Table of contents

- What is Binance?

- What is BNB?

- What is BNB Used for?

- How does BNB get its value?

- Binance Chain and Binance DEX

- How does Binance Chain Work?

- Key Metrics

- BNB’s Timeline

- Where can I buy BNB?

- How to properly store BNB?

- Real world use cases (Who’s using it?)

- Pros and Cons

- FAQ

- Confirmation time

- Trading fees

- Inflation Rate

What is Binance?

Binance is currently the top cryptocurrency exchange in the space. Despite being a relatively new exchange starting only in 2017, by 2018, it was already handling the most volume compared to all other crypto exchanges. Its success comes from its user centric focus, ease of use, security as well as great marketing. They constantly release new products for their users. It has become a favorite not only for users but also for market makers and crypto projects. Getting listed on Binance has become a seal of approval thus causing most new listings to increase in price upon announcement. Having one of the most liquidity, it draws in even more users since liquidity begets liquidity. For exchanges, the main revenue generator for them comes from the trading fees collected when users transact any trade. Binance has been generating hundreds of millions in revenue every year even during the bear market.

What is BNB?

BNB is the native cryptocurrency for the Binance Ecosystem. It was offered in their ICO back when they started in July of 2017 raising $15m in the process. It was sold for 10 cents a piece. It’s currently trading around $16 with an all time high of hitting over $40. It originally ran on the Ethereum network as an ERC 20 token. When Binance launched their own blockchain called Binance chain BNB was migrated to this network. Today there are dozens of tokens that are issued on the Binance Network following the BEP12 token standard.

While many cryptocurrencies claim to be utility tokens, they aren’t and they only claim to avoid being regulated as a security since the opposite of utility tokens are security tokens. Security tokens require regulatory oversight and are subject to securities laws and taxation. Few of them actually provided any utility and Binance’s BNB is a clear example of a utility token. It’s primary purpose is to be used as a discount for transaction fees on the exchange. Paying with BNB instead of other currencies gives users a discount depending on how much BNB they hold which determines their tier. This continues to be the main use case but it has since expanded to cover even more use cases.

What is BNB Used for?

Trading Fee Discount

As mentioned above, BNB is primarily used to get discounts for trading fees. Right now, paying with BNB gives users a 25% discount on their trading fees. However, Binance does plan to phase this discount out by dropping from 25% to 12.5% to 6.75% and eventually to 0.

Payments

BNB has been pushing itself to become a medium of exchange as well. You can use BNB to pay for different things like travel expenses (via travelbyBit), mobile data (via Dent App) and virtual gifts (via Gifto). Crypto.com recently included support for Binance’s BNB to its platform. MCO Visa card holders can now use BNB to pay for goods and services. A full list of services can be seen in this link: Use BNB

Lending

Several lending platforms like Nexo and ETHLend support the BNB token as collateral for instant crypto loans.

IEO (Initial Exchange Offering)

In 2019, Binance kicked off the IEO craze with its Launchpad that was quickly followed by other exchanges. IEOs are similar to ICOs which was a fundraising mechanism for new crypto projects. However, the difference is that the capital raised via IEO comes exclusively from the exchange and its users. This meant that crypto projects could leverage an exchange’s brand and reputation to raise money for their project.

Since IEO projects also get listed on the Binance platform right after the sale, this provides instant liquidity for token buyers. Since demand is much higher than the supply, Binance uses a lottery system to determine who can take part of the IEO. Users will have to hold between 100-500 BNB tokens over a 20 day period leading to the announcement. The more BNB you hold, the more lottery tickets you get.

Referral Incentive

Binance currently offers incentives for referring new users to the platform. Normally the referrer gets 20% of the trading fees. However, if the referrer holds 500 BNB, the referral percentage increases from 20% to 40%.

Community voting

Binance has been holding community voting to give projects a chance to list on Binance. BNB token holders can vote which project they would like to see listed on the exchange. Every 50 BNB gives users 1 vote with a maximum of 10 votes per user.

Dust Conversion

Sometimes when you exchange cryptocurrencies to other cryptocurrencies, there will be a few tokens left often called dust since the value is insignificant. You can now convert these dust to BNB to keep your balances clean

Listing on Binance DEX

With the rising popularity of Binance DEX, projects that want to list on Binance DEX will have to pay a listing fee of 2,000 BNB. They will need to submit a proposal which costs 10 BNB followed by a deposit of 1,000 BNB. If their application is denied, the 1,000 BNB will be refunded. If they do get accepted, they will have to pay 2,000 BNB with the initial 1,000 BNB being refunded to them.

How does BNB get its value?

Economics tells us that what moves the price of anything is demand and supply. All the different use cases explained above are what drives the demand part of the equation. As for the supply, Binance also has a trick up their sleeves in dealing with it.

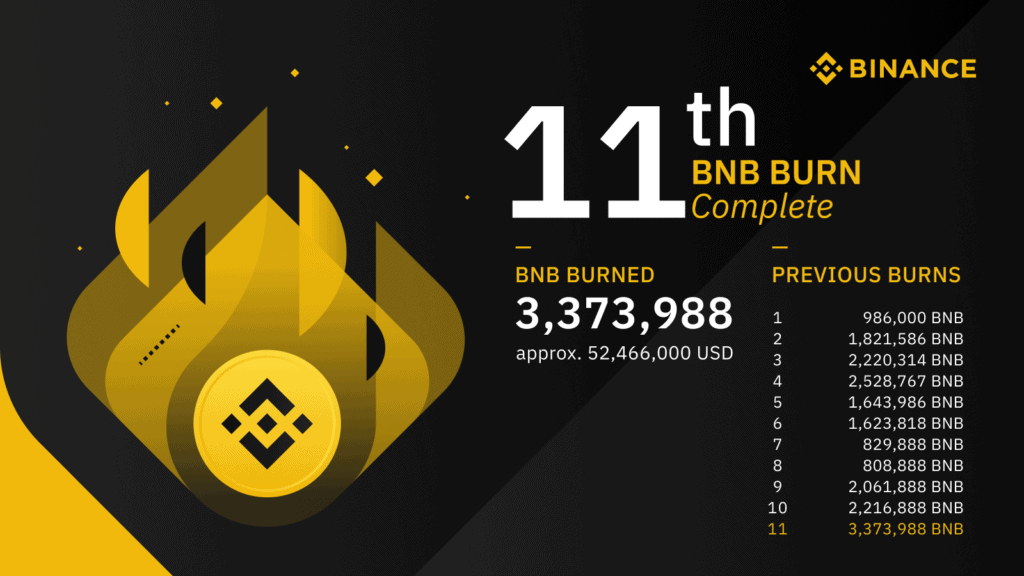

Every quarter, Binance does a burn of their BNB token. A burn is an act of destroying the cryptocurrency and removing it from circulation forever. With an initial supply of 200,000,000 BNB tokens, this total is reduced every quarter until 50% is burned leaving only 100,000,000 BNB left in circulation. All transactions will be done and verifiable on the blockchain. Initially, it was based on 20% of all profits but they have since changed to “trading volume activity” as a way to weave through regulations. The value is derived from the volume of Binance spot, margin, and futures exchanges. The more volume processes, and thus more trading fees collected, the more BNB will be burned. The last burn was done on April 18 representing the first quarterly burn of BNB for 2020. They burned 3,373,988 BNB or equivalent to 52.5 million USD worth of tokens. It was the biggest burn ever recorded. To date, they have burned over 20 million BNB tokens.

Binance Chain and Binance DEX

Ever since the inception of the Binance, they have envisioned running their own blockchain network. The immediate goal was to create a platform that specialized in one thing: asset exchange. With the Binance chain, users can easily send and receive BNB and BEP2 tokens. Companies, on the other hand, can quickly create their own BEP2 tokens. The very first application running on the Binance chain is Binance’ own DEX (decentralized exchange). Unlike a normal centralized exchange, in a DEX, users have total control over their assets. They no longer need to send their tokens to an exchange before trading it against another pair. Instead, they just connect their wallet and trade directly from it. Another plus for decentralized exchanges is that it’s run by a group of nodes that does the hosting and governance which includes deciding which tokens to list. In this decentralized setting, there is no single point of authority nor failure, the very essence of decentralization. Since the Binance DEX is running on a blockchain, users can actually see open orders as well as balances of other individuals if they know their public addresses.

When Binance Chain launched, it did not have any smart contract functionality. However, they are showing signs that this is a direction they would like to move forward with. In April 2020, Binance Chain developers released a whitepaper proposing specifications for a new blockchain that would enable complex smart contract functionality. They will be using Ethereum’s Virtual Machine to allow developers to build decentralized apps. However this proposal will run on a separate chain called Binance Smart Chain with the Binance DEX still runing on the original Binance Chain. BNB will be used as the gas for the Binance Smart Chain.

How does Binance Chain Work?

Binance Chain uses BFT and PoS (upcoming) based consensus mechanism to produce blocks among a series of qualified validators. This is similar to the architectures of several existing popular blockchain platforms such as EOS and NEO. There will be no mining like in Bitcoin’s Proof of Work consensus mechanism.

Types of Nodes

Validator nodes are a group of nodes that take the responsibility of maintaining the Binance Chain and DEX data. They are also in charge of validating all the transactions. They join the consensus procedure and vote to produce blocks. The fees are collected and distributed among all validators. The initial validators are selected from trusted members of the Binance community but will eventually be open to all.

Witness nodes represent the majority of nodes in a Binance Chain deployment. Although they do not join the consensus process and produce blocks, they act as witnesses to the consensus process. They also propogate data around the network to other nodes.

Accelerated nodes facilitate accelerated transaction routing and provide richer, faster user interfaces. There are always several Accelerated Nodes running at the same time around the world (owned by different organizations) and you are encouraged to choose one of them to use, or allow your Wallet to choose one randomly. For rapid API access, you’d better stay with one Accelerated Node to get better performance.

Fees

Since Binance DEX is the only application currently running on top of Binance chain, fees will mostly be coming from there. Unlike most blockchain networks, there is no set reward for these nodes or validators. They are incentivized based on the fees collected on the network. Since all transactions done on the blockchain, every action has a corresponding fee. To promote usage, order placement currently does not have a fee. However, cancellation of orders, order expiring, and order execution all have corresponding fees. Users can pay in BNB or in any other asset with a corresponding rate quoted against BNB.

Aside from the DEX related fees, other actions that have fees have to do with BEP assets such as minting, burning, locking and also submitting proposals. A full list can be seen in this link: Trading Spec

Key Metrics

| April 2020 | |

| Price of BNB | $16.14 |

| Avg. Block time | 1 second |

| Circulating supply | 147,883,948 BNB |

| Max Supply | 179,883,948 BNB |

| Burned Supply | 20,116,052 BNB |

BNB’s Timeline

July 2017 – Binance exchange was launched and its ICO was held

2018 – Binance became the top cryptocurrency exchange

2019 – Binance launched IEOs

April 2019 – Binance DEX was launched

April 2020 – Binance Smart Chain was introduced

Where can I buy BNB?

Auto generated

How to properly store BNB?

Now that BNB runs its own blockchain network, it can only be stored on BEP-2 compatible wallet addresses. BNB wallet addresses start with bnb followed by a mix of 39 alphanumeric characters.

Hardware Wallets – auto generated

Online Wallets – auto generated

Real world use cases (Who’s using it?)

Aside from being used in the Binance exchange, BNB is already being used all over the world as a form of payment. BNB can be used to book hotels, buy properties, or buy stocks. A full list of merchants can be seen in this link: Use BNB

Pros and Cons

Pros

- Backed by Binance which is the largest cryptocurrency exchange

- Can be used as a discount for trading fees

- Already accepted by many merchants

- Fast transactions and low latency

Cons

- Tied to the success of the Binance exchange

- Not yet decentralized since validator nodes were all hand picked

- Low adoption as a token standard compared to ERC20

FAQ

Confirmation time

1 second block confirmation time

Trading fees

When trading at Binance DEX, the fee is 0.04% when using BNB to pay for trading fees while paying in other cryptocurrencies has a fee of 0.1%. Full list of fees can be seen here: Trading Spec

Inflation Rate

Binance is a non inflationary asset with a max supply of 200 million BNB. In fact, BNB is deflationary since they do token burns up until 50% of supply has been burned.