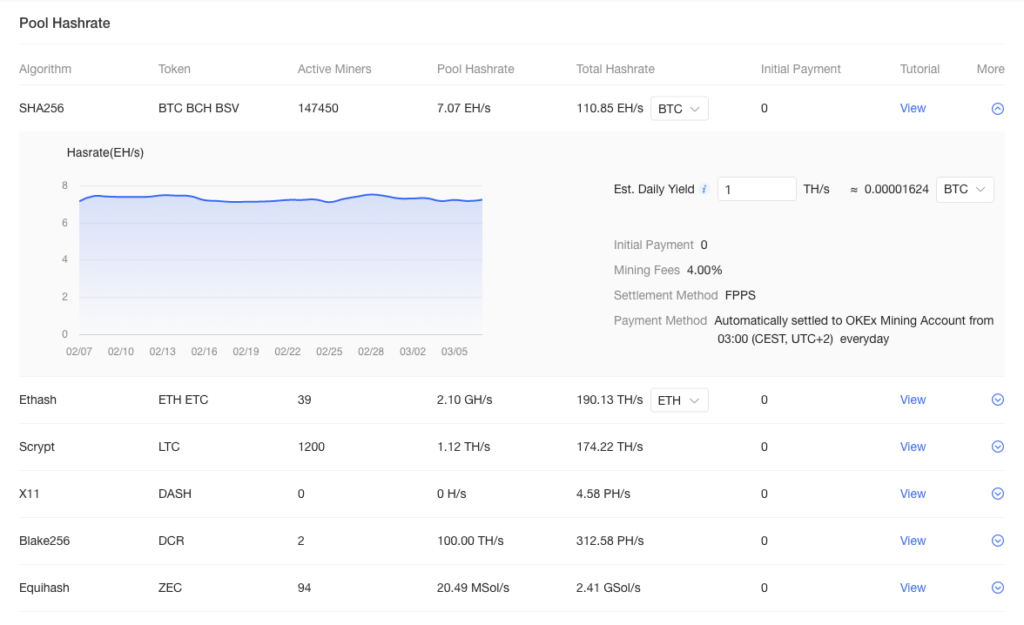

OKEx also supports mining of PoS and PoS-variant assets such as DAI, VSYS, XTZ, CRO, EOS, IOST, ATOM, and YOU

You can find more details in the links below:

https://medium.com/okex-blog/get-to-know-okex-pool-d7876bf22e53

https://www.okex.com/pool

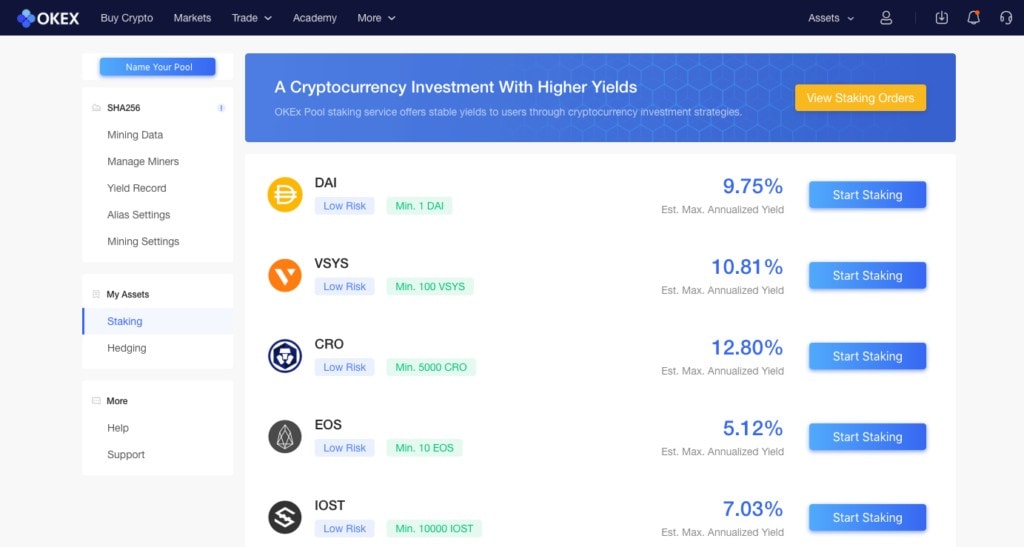

OKEx Academy

OKEx Academy covers a wide array of tutorials helping new users get around OKEx and the crypto space in general. It also includes articles and blogs that are divided into three main categories: Beginners Tutorial, Trading Ideas and Industry Analysis. They also have a blockchain glossary that proves to be very useful. They cover the basics of major cryptocurrencies as well as the different trading styles and techniques.

OK Jumpstart

https://www.okex.com/activity/jumpstart

OK Jumpstart is the IEO token sale platform of OKEx. Started in the middle of 2019 in the year of the IEO craze, OK Jumpstart has had 10 successful IEOs already. An IEO is similar to an ICO, also known as an Initial Coin Offering. An ICO is the first time that a crypto token has been made available for sale to the public. This is akin to an IPO in traditional markets. What makes IEOs different is that instead of companies raising funds directly from users, companies transact via a trusted third-party exchange. This allows projects to leverage an exchange’s brand as well as user base.

Their latest IEO was for HyperDAO, $HDAO. The project raised $2,000,000 selling 200,000,000 tokens for $0.01 each. As of this writing, the HDAO token is trading around $0.03 giving IEO participants a 3x return on their investment. This shows OKEx also has that magic touch in increasing token price of their IEOs.

Currently, the allotment amount for those who will join the IEO is determined based on users’ OKB holding amount and period plus their trading volume. The full details of the allotment mechanism is seen here: OKEx Jumpstart: New Rules Explained | Company Updates| OKEx Academy

OKEx Wallet and Mobile App

BTC Wallet | Blockchain Wallet | Crypto Wallet | OKEx Blockchain Wallet

OKEx also has its own mobile wallet integrated to its mobile app. This is available in both Android and iOS (iPhone and iPad). Setting it up, even from mobile, was easy and straightforward. The OKEx wallet supports multiple cryptocurrencies. The OKEx mobile app allows you to trade right from your mobile device with spot and interactive charts. Even the derivatives markets are available here. It works flawlessly and the UX is on point.

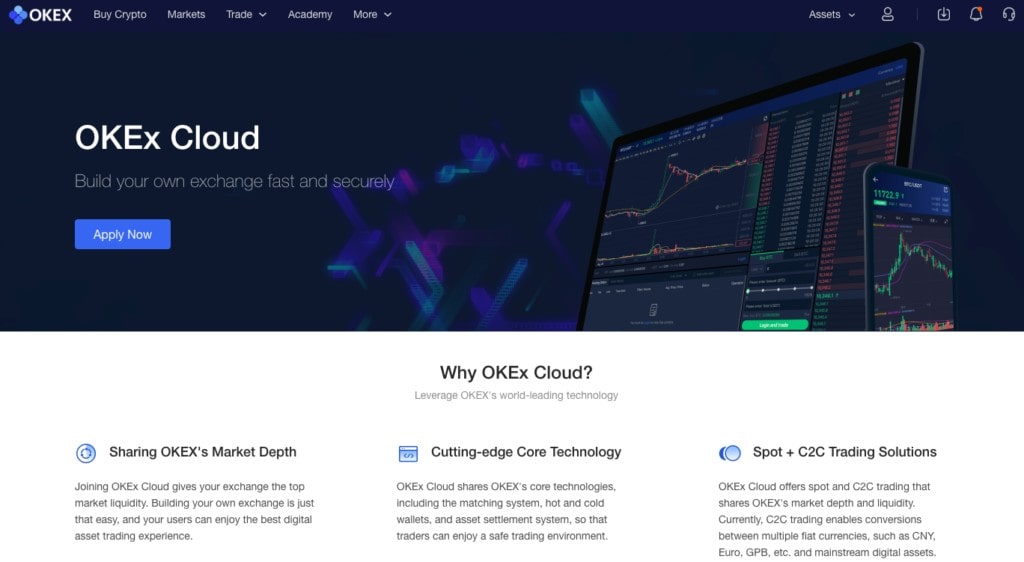

OKEx Cloud

OKEx Cloud | OKEx Cloud Mining

OKEx Cloud is a B2B2C product offered by OKEx. This allows other companies to easily build an exchange tapping into OKEx’ market liquidity. By pooling it together, this adds even more depth to OKEx’ order books. They will be able to use OKEx’ cutting edge technologies like: advanced order matching system, hot and cold wallets, and asset settlement system, so that traders can enjoy a safe trading environment.

OKEx Main Exchange

There are more than 300+ different trading pairs to choose from. As for listing, OKEx has been quick to add several high profile tokens. An example was when they were one of the first to list the HBAR Hedera Hashgraph Token. This points to their quick and highly equipped team since HBAR has their own mainnet and is not an ERC20 based token.

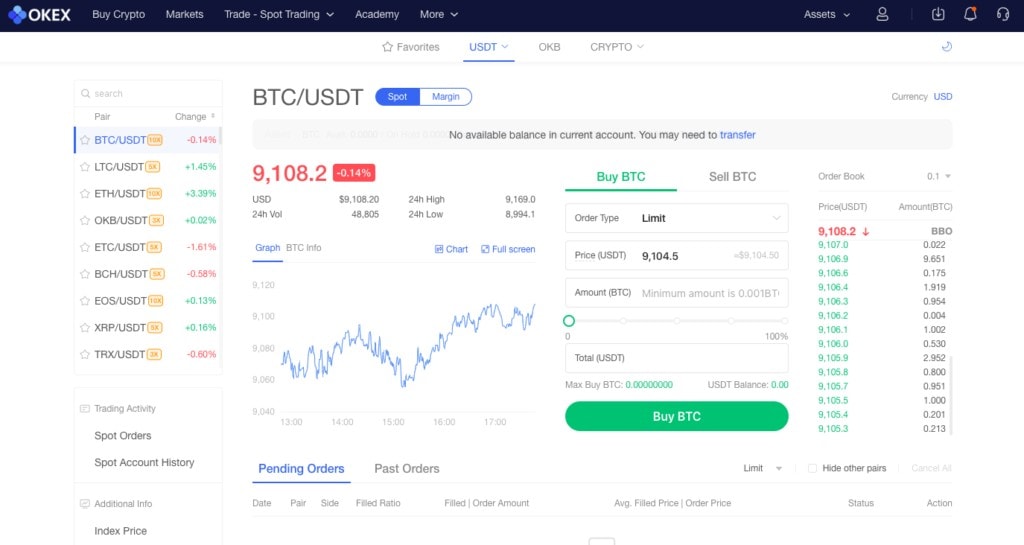

User Experience

At first glance, OKEx main spot exchange offers a sleek and very minimalist design. You see a price chart in the middle that is in a line format. You have the different tradable pairs on the left side and the order books on right. The order book below reveals a very deep view into the order books reaching up to the 60 closest and sell orders.

OKEx offers a ton of order types. Some of these advanced order types aren’t offered in any other exchange. People who are in the finance and trading sector working with traditional brokers will be happy to see these advanced options.

Limit Order – The basic order type is the limit order which fills your order after you specify your price and quantity.

Advanced limit – brings out an order option button. You can choose between Post Only, Fill or Kill and Immediate or Cancel (IOC). Post only never takes liquidity and makes sure the order is a market maker. Fill or Kill makes sure the buy/sell order is executed or canceled entirely without partial fulfillments. IOC is the opposite of the Post only in that any portion of an order that is not filled immediately will get cancelled.

Market Order – this is a type of order that buys or sells a certain number of cryptocurrency at the market price.

Stop Limit – This is similar to the limit order but the order will be placed only after the trigger price indicated by the seller is hit.

Trail Order – This allows users to set in advance strategy for significant swings in the market. When the last price reaches maximum (or minimum) market price after a trail order is submitted (1±user-defined callback rate), this triggers the order to be executed on the market.

Iceberg – An iceberg order is an algorithmic order type allowing users to avoid placing a large order to avoid slippage. An iceberg order automatically breaks up a user´s large order into multiple smaller orders. These orders will be placed on the market according to the latest best bid and ask price as well as the parameters set by the user. When one of the smaller orders has completely filled, or the latest market price has deviated significantly from the price of the current order, a new order will be placed automatically.

TWAP – Time-weighted average price (TWAP) is the average price of an instrument over a specified time. TWAP is a strategy that will attempt to execute an order which trades in slices of order quantity at regular intervals of time as specified by users. The purpose of TWAP is to minimize the market impact on basket orders. This helps save you from sudden large scam wicks.

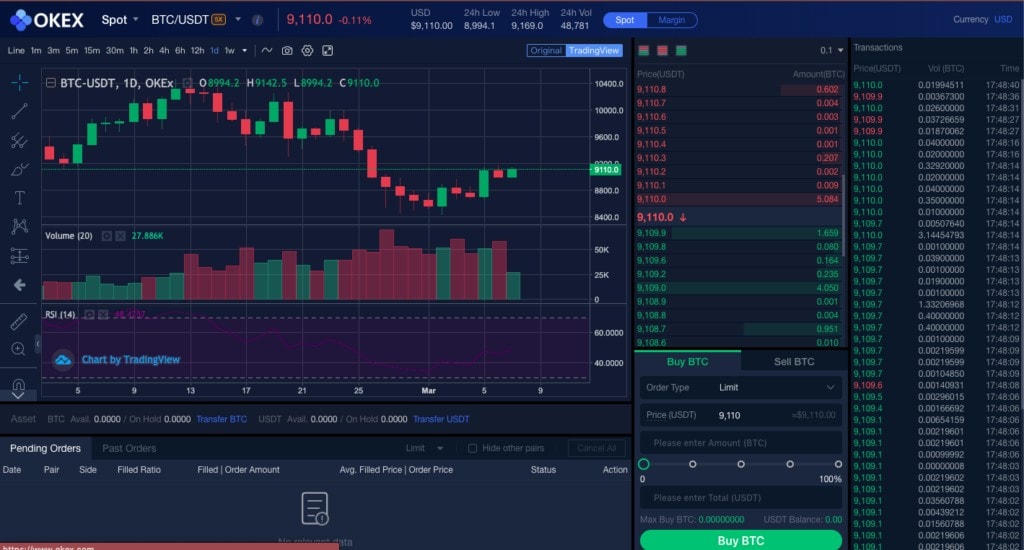

Clicking on the full screen icon on top of the price screen reveals the full featured chart. Different time frames, indicators as well as drawing tools are all available here.

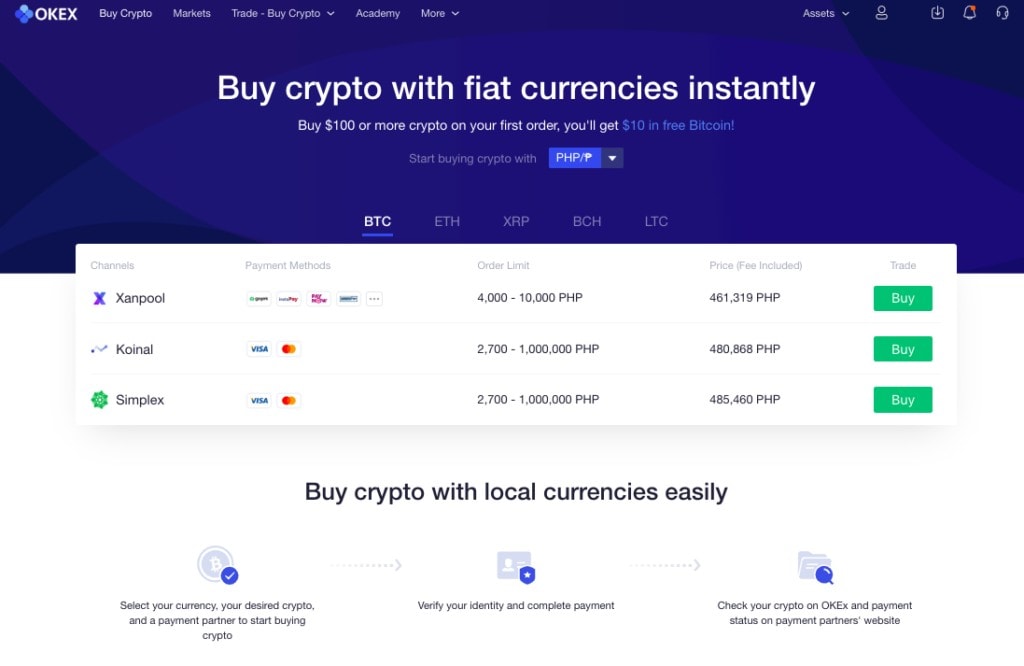

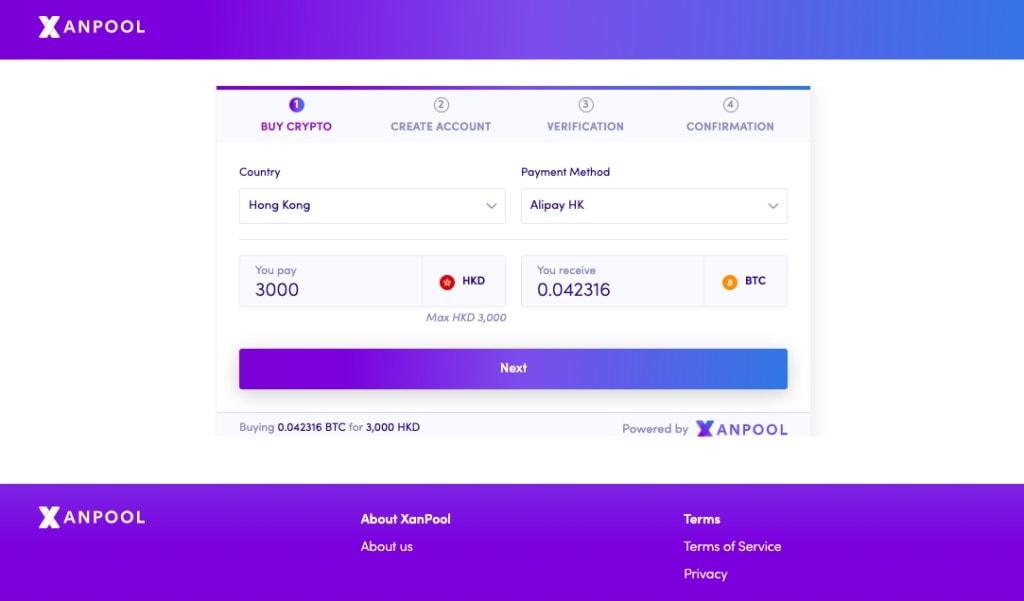

Fiat Gateways

Even though OKCoin handles a large volume of the crypto to fiat exchange, OKEx also offers options to buy crypto as well. Buying bitcoin and other cryptocurrencies has become as easy as shopping on Amazon. Multiple payment merchants like Xanpool, Koinal, and Simplex are integrated with OKEx to process these crypto currency orders. Check out our “How to Buy Bitcoin guide”.

Different payment methods are available depending on your country and payment merchant. Available payment methods range from Credit cards, debit cards and bank transfers to newer forms of payment like Alipay HK, GoJek Pay and Instapay. Fees and exchange rate depend on the payment merchant but all are clearly seen on the main page.

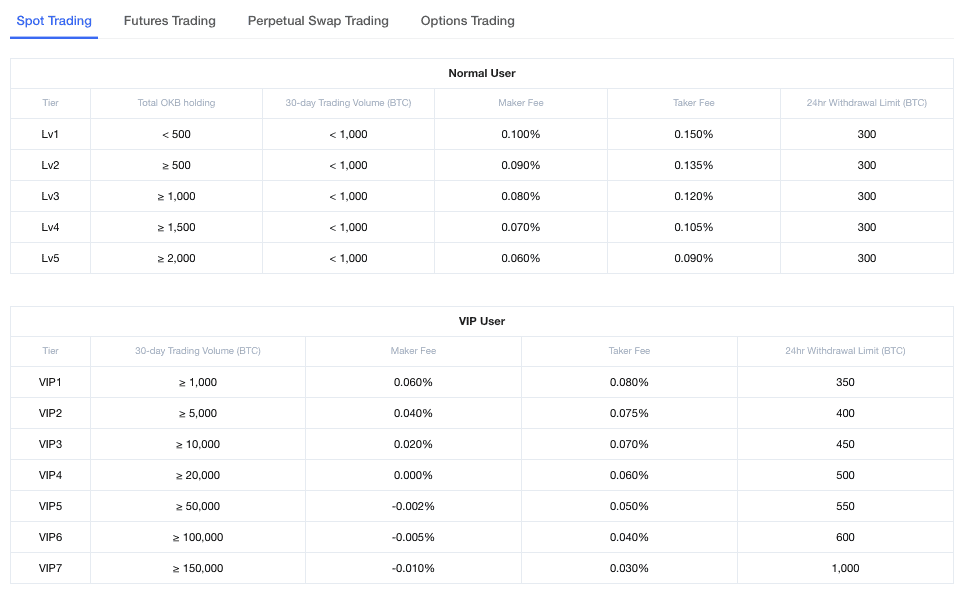

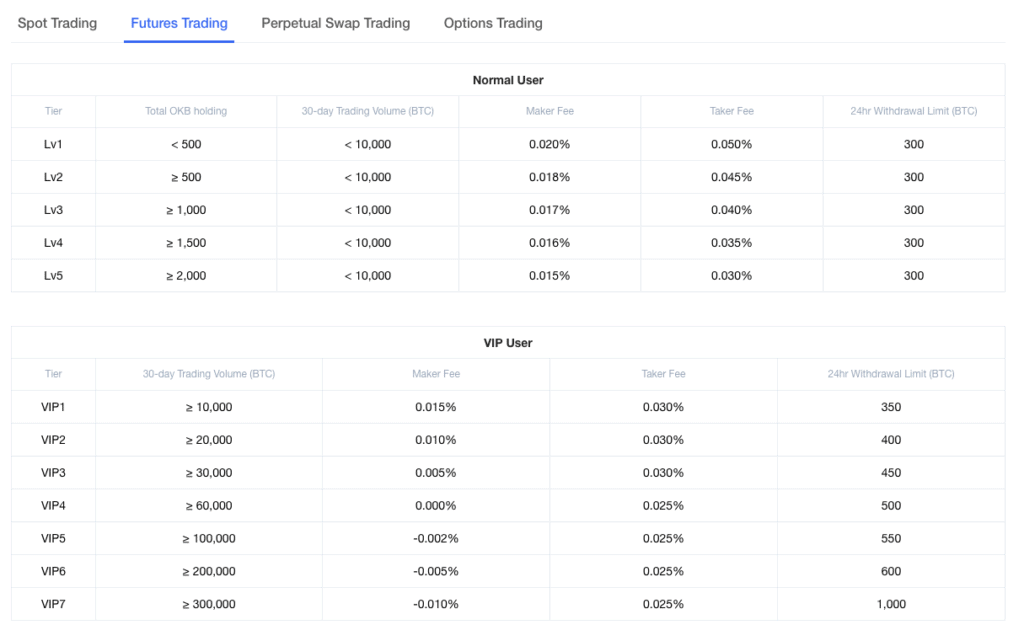

Fees

OKEx’s fees are at par with most exchanges. They have a 0.1% (Maker Fee) and 0.15% Taker Fee. This is good given other exchanges can charge as high as 0.5% for retail traders. You will notice the distinction between normal users and VIP users. Normal users can increase their level based on their OKB (OKEx utility token) holdings while VIP users level up based on the volume they trade.

There are no charges for depositing as a common standard of crypto exchanges. But when you withdraw a crypto currency, the fee is taken in the form of the token. OKEx regularly updates these fees depending on the network fees. The latest update was on January 29, 2020.

OKEx lowered the withdrawal fees for BTC, ETH, XRP, BCH, and USDT-ERC20. BTC withdrawal fee has been adjusted to 0.0004 BTC from 0.0005 BTC; ETH is adjusted to 0.003 ETH from 0.01 ETH; XRP is adjusted to 0.1 XRP from 0.15 XRP; BCH is adjusted to 0.0001 BCH from 0.001 BCH; USDT-ERC20 is adjusted to 0.88 USDT from 1 USDT.

Derivatives and Margin Trading

As mentioned above, OKEx offers a wide range of derivatives products. They were one of the first to launch BTC futures trading platform. Right now, they offer perpetual swaps, futures and even options trading.

Derivatives trading platforms allow users to trade derivatives of underlying assets. Users can buy more than their balance allows but with it also carries the risk of possible liquidation. In normal spot trading, your balance will never go to zero unless the underlying asset goes to zero. But with leverage trading offered by derivatives platforms, users can get liquidated depending on the leverage they use. Using a 10x leverage, a 10% move in asset can either double your holdings or bring it to zero.

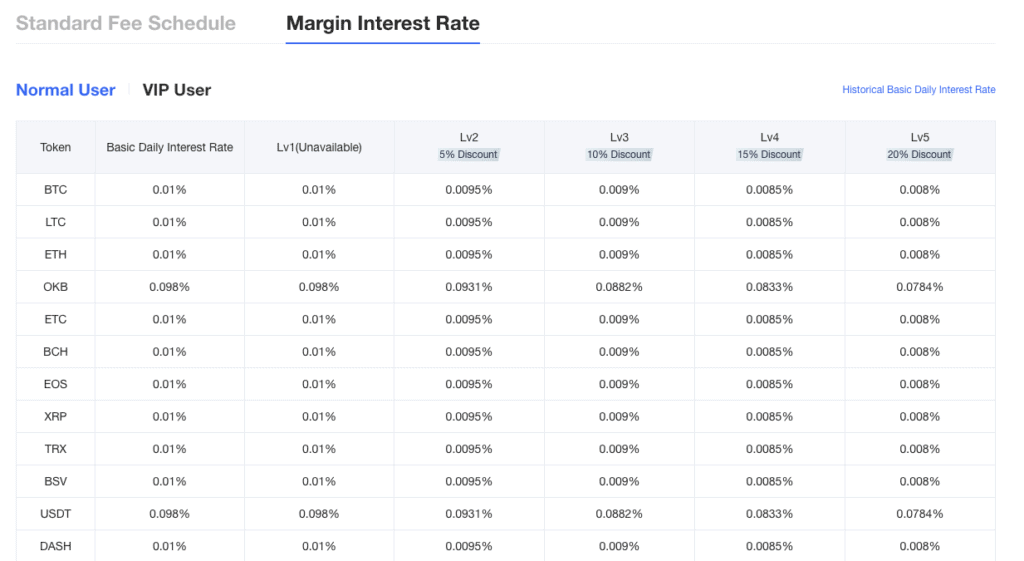

Margin Trading

Margin trading allows you to borrow money from the exchange and use it to trade while using your available assets as a collateral. Margin trading in OKEx allows up to 10x leverage while the futures platform allows up to 100x leverage.

As for the fees, daily interest fees vary depending on the asset. Some of the most popular assets like Tether, BTC, and ETH have daily interest rates of 0.098%, 0.01% and 0.01% respectively. Again, these fees could go lower when you reach a higher VIP status as seen in the fees schedule below. Compared to other exchanges, this is quite expensive.

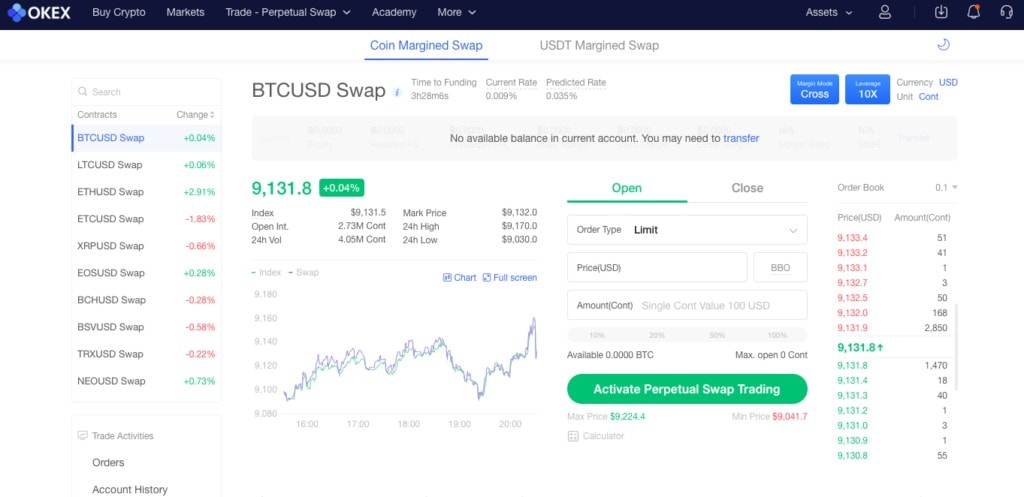

Perpetual Swaps

OKEx Perpetual Swap is a crypto asset derivative product that is settled in crypto assets such as Bitcoin (BTC) and USDT, etc. It mimics the spot market price but there are differences since this is just a derivatives product. Traders can long or short a position to profit from the increase or decline of a digital asset’s price, or manage their investment risks by hedging.

One thing to note about perpetual swap contracts is that they do not have an expiry that unlike futures markets. There will be a funding mechanism that is used to anchor the perpetual swap prices to the spot price. This will be explained in the Funding Fee section below.

https://www.okex.com/en/futureTrade/beforePerpetualFuture

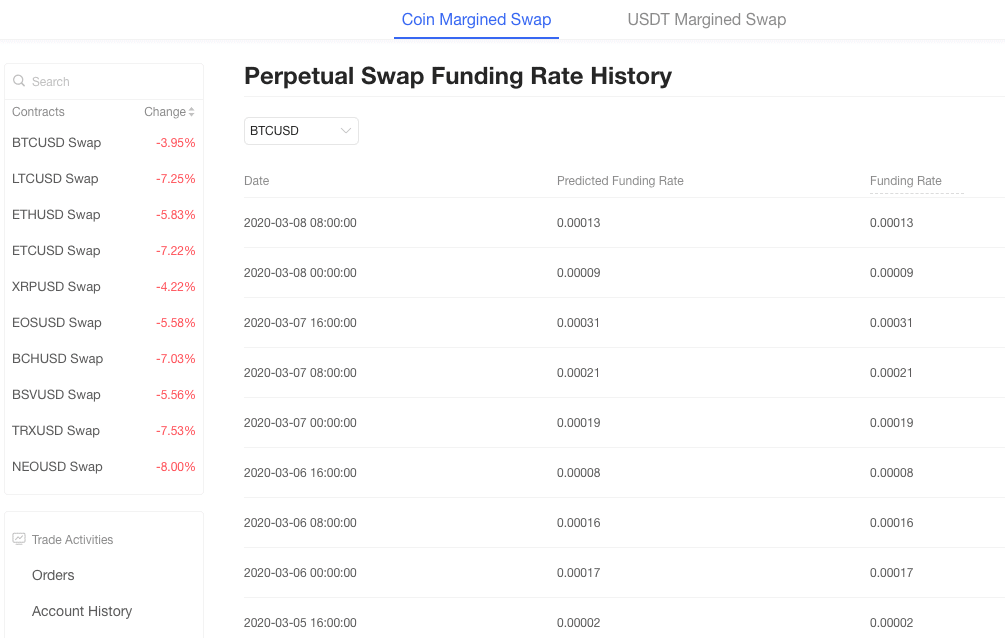

Funding Fees

One additional fee that you must be wary of is called funding fee. This is a fee added on top of the maker and taker fees. The funding fee essentially works as a mechanism to reach spot price equilibrium. When there are more buyers (long position) than sellers (short position), the funding fee is positive. This means those in a long position will pay the funding fee to short sellers. And if there are more short sellers, the funding fee is negative and short sellers pay those in long. You basically get rewarded for going against the majority. This fee is calculated and deducted every 8 hours. For more details as well as a computation check out this link. XI.Funding Rate Calculation – Help center

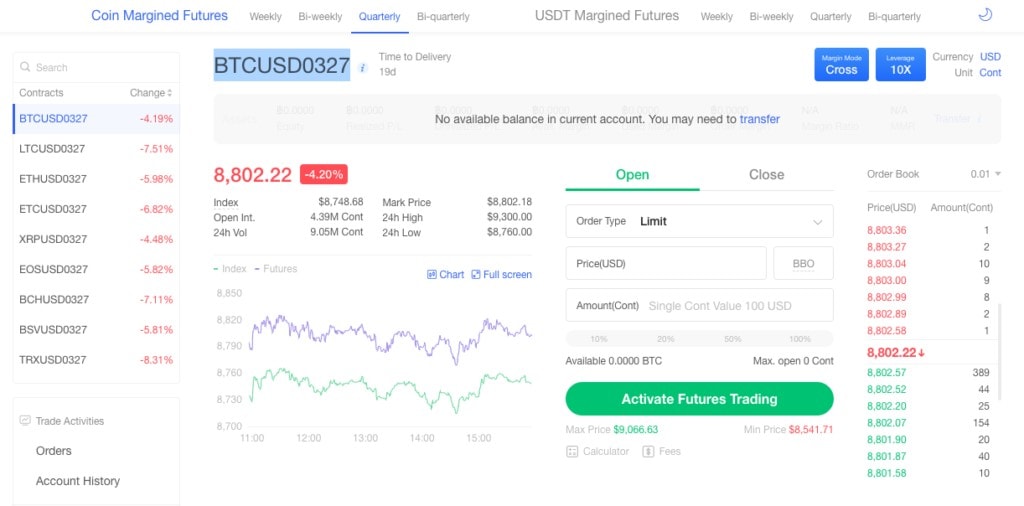

Futures Contracts

Unlike perpetual swap contracts, futures contracts have an expiry date. You can trade up to a max leverage of 100x. There are weekly, bi-weekly, quarterly and bi quarterly contracts. For example, if you are trading the “BTCUSD0327” contract, you are trading the BTC contract that will expire on March, 27 of 2020. You will see the amount of time left before this is settled. If you expect the BTC price to settle at $10,000 by March 27, you can buy it now for 8,800 and receive the BTC upon expiration. For futures contract trading, you will not be charged funding fees which is an advantage against perpetual swap contracts.

Futures trading on the other hand is a derivatives platform meaning the futures price is just based on the real trading price but is not the actual movement of the price. In practice, the price difference is miniscule.

Futures trading fees are seen below.

Options Trading

OKEx launched their options trading market at the end of 2019. Options give contract holders the right to buy or sell an underlying asset on a fixed day in the future. This is a great way to hedge the value of your asset without necessarily selling it. It works like an insurance policy. The longer the insurance, the more you will have to pay for it. You can find more details about options trading in this link: 1. OKEx Options Introduction – Help center

OKEx DEX (Decentralized Exchange)

OKEx will be debuting their OKEx DEX on the OKChain testnet. This will be the company’s first non-custodial, decentralized cryptocurrency exchange. Unlike the main exchange which is centralized, also called a CEX, the OKEx DEX operates without a central authority. This means users are trading directly with each other, peer-to-peer. Instead of sending funds to the exchange, users have full control of their own funds. They simply connect their wallet and trade from there. With this, the OKT token will also be released. More details will be released regarding token listing and DEX governance as soon as they fully launch.

OKEx Customer Support

OKEx offers multiple ways for users to get customer support. Currently, there are two ways of reaching out to them. One is through email: support@okex.com and the other is through their phone number: +1 226 7984487

These are standard customer support services. They can definitely improve on this by adding live chat which is present in other major exchanges. Online reviews show several incidents including slow response times and failure to resolve issues.

Operation Security

As for any financial service or anything that deals with payments and money, security is of paramount importance. OKEx takes security very seriously. To date, there are no official hacks that have been reported. Although there are some reports of individuals being hacked, OKEx does not take responsibility for these.

2FA – This has been a standard form of account protection. This involves using a separate device that generates a unique code or combination every few seconds. You will be asked to enter this upon signing in.

Mobile Verification – You will receive an SMS for withdrawals, changing of passwords and security settings.

Funds Password – A password will be required for placing orders when enabled.

Email verifications – Whenever you would like to withdraw funds, an email will be sent to your email address for you to confirm if this transaction is legitimate.

Anti-Phishing Code – This security feature makes sure the emails sent to you are officially from OKEx. You will configure and choose a word that will be your anti-phishing code. All emails from OKEx will include this email. This is an effort to combat email spammers and phishing links.

Hot and Cold Wallets – This is a standard procedure that separates revolving funds (hot wallet) and most user funds (cold wallet). The cold wallet is disconnected from the internet so it is less likely to be hacked. It is akin to banks not having all of their money locked in a giant safe. They only hold what they expect to be transacted that day.

Liquidation Fund

While OKEx does not have a hack insurance of fund, they do have liquidation funds for their futures and derivatives market. This fund will be tapped into when liquidations happen that cannot be covered anymore by a user’s balance.

In 2018, a major $416 million BTC futures trade went wrong and the user couldn’t cover it. OKEx initiated a socialized clawback of 18% for all other users’ earnings. This outraged a lot of other users. Hopefully, the liquidation fund will be able to cover these types of mishaps in the future. The total balance of the derivatives fund at the moment is at $81 million.

OKB Token and OKT Token

There are currently two tokens associated by OKEx. There is the OKB token and the OKT token. Both work independently of each other and have different use cases.

OKB Token is the global utility token of OKEx. It was issued by the OK Blockchain Foundation and is an ERC 20 token. OKB is mainly used in the OKEx exchange for fee discounts and IEO allocations. OKB was originally planned to have a total supply of 1 Billion tokens but plans changed and the original 300 million issued will be the only ones in supply. OKB derives its value from platform performance and buy-back and burn schemes making it a deflationary token. To date, there have been 7 coin burns totalling over 17 million tokens being burned from the supply. Currently, OKB has a token price of just over $5 each.

OKT on the other hand, is the native token of OKChain issued to fulfill the DPoS requirement. The issuance of OKT will be on the genesis block, and is expected to increase by 1-5% every year (inflationary). OKT derives its value from the usage of the DEX, Defi and other applications on OKChain. The token has yet to launch.

Conclusion

OKEx has been around for a while already. While other once bigger exchanges have fallen, OKEx has consistently stayed at the top. It definitely caters well to more experienced traders given their advanced tools, trading platforms and top notch liquidity. They have been constantly releasing new products as well. They properly explain advanced concepts and most are covered in their blogs and FAQs. They have been active on social media as well which helps boost their popularity. It will be very exciting to see where OKEx will be and if it eventually overtake Binance as the top exchange. It certainly deserves its spot at the top.