What is Ripple?

Ripple Network, also known as RippleNet, is an open source technology platform that focuses on providing real-time payment settlement and currency exchange services. It is composed of different products such as xRapid, xCurrent and xVia. It was developed by Ripple Labs and created mainly for financial institutions such as banks and remittance companies to use. The main goal is to onboard these financial institutions and connect them all into one network thus allowing fast and cost efficient global money transfers. It aims to solve the problems of these legacy institutions namely high transaction fees, and slow and unreliable transactions. The current alternative in the market is the SWIFT network used by banks which takes days for settlement to happen and is expensive.

XRP, also called Ripple, is a digital asset built for these payments and settlements. It is the native digital currency for its distributed ledger database (XRP ledger). It acts as a bridge that allows for these fast transactions to happen. In a simple case of cross currency payment, a party can exchange its currency to XRP, send the XRP and let the receiving party convert to his own currency all without the need of a central intermediary. This is opposed to the current way remittance is done where it goes through multiple parties not only increasing the cost along the way but also increasing the processing time.

Products

Ripple has a host of different products such as xRapid, xCurrent and xVia. All of these still have the main goal of helping financial institutions coordinate and transact with each other in a cheaper and faster way.

xRapid

xRapid is an on-demand liquidity solution provided by Ripple Labs. It is designed to use XRP as a bridge currency between different fiat currencies when making cross border payments. Both XRP and xRapid use the patented RPCA (Ripple Protocol Consensus Algorithm) which relies on the XRP Ledger. This enables faster settlement times and much lower fees when compared to legacy systems currently being used in the market.

xCurrent

xCurrent provides instant settlement and tracking of cross-border payments between RippleNet members. xCurrent is cryptographically secure and offers end-to-end payment flow with transaction immutability. Since xCurrent is not based on the XRP Ledger, it does not use the XRP cryptocurrency. Instead, it uses the Interledger Protocol (ILP) which is used to connect different ledgers and payment networks operating on the RippleNet platform. It has nothing to do with digital assets and is widely used by banks from developing countries.

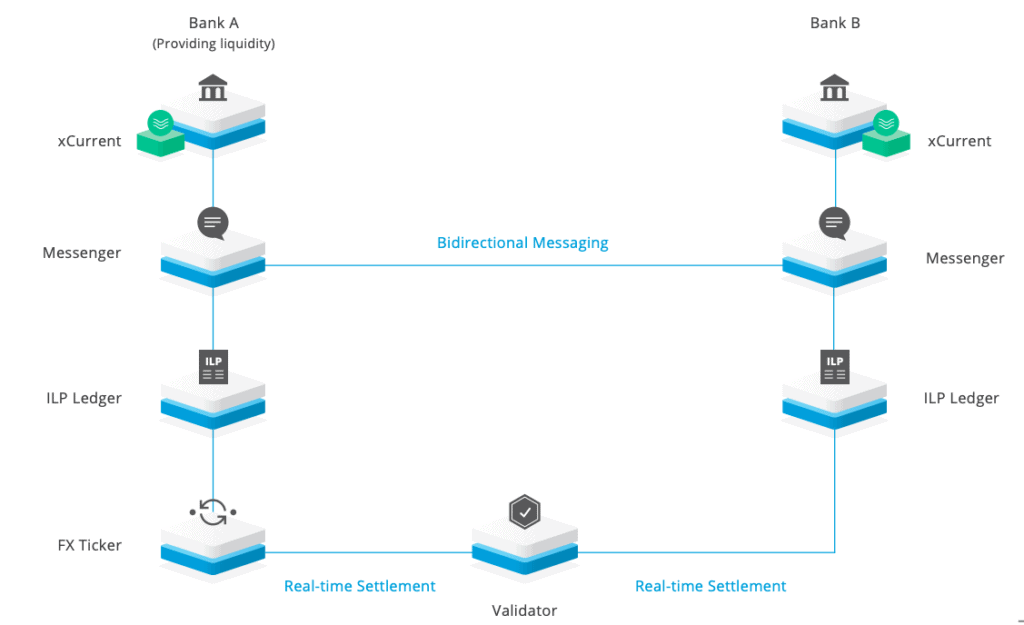

Four main components of xCurrent:

- Messenger – The xCurrent messenger is an API based messaging module that allows communication between RippleNet financial institutions. Transacting parties can use the messenger to exchange information regarding risk and compliance, fees, FX rates, payment details and expected time of funds delivery.

- Validator – The validator module cryptographically confirms the success or failure of each payment. It also coordinates movement of funds across the ledgers of the transacting parties. With this, there is no settlement risk since it uses an atomic settlement procedure with a single pass-fail outcome, meaning they are either settled instantly or not at all. Financial institutions can run their own validator or can rely on a third-party validator.

- ILP Ledger – ILP Ledger is a subledger of each transacting bank’s general ledger. It is used to track credits, debits, and liquidity across transacting parties. It gives financial institutions end-to-end visibility.

- FX Ticker – This module allows liquidity providers to post FX rates used to facilitate the exchange between ILP Ledgers. This component provides the exchange rate between any pair of ledgers. The rates can be based on the bank’s own exchange rates.

xVia

xVia allows financial institutions to easily send payments to and from emerging markets by leveraging the RippleNet. Its an API-based standardized interface allowing financial institutions providers to interact all using a single framework. This not only makes it possible but also faster and cheaper. With xVia, banks can send payments through other banking partners that are connected to RippleNet. It also enables them to attach invoices or other information they deem necessary for the transaction.

Partnerships

If there’s one thing that Ripple is good at, it is in forming partnerships with financial institutions. To date, there are over 200 members in the RippleNet. These members use Ripple’s main products such as xRapid and xCurrent. This is a combination of banks already deploying Ripple products as well as those still in the exploratory phases. Partners include Banco Santander, a spanish multinational bank, American Express, and Mitsubishi UFJ Financial Group, one of the top 5 banks in Japan.

Ripple has also formed a strategic partnership with MoneyGram. MoneyGram is an international money transfer service that is used in over 200 countries. Later on, Ripple invested into Moneygram pouring in over $61 million dollars. The aim is for MoneyGram to test and deploy Ripple products such as xRapid and xCurrent for its money remittance services. Although they are testing the blockchain solutions offered by Ripple, they have also recently announced a new service called FastSend which is a real time money sending service which is supported by Visa direct rails. It allows users to send money quickly to other people’s phone numbers via the MoneyGram website or mobile app.

What sets Ripple apart?

Ripple is very focused on targeting which are the banks. Their products are made especially for them. Since it is a network of banks, having a few hundred banks onboarded is a great deal. It encourages even more banks and financial institutions to join the Ripple Network. With RippleNet, even smaller banks and financial institutions can be part of this network. Compared to legacy products like SWIFT, Ripple’s technologies allow for transactions and settlement to happen almost instantaneously. Instead of going through multiple parties with each party taking their cut and adding to the processing time, transactions can happen directly with XRP being the main middle man. This greatly optimizes the speed as well as lowers the cost of doing transactions significantly.

How does Ripple Work?

RPCA (Ripple Protocol Consensus Algorithm)

Ripple uses a different approach than Proof of Work (popularized by Bitcoin) and it’s common alternative, Proof of Stake. Instead, Ripple validates transactions and recommends its clients to use a list of identified, trusted participants to validate their transactions. This list is called the Unique Node List (UNL); each server maintains a unique node list, a set of other trusted nodes. Only the votes of the other members of the UNL are considered when determining consensus (as opposed to getting consensus from every other node on the network like in the case of Bitcoin). With less nodes needed for verification, it allows for transactions to be processed much faster. This then brings up the question of decentralization. However, Ripple was always designed to bring together financial institutions.

With the RPCA, Ripple is able to transact over 1,500 transactions per second. It is always available 24/7 unlike its legacy counterparts. When XRP launched, its full 100 billion supply was already created. 20% of that was given to its founders. The remainder was held in escrow and is distributed by Ripple to its partner bank as they see fit.

Key Metrics

| April 2020 | |

| Price of XRP | $0.195 |

| Avg. Ledger Interval | 3-5 seconds |

| Circulating supply | 44,089,620,959 |

| Max Supply | 100,000,000,000 |

| Avg. Transactions per hour | 41,888 |

| Avg. Transaction Fee | 0.00012 USD |

Ripple’s Timeline

2012 – Ripple was released

2018 – Over 100 banks have signed up with RippleNet

Nov 2019 – Ripple invested into MoneyGram

Where can I buy XRP?

Auto generated

How to properly store XRP?

Since XRP runs on its own network, it will not be compatible for Bitcoin or Ethereum wallet addresses. XRP has a distinct address since it always start with an r followed by a mix of 33 different alphanumeric characters.

Hardware Wallets – auto generated

Online Wallets – auto generated

Real world use cases (Who’s using it?)

Ripple’s xRapid and xCurrent solution is being used by hundreds of banks all over the world. Again, this does not mean that they are all using or holding XRP tokens especially given its volatility. However, Ripple hopes that banks will eventually use the XRP currency later on after trying out Ripple’s primary products.

Pros and Cons

Pros

- High throughput handling thousands of transactions per second

- Adoption from banks are promising for some of their products

- Low transaction costs

Cons

- Centralization concerns

- Not all banks are using the XRP token

- Founders have a huge allocation of XRP tokens

FAQ

Confirmation time

XRP’s ledger updates every 3-5 seconds so transactions are confirmed in just the same amount of time.

Transaction fees

Transaction fees in the network are very miniscule at just around 0.00012 USD

Halving dates

Ripple is a non inflationary token meaning that there will be no XRP released. All the XRP has already been created but most of it is still held in escrow by the company.