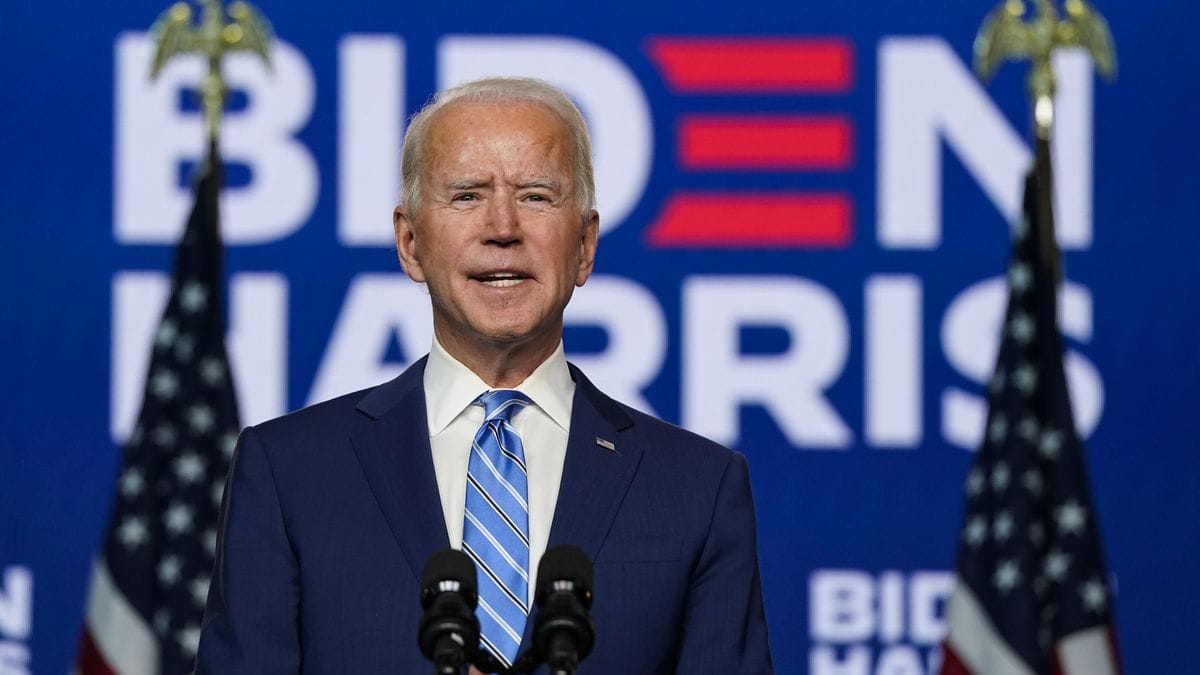

Last week was particularly turbulent in the cryptocurrency market. Between the power outage in China which caused a slowdown in the network and the US Treasury’s tougher stance on cryptocurrencies, the prices of the main projects and the entire sector plunged. But another element could also explain this downward trend of the previous week: the increase in capital taxes desired by the Biden administration.

The objective of this tax will be to finance massive investments in the American economy. Among the elements of this tax plan, we find the will to tax at 39.6% the income from movable assets for American households with an income of more than 1 million dollars per year. Remember that this rate is currently 20% and that it should therefore double to align with the highest income tax bracket. The idea is to align the taxation of capital with that of income. Indeed, in the United States, it is common to remunerate executives of large companies through a gift of shares of the group. With this reform, the Biden administration intends to tax the resale of these shares at the same level as the income received.

This announcement and the press release also had a direct impact on the world’s stock markets and on an index like the CAC 40. An increase that comes on top of the increase in taxes for companies and a rate that went from 21 to 28%. Tax increases that should allow to finance measures for families weakened by the health crisis but also the education sector.

In this climate of tax hikes, investors are looking to pocket their profits, whether on stocks or other assets like cryptocurrencies. Creating in the process, a surplus of sales over demand and an inevitable drop in the price of the assets concerned. The official announcement of this measure is expected tomorrow, Wednesday, April 28.

What impact on the crypto market? This information has had a significant impact on the crypto market. An impact that is even stronger when you consider that the United States is one of the most influential countries in the world on the digital currency market.

After peaking above $65,000 in mid-April, Bitcoin fell sharply last week and finally dropped below $50,000. Taking with it the downward trend of many digital currency projects. Over the course of this week, the cryptocurrency market has devolved by more than $450 billion.

At the beginning of this week, the trend seems to be more positive again with a strong rebound on Bitcoin. Nevertheless, technical analysis still calls for caution and there is no indication that this rebound is the start of a real uptrend.

Nevertheless, it seems difficult, if not impossible, to attribute the entire Bitcoin correction to this one factor. Indeed, the week was marked by a huge power outage in China which had an impact on the Bitcoin network.

The US Treasury’s tougher talk and its willingness to fight money laundering even more actively also played into the price of BTC and major crypto projects. Other factors such as the disappearance of the Turkish platform Thodex and the flight of its creator with more than 2 billion dollars can also be explanatory variables of this bad week.

For others, this downward trend of several days was also a response to a run on Bitcoin after the stock market introduction of the Coinbase platform. It is actually the combination of all these factors that explains the bad week for the crypto market.