What is Tether?

Tether is a cryptocurrency pegged to a fiat currency (stablecoins) or an asset like gold. USDt (USD Tether) is their most popular product and is almost synonymous to the name Tether itself however, they also have other products like Tether Gold (XAU₮) and Tether (CNH₮) . It takes the benefits of cryptocurrencies and combines it with the value and stability of the asset (e.g. Dollar).

Before we get into the details, it’s good to understand the need for fiat currency pegged cryptocurrencies. Ever since the dawn of civilization, humans have been engaging in trade. They started with bartering (actual exchange of goods) but eventually decided to find something that’s easier to carry around but holds value. It started with metal coins which then evolved into asset backed currencies and finally fiat currencies which is what we have today. Fiat currencies are not backed by physical assets but by the government itself. Lastly, there are cryptocurrencies which are still very new. These are currencies not backed by anything but by code and by the people who believe in them. There is no central figure backing.

Compared to the history of gold and money, cryptocurrencies’ existence has just been a blip in time. Bitcoin, the first real successful cryptocurrency, is just over 10 years. Compared to gold and money which can be said to be as old as civilizations, it’s still in its infancy. To date, there are just over 21 million bitcoin wallet addresses that have over 1 dollar in them. This includes multiple wallets owned by different individuals. It’s safe to say that Bitcoin and cryptocurrencies are not mainstream nor widespread. Even in terms of market cap, Bitcoin’s market cap is infinitesimally small at $127 Billion. Compared to gold’s $9 trillion market cap, and the global monetary supply which is more than tens of trillions of dollars worth. Having such a small market cap has made it very volatile. It also makes it more prone to manipulation. And it’s volatility is hurting its purported use case of being a medium of exchange. It’s hard to use Bitcoin for daily transactions when the value it holds can swing 10% in a day. At the end of the day, it will be easier and less risky to transact with fiat currencies because of their current stability. This is the reason why there is a need for stablecoins like Tether.

What is a stablecoin?

Stablecoins are cryptocurrencies that aim to take advantage of blockchain like transparency and efficiency and marrying it to the value stability of regular fiat currencies like the dollar. It removes the volatility commonly associated with cryptocurrencies. Tether’s USDt is one of the earliest stablecoins and has been the most popular even to today although there have been more and more competitors in the space.

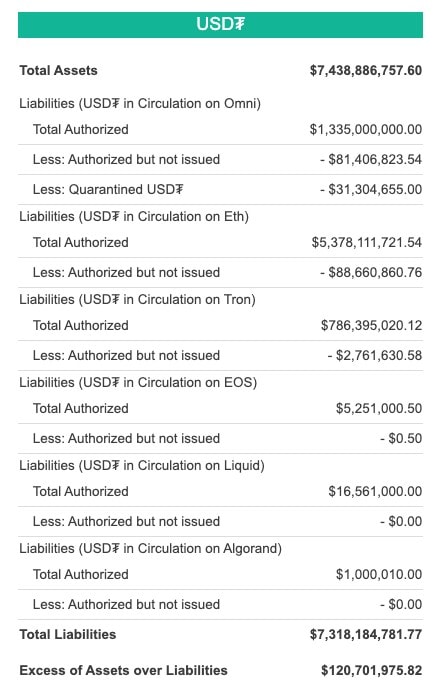

There are multiple approaches in creating a stablecoin. The first is pegging it to a fiat currency or physical asset, the second is pegging it to a basket of other cryptocurrencies and lastly, the third is using an algorithm to shift the supply to keep the value stable. Tether takes the first approach in pegging the USDT to the dollar by holding an equal amount of dollar assets in their reserves. There are currently 7.3 Billion USDts in circulation. This means that there should be at least $7.3 Billion dollars in its reserves. In their transparency section on the website, they show to have total assets amounting to $7.4 Billion dollars. However, they were more specific in saying that these assets are not exactly 100% cash but rather a mix of “traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties”.

The Business of Stablecoins

So if a dollar is as good as the USDT with no reason for price increase, what incentivizes companies to create and host stablecoins? As a network, users will have to pay transaction fees in order to transact. The fees go to those that run the network, in this case Tether Ltd. which is a hong kong based company.

Another incentive is for promotional purposes. This is the reason why most major cryptocurrency exchanges have released their own USD stablecoins such as Binance’s BUSD, Gemini’s GUSD and Huobi’s HUSD.

Tether and Bitfinex

Although Tether is not directly affiliated with any one exchange and is available in almost all crypto exchanges, it’s close ties with Bitfinex are uncanny. Tether Ltd and Bitfinex are separate entities. Both entities share the same chief executive officer, chief financial officer, chief strategy officer, and general counsel. Users also noticed that most of the new USDt minted go straight to Bitfinex before reaching other exchanges. And since Tether is not decentralized, there is no check and balance in place aside from the audits they conduct and release.

How does Tether maintain the $1 peg?

Since USDt is pegged to the amount of dollars it has, in theory it should always be as good as 1 dollar. However, there are times when USDT goes above or below the $1 peg depending on market demand. This is where market makers and arbitrageurs come in. If a trader can buy it for less than a dollar or sell it for more than a dollar, they are incentivized to do so as long as they are net positive for the trade minus the fees. It is this free market movement that keeps Tether’s peg at $1. There are also multiple fiat to Tether trading pairs in different exchanges that allows market participants to quickly cash out if they choose to.

Other Tether products

While Tether is most well known for their USDt product, they also have Tethers to other fiat currencies. They have over 40 million in Euros, 23 million in CNY and 50,000 in fine troy ounces of gold.

Use cases

In theory, USDt can be used to buy anything. However, dues to still low adoption of merchants accepting this new form of payment, USDt is still mostly used for cryptocurrency trading. It is used as a hedge to other cryptocurrencies that are very volatile. If a user thinks that the price of an asset such as Bitcoin will fall relative to the dollar, then they can buy USDt with their Bitcoin which is as good as converting Bitcoin to USD. Compared to the USD, USDt is easier, faster and cheaper to send from one exchange to another. Users will no longer need to work with banks and do wire transfers that could cost a lot more and take days if not weeks.

However, if adoption kicks in and more merchants start accepting crypto currencies, USDt could be one of the most used currencies since it’s pegged to the USD which is the most used currency in the world and not to mention, the global reserve currency of the entire world.

How does Tether Work?

No Consensus mechanism

While Tether uses blockchain technology, it is not decentralized. All the decisions are made by Tether Ltd. which includes how much tether to print. While blockchain can show us the flow of Tether, we have no idea about the flow of their actual cash. USDt is not regulated nor licensed and does not have regular public audits by 3rd parties.

Creation and Redemption of Tether

When it comes to creating and redeeming Tether, it has a significant barrier to entry. First, the minimum issuance and redemption is set at $100,000 via Tether Limited. Second, users are charged a ‘verification fee’ prior to the transaction either creating or redeeming of USDt. Third, purchases and redemptions are not available to US residents. Lastly, users are limited to one fiat redemption transaction per week.

Different blockchains

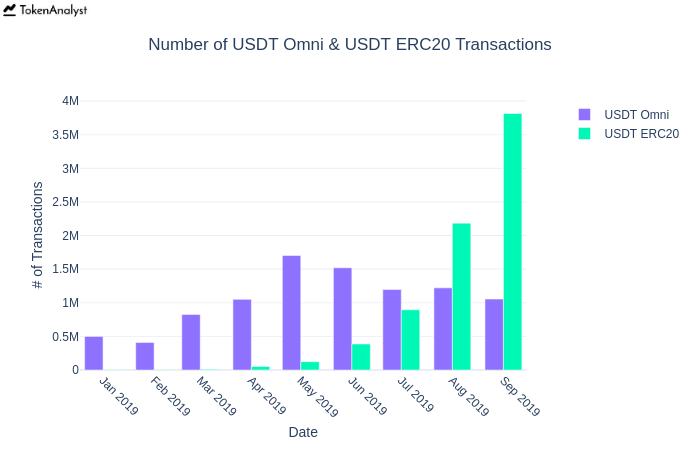

Tether was initially made available on the OMNI blockchain. OMNI is a Bitcoin-based blockchain protocol used to create digital assets. Since it is Bitcoin based, fees are paid in Bitcoin and can be quite expensive and slow compared to other blockchain networks. However, they did launch an ERC20 token in 2017. This quickly picked up and erc20 tokens account for more than 70% of their circulating supply. In fact, it is one of the biggest users of the Ethereum network. Out of the $7.1 Billion in circulation, more than 5 Billion is in ERC20, 1.5 Billion in OMNI and the rest split between other blockchain networks such as TRON EOS Liquid and Algorand blockchain networks.

Key Metrics

| April 2020 | |

| Price of USDt | $1 USD |

| Avg. Block time | Varies on blockchain network |

| Reward per block | ~ |

| Circulating supply | 7,318,184,782 USDT |

| Max Supply | ~ |

Tether’s Timeline

October 2014 – Tether (formerly “Realcoin”) was launched on the Omni Layer protocol

September 2017 – Tether launches ERC20 based token

April 2019 – Tether introduced on TRC10 token based on the TRON network

Jan 2020 – Tether launches Tether gold

Feb 2020 – Tether launches on Algorand blockchain

Where can I buy Tether?

Auto generated

How to properly store Tether?

Most of the USDt in the market is in ERC20 token format. This means that you can store it in any ERC20 wallet. However, there are still USDts that are in other blockchains such as OMNI and TRON so you will have to get a wallet that is compatible for those.

Hardware Wallets – auto generated

Online Wallets – auto generated

Pros and Cons

Pros

- Offers stability of fiat currency

- Fast and cheap transaction fees

- Available in different blockchain networks

- Offers other currencies and assets as well

Cons

- Not regulated or licensed

- No public audits by third parties

- Centralized party controlling Tether

- Tether Ltd. can freeze or “quarantine” USDt tokens

FAQ

Transaction Time

Average block time in the Ethereum network is 13.5 seconds

Transaction fees

Transaction fees vary on the blockchain network used. For ERC20, average transaction fee is 0.00077 ETH which is equivalent to $0.148 USD.