Overview and History

Coinbase is a digital currency wallet and trading platform. It is one of the oldest and biggest crypto exchanges in the world especially in the U.S. They have managed to stay on top of regulatory hurdles and continue to serve a large portion of american users. It has been a go to place for buyers, sellers, and traders since 2012. It has well over 30 million users worldwide and has already processed more than $150 Billion worth of transactions to date.

It was founded by Brian Armstrong and counts has raised over $217m dollars in venture capital from top investors such as Andreessen Horowitz, Y combinator, and ICE (parent company of NYSE). One of Coinbase’ strong suits is its regulatory compliance. They have more than 55 staff onboard just on their compliance division alone making sure Coinbase always stays above board. This gives investors even more confidence in Coinbase.

When Coinbase started, their goal was to help people easily and safely buy Bitcoin. As the years passed, they have expanded their coverage in many ways. Right now, they offer not only Bitcoin but also 18 other cryptocurrencies. They offer different services, from professional trading to custody, to over 100 different countries all over the world.

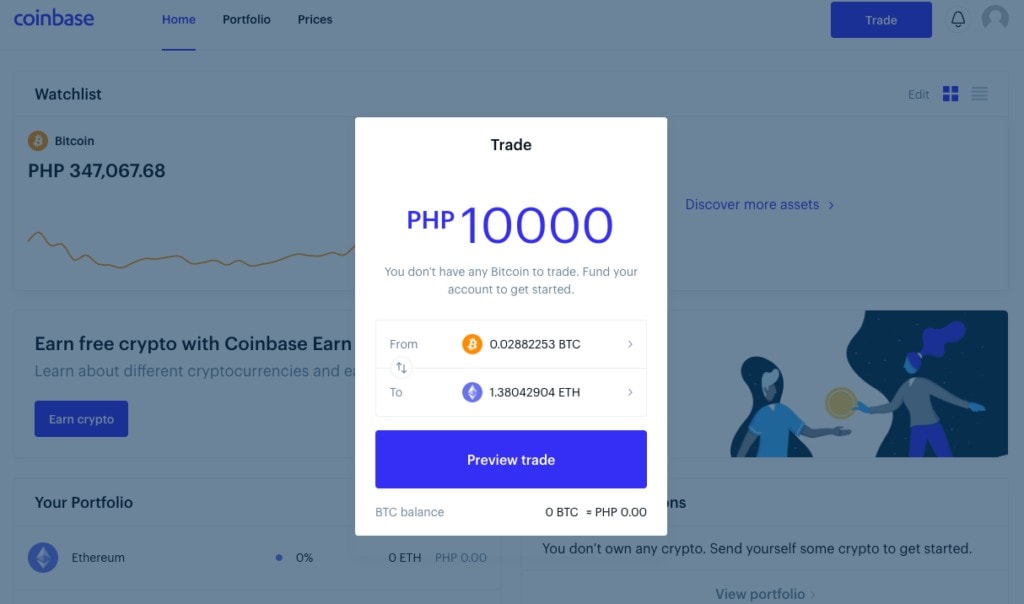

Coinbase Main Interface

Coinbase was made to be a place where consumers can easily buy, sell, trade, and store digital currencies. You can buy it using different payment options such as credit card or bank transfer and you can also easily convert from one type of cryptocurrency to another.

Buying and Selling

Buying and selling cryptocurrencies using fiat money was Coinbase’ main business and remains to be one of its most used features. For now, this service of fiat to crypto conversion is only available in certain major countries like the U.S. Canada, Singapore, U.K. and the following european countries:

Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Latvia, Liechtenstein, Lithuania, Malta, Monaco, Netherlands, Norway, Poland, Portugal, San Marino, Slovakia, Slovenia, Spain, Sweden and Switzerland

The first step is to add a payment method. Coinbase offers different options such as credit cards or debit cards, bank transfer and even Paypal. Second, go to the Buy/Sell tab. Choose the cryptocurrency you would like to buy or sell. Afterwards, choose the payment method and enter the amount you would like to buy and click the buy button. The amount you bought will be transferred directly to your Coinbase wallet which is accessible in the accounts section.

The interface is intuitive and simple to use. They may ask for a lot of details on the onset but after your first purchase, buying Bitcoin or other cryptocurrencies could be done in just a few clicks.

Trade Interface

As for trading between cryptocurrencies, the process is similar. Simply choose the cryptocurrency pair you would like to exchange and enter the amount. Amount entered is usually in your home fiat currency but the cryptocurrency amounts will be converted instantly. Be sure to have enough balance in your wallet first.

Supported Countries

Unlike the buying and selling service which is limited in terms of availability, the crypto to crypto trading is available in all countries which Coinbase serves as this requires less regulation. A full list is available here: Coinbase Supported Countries

Fees

For buy and sell transactions, Coinbase charges a 0.5% spread. On top of it, they add a Coinbase fee whichever is greater, a) the flat fee, or b) a variable percentage fee determined by region, product feature and payment type.

The flat fees are as follows:

- If the total transaction amount is less than or equal to $10, the fee is $0.99 | €0,99 | £0,99

- If the total transaction amount is more than $10 but less than or equal to $25, the fee is $1.49 | €1,49 | £1,49

- If the total transaction amount is more than $25 but less than or equal to $50, the fee is $1.99 | €1,99 | £1,99

- If the total transaction amount is more than $50 but less than or equal to $200, the fee is $2.99 | €2,99 | £2,99

The variable fees are as follows:

| Instant buys (Credit and Debit Cards) | Standard Buy/Sell | Bank Transfers (SEPA) – in/out | |

| Australia | 3.99% | ||

| Canada | 3.99% | ||

| Europe | 3.99% | 1.49% | Free/€0.15 |

| Singapore | 3.99% | ||

| U.K. | 3.99% | 1.49% | Free/€0.15 |

For the U.S.

| Payment Method for Purchase/Payout Method for Sale | Effective Rate of Conversion Fee (after waiver) |

| U.S. Bank Account | 1.49% |

| Coinbase USD Wallet | 1.49% |

| Credit/Debit Card *** | 3.99% |

| USD Deposit Method | Fee |

| ACH Transfer | Free |

| Wire Transfer | $10 ($25 outgoing) |

Full details are seen in this link: Coinbase pricing and fees disclosures

Coinbase Pro

Coinbase Pro, formerly known as GDAX, is Coinbase’s trading platform catered more towards experienced and professional traders and investors. It is one of the biggest exchanges when it comes to daily transaction volumes for spot exchanges handling over $300 million worth of daily transactions. You can easily login using the same credentials you use on their main website. Majority of their volume comes from the U.S. which is around 46% of their total website visits.

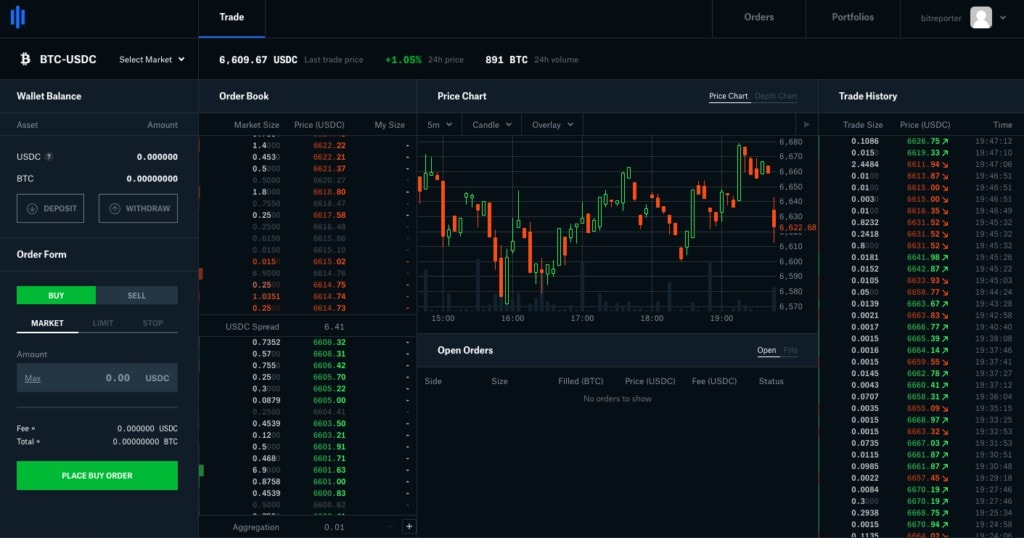

Trade Interface

At first glance, the site looks like those old fashioned platforms offered by traditional brokerages. The chart is in the middle, the order options and order books are on the left and the trade history is on the right. It can be downright intimidating especially for new users.

In terms of functionality, Coinbase Pro has very limited features. They do not have TradingView charts integrated. You cannot draw on their charts. They also offer very limited indicators and timeframes to choose from.

Right now, Coinbase Pro offers 58 trading pairs for 25 coins. They have markets in BTC, USDC, DAI, and ETH. You will notice that they do not have USDT here. Coinbase has their own USD stablecoin called USDC. It has the same purpose as USDT with the main difference being that USDC is regularly audited to make sure it is backed by actual dollars. On the downside, it’s used much less especially outside of Coinbase.

Fees

Like many other exchanges that want to encourage users to increase their trading volume, Coinbase offers a tiered trading fees system based on your trailing 30-day period across all order books. The more volume you trade, the lower your trading fees will be. Entry level starts at 0.5% Maker and 0.5% taker fee. Compared to others, Coinbase has one of the highest fees especially among top tier exchanges. However, as your volume increases, the rates become more and more competitive and can go as low as 0.04% for taker fees and 0.00% for maker fees.

Maker fees are also usually lower than taker fees.The difference between the two is the taker fee is taking liquidity from the exchange while the maker fee is providing and adding liquidity. If you place an order and it is filled instantly, you are on the taker side. If you place an order and it floats on the exchange, it means you’re on the maker side.

Deposit and Withdrawals

Coinbase Pro’s deposit and withdrawal fees vary depending on the method of deposit and withdrawal. The exact rates are displayed in the table below:

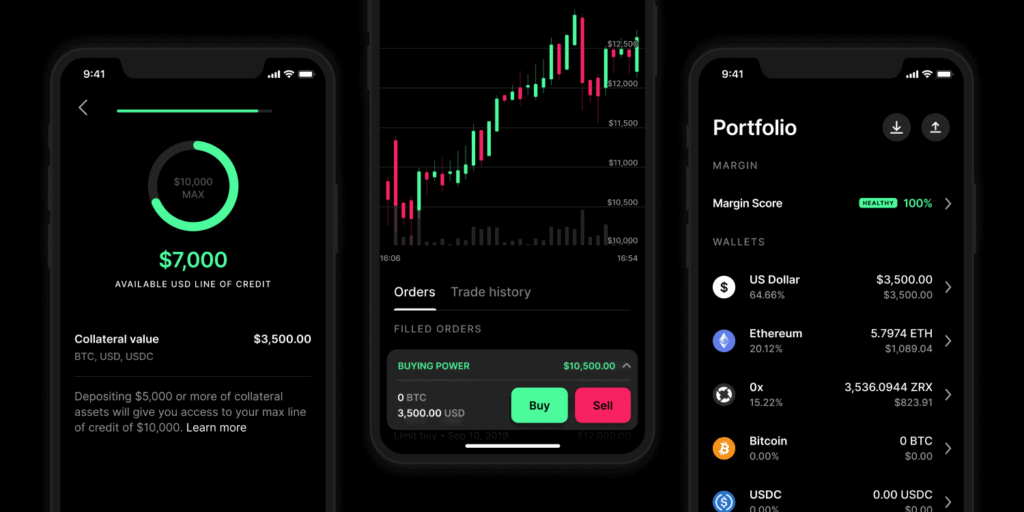

Coinbase Pro Margin Trading

With most major exchanges offering margin trading, Coinbase Pro has followed suit and has begun to offer margin trading in February of 2020. Margin trading allows you to borrow money from the exchange (at an annualized interest rate of 8%) and trade with it while using your available assets as a collateral. Margin trading in Coinbase offers users access up to 3x leverage on USD-quoted books.

As for availability, the roll out of the margin function will be gradual. Coinbase Pro starts off offering it to 23 U.S. States. Eligible users are those that are active on Coinbase Pro, measured by recent trades, balances, and deposit and withdrawal activity.

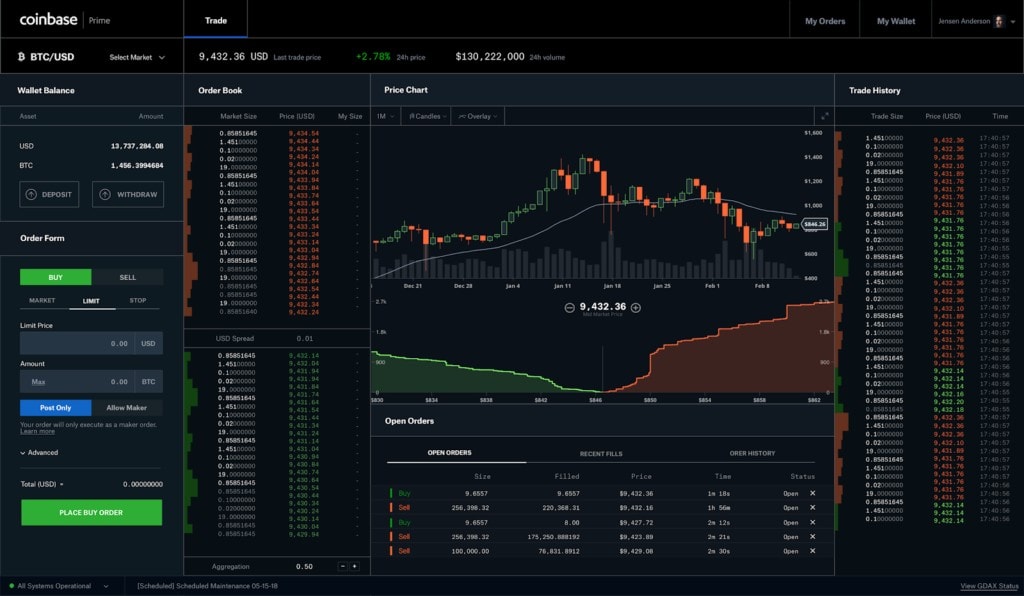

Coinbase Prime

In 2018, Coinbase created a professional trading platform tailored specifically for institutional clients called Coinbase Prime. This will require users to register the legal entity of their institution.

Institutional clients will have more needs as compared to the average investor. Coinbase Prime aims to fill the need of institutional clients such as lending and margin financing products, high touch and low touch execution services like over-the-counter (OTC) trading and algorithmic orders, and new market data and research products. Coinbase Prime will also offer platform improvements such as multi-user permissions and whitelisted withdrawal addresses.

Coinbase Custody

Leveraging on their stellar reputation, Coinbase launched Coinbase Custody in July of 2018. They aim to be the most trusted and easiest-to-use crypto custody service available. Coinbase Custody is a combination of Coinbase’s battle-tested cold storage system for crypto assets, an institutional-grade broker-dealer and its reporting services, and a comprehensive client coverage program.

A list of all the features Coinbase Custody implements and offers for handling clients’ accounts include:

- On-chain segregation of crypto assets

- Split, offline private keys that require a quorum of geographically distributed agents to use cryptographic hardware to sign transactions

- Multiple layers of security

- Robust cold storage auditing and reporting

- Insurance policy for digital assets

- Offers staking from offline storage

- Participation in governance activities

Coinbase Custody operates as a separate and standalone entity, independent to Coinbase, Inc. Coinbase Custody is a fiduciary under NY State Banking Law. All digital assets are segregated and held in trust. They support all major assets listed on their platform including BTC, ETH, ALGO, XTZ, XRP and LTC. For a full list, check the link at: Coinbase Custody | Supported Assets

KYC

Exchanges have been more and more strict with KYC over the years. Gone are the days that allow you to just sign up for an account and deposit and withdraw as you please. This is true especially for bigger companies which draw scrutiny from regulators. Coinbase is one of the few that has always had strict regulatory oversight. They work closely with regulators to make sure that they are compliant. This gives investors more confidence in them.

Coinbase requires an extensive amount of KYC and for good reason. They need to make sure what services they can offer that are allowed by the users’ jurisdiction. They require the following details:

- Verified email address

- Verified mobile phone number

- Full Name

- Birth date

- Current Address

- Purpose of account

- Occupation

- ID verification

- Selfie with ID

It may seem like a hassle but these are one time verifications. After setting it up, purchasing Bitcoin or other cryptocurrencies can be really easy and almost instantaneously.

Coinbase Customer Support

Coinbase offers many different ways for you to reach out to them in case you have trouble with your account or any other issues. The support link will lead you first to their comprehensive FAQ. It is divided into three categories: Coinbase, Coinbase Pro and Coinbase Custody which are their top three consumer facing products. Institutional clients will have all of these plus a dedicated support staff.

If you have a specific problem that is not available on the FAQ, you can submit a ticket and they will reply to you within a day or two. When you click the help button, it launches a dialog box with “Ada”, their own customer service bot. And Lastly, they also have a hotline for the U.S. UK and Canada which is open for all who would like to solve their issues over the phone.

Operation Security

Being one of the biggest exchanges, Coinbase has seen multiple attempts from hackers to attack their system. Coinbase takes pride in their security and has so far done a splendid job. This is also a reason why many institutional players trust Coinbase with handling their trades. Here are some of the steps that Coinbase implements and offers to ensure better security.

2FA – This has been a standard form of account protection. This involves using a separate device that generates a unique code or combination every few seconds. You will be asked to enter this upon signing in.

Phone Verification – A code will be sent to your phone which you have to input for all requests including withdrawals and changing of security settings.

Email verifications – Whenever you would like to withdraw funds, an email will be sent to your email address for you to confirm if this transaction is legitimate.

Security Key – A security key is a physical hardware authentication device designed to authenticate access through one-time-password generation. Coinbase supports Universal Second Factor (U2F) security keys.

Hot and Cold Wallets – This is a standard procedure that separates revolving funds (hot wallet) and most user funds (cold wallet). The cold wallet is disconnected from the internet so it is less likely to be hacked. It is akin to banks not having all of their money locked in a giant safe. They only hold what they expect to be transacted that day.

Conclusion

Coinbase is one of the biggest players in the crypto space. They have continuously innovated and offered more and more services to more and more people. They are well trusted and have a solid security record. Their stellar reputation especially on the regulatory side is also unrivaled. There are very few exchanges that would set up their headquarters in the U.S. due to its strict regulations but Coinbase has managed to stay on top of it. that It is no wonder they handle a ton of volume on a daily basis. They have products made for everyone from beginners to institutional players like hedge funds.

On the downside, Coinbase charges a lot more in terms of fees compared to other exchanges. The user interface and functionalities could use an upgrade especially compared to other top tier exchanges. But given their stellar reputation, bigger players wouldn’t mind these fees as they feel safer doing trades on Coinbase.

Coinbase is definitely a solid first choice for beginners especially those in the U.S. and European countries. Coinbase Pro has great liquidity too which draws in even more users. Anyone looking to just buy and sell Bitcoin and Ethereum can easily use either Coinbase or Coinbase Pro. Those who want convenience can opt for Coinbase, but traders who are looking for more sophisticated trading can choose Coinbase Pro.