Table of contents

- What is Ethereum?

- What are Smart Contracts?

- What is Ether?

- What is Gas?

- How does Ethereum Work?

- Proof of Work

- What is Ether used for?

- Key Metrics

- Ethereum’s Timeline

- Where can I buy Ether?

- How to properly store Ether?

- Real world use cases (Who’s using it?)

- EEA (Enterprise Ethereum Alliance)

- Pros and Cons

- FAQ

- Confirmation time

- Transaction fees

- Halving dates

What is Ethereum?

Bitcoin ushered in the era of decentralized money using blockchain technology. With blockchain, it allowed a new kind of peer to peer money that promotes decentralization, immutability and transparency. However, Bitcoin is limited to financial transactions. What if we could use blockchain technology and apply it to the different aspects of our lives creating a more transparent world? This would require use cases to branch out of finance and into other areas. This is where Ethereum comes in. It wants to be a blockchain based software platform that allows others to build applications on top of Ethereum to provide the benefits of blockchain to a wider scope of use cases than just a digital cash system. Today, Ethereum is used to build games, enterprise software, media and even government applications.

Ethereum is a next-generation smart contract and decentralized application (Dapps) platform which allows programmers to build on top of it. It was designed to be simple, transparent, modular and universal. Ethereum is coded in Solidity which is a turing complete programming language built specifically for Ethereum. It wants to be a ‘World Computer’ that would decentralize the existing client-server model using blockchain technology. Since blockchain allows for records of data stored in a network of different computers that can be spread all over the world, applications built on top of it are decentralized and do not have a single point of failure.

Ethereum was the brainchild of Russian-Canadian programmer Vitalik Buterin. The whitepaper was published in late 2013. In 2014, Vitalik and other core members founded the Ethereum Foundation, a non-profit focused on developing Ethereum research, core protocol upgrades and ecosystem growth. That same time, they raised 31,529 BTC ($18 million at the time of offering) in exchange for 60 million Ether (Ethereum’s native token) at a price of $0.30 each. The Ethereum network launched in 2015 and has grown to be the second move valuable cryptocurrency in the market just behind Bitcoin. To date, the Ethereum Foundation still oversees Ethereum networks’ upgrades and provides grants to different projects helping the growth of the Ethereum ecosystem.

What are Smart Contracts?

You may have heard of the term smart contract especially when talking or reading about Ethereum. Smart contracts are lines of code that dictate the terms of the contract and execute these terms. This means that the code will execute even without a third party or central figure to oversee and enforce the rules since it is all coded into the program. Ethereum allowed the creation of these smart contracts on the blockchain and thus harnessing blockchain’s immutability, transparency and decentralization. Smart contracts make transactions trackable, transparent and permanent.

What is Ether?

While most people use the words Ether and Ethereum interchangeably, they represent 2 different things. Ether is the native cryptocurrency token which you can store, trade and use while Ethereum is the name of the network.

Unlike Bitcoin, Ether was not primarily made to be a form of money or store of value. Ether was designed for fueling the Ethereum network. So while Bitcoin is commonly dubbed digital gold, Ether is more akin to digital oil. Since Ethereum is hosted by nodes all over the world, these nodes are incentivized to support the network since they are paid in Ether from the network and from the tx fees for the bandwidth and space taken up by the decentralized applications.

What is Gas?

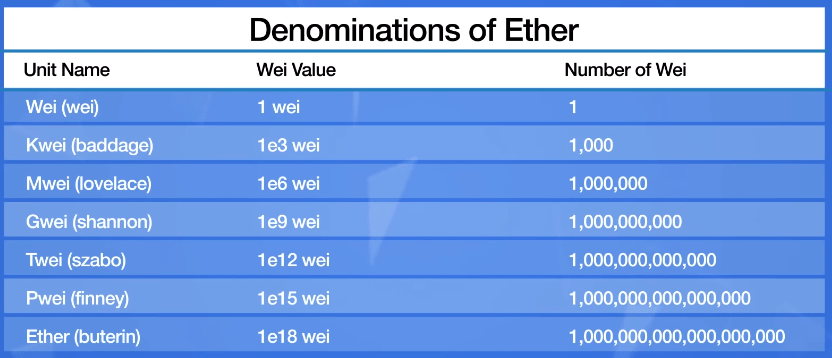

It is the built in pricing system of the Ethereum network. It takes into account bandwidth, space, and computational difficulty of each transaction. Gas costs will be determined in terms of GWEI or gigawei which is just a fraction of an ether to the ninth power (0.000000001 ETH). The chart below shows the denominations of Ether.

Right now, the Ethereum network can handle 15-25 transactions per second. This is much higher than Bitcoin’s 7 transactions per second but is still infinitesimal compared to centralized servers like VISA that can handle thousands of transactions per second. If Ethereum wants to replace traditional services, it will have to greatly increase this capacity. Several proposals are already on the works to allow Ethereum to scale better such as a technology called Sharding. Users can pay higher transaction fees in order to get prioritized by the nodes so their transactions can push through much faster. A useful website to see the current transaction costs and estimated time is seen here: ETH Gas Station | Consumer oriented metrics for the Ethereum gas market

How does Ethereum Work?

Proof of Work

Like Bitcoin, Ethereum uses a Proof of Work consensus mechanism. This rewards miners for validating transactions in exchange for the hash power they provide. The hash power they provide is used to guess answers to a cryptographic puzzle. So the more hashpower they provide, the higher their chances of guessing the puzzle correctly. If a miner finds a hash that matches the current target, the miner will be awarded ether (currently 2 ETH) and broadcast the block across the network for each node to validate and add to their own copy of the ledger. It takes almost no time to validate that the hash is correct. Afterwards, they move on to mine the next block.

Since mining is a game of trial and error, miners can’t cheat at this game. There’s no way to fake this work and come away with the correct puzzle answer and thus the name ‘proof-of-work’. Approximately every 12–15 seconds, a miner finds a block. If miners start to solve the puzzles more quickly or slowly than this, the algorithm automatically readjusts the difficulty of the problem so that miners spring back to roughly the 12-second solution time.

Ethereum uses a specific proof-of-work algorithm called ‘ethash’. Unlike Bitcoin which can be mined using ASICs (Application Specific Integrated Circuits), ethash is designed to require more memory to make it harder to mine using expensive ASICs. With ASICs, mining becomes profitable only for bigger players who have the capital and the economies of scale. In effect, the network becomes more centralized. So far, ethash has succeeded in fending off ASICs making it still profitable for smaller players. However, Ethereum plans to eventually switch from Proof of Work to Proof of Stake. Instead of providing hash, nodes have to deposit certain amounts of ETH as a stake and any bad actors will have their stakes penalized.

However, there are plans to shift Ethereum away from Proof of Work and to Proof of Stake. Proof of Stake will increase decentralization since it will be easier for anyone to support the network. It will also waste less energy since Proof of Work is basically solving complex yet useless puzzles and uses a ton of energy. Hopefully, this will be implemented when they release Ethereum 2.0.

What is Ether used for?

As mentioned above, Ethereum wants to bring in a new wave of applications called dapps. Dapps can be accessed and used directly by users without any middleman. This means there is also no authority that can censor or pull the plug. An example would be a decentralized blog. Once published, the contents are added to the blockchain and therefore cannot be removed without taking control over the entire network. This also means that all changes will be recorded allowing for full transparency. These dapps built on Ethereum will all be powered by Ether. To date, there are over 2,811 dapps launched on Ethereum. The most popular categories of dapps are gaming, finance and gambling . Popular dapps include Cryptokitties (a blockchain game that allows users to buy, breed and trade virtual cats) and Augur (which is a decentralized prediction market). You can find more example of dapps at State of the DApps — Ethereum

One of the largest use cases for Ether came with the creation of ERC-20 tokens. ERC stands for Ethereum Requests for Comments and the number 20 is the proposal number. This proposal focuses primarily on creating a token standard on the ethereum blockchain so other companies can issue their own ERC20 tokens that run on the Ethereum. These tokens can be assets and also utilities that serve their own purpose. Some of the most well known ERC20 token projects are Chainlink and BAT (Basic Attention Token). With this new token standard, creating tokens was very easy and thus created the ICO (initial coin offering) boom. This is similar to an IPO where the new tokens created are sold for the first time to the public before being traded anywhere. This allowed projects to raise money on their own without the need for a 3rd party to regulate them. This eventually drew regulatory scrutiny after numerous cases of fraud have shown up. You will notice then that this has curbed the number of ICOs being held today compared to 2017 and 2018. To date, billions of dollars have been raised in ETH to fund thousands of different projects. Some have been a success and given good returns to early supporters while others are outright scams that only used this unregulated fundraising activity for their financial gain.

Key Metrics

| April 2020 | |

| Price of Ether | $160 |

| Market Cap | $17 Billion |

| Circulating Supply | 110,469,275 ETH |

| Max Supply | No Max Supply |

| Rank | 2nd |

| Number of wallets | Over 90 million wallet addresses |

| Hashrate | 175 Terahash per day (ETHash) |

| Avg. Transactions per hour | 34,193 |

| Avg. Transaction Value | 2.04 ETH (~$346) |

| Avg. Block time | 13.2s |

Ethereum’s Timeline

2013 – Vitalik conceives of Ethereum and releases the whitepaper

2014 – Formation of the Ethereum Foundation and fundraising of ~$18 million

July 2015 – Mainnet launch of Ethereum also called Frontier.

March 2016 – first hard fork called Homestead which introduced the solidity smart contract

April 2016 – DAO hack incident

January 2018 – Ethereum hits all time high at $1,448 per Ether

June 2018 – U.S. SEC director does not recognize ETH to be a security and thus does not fall under security regulations

Where can I buy Ether?

Auto generated

How to properly store Ether?

Ethererum uses a different wallet from Bitcoin. This means that you cannot deposit Ether in your bitcoin wallet. Using the ERC-20 standard, Ether can be safely stored on ERC20 addresses. These ERC20 address will always start with 0x followed by 40 different letters or numbers.

Hardware Wallets – Auto generated

Online Wallets – Auto generated

Real world use cases (Who’s using it?)

Aside from conducting ICO’s Ethereum is also used in a myriad of different ways. Recently, Ethereum led the Decentralized Finance movement (DeFi) and it is becoming the top use case for it. The DeFi movement aims to create a more transparent financial system through decentralized financial applications. To date, over $700 million is locked up in DeFi applications. The top 3 applications are Maker (a decentralized credit platform that supports the DAI usd stablecoin), Synthetix (a decentralized platform that creates on chain synthetic assets that track the value of real-world assets) and Compound (an algorithmic money maker protocol that let’s users borrow or lend assets against collateral). You can refer to https://defipulse.com/ for the top DeFi applications currently in the market.

EEA (Enterprise Ethereum Alliance)

It is no doubt that many companies will benefit from what Ethereum offers. However, they see the transition as something hard and daunting. The EEA is a member driven standards organization that aims to facilitate and guide the conversion of enterprise grade software into Ethereum’s blockchain based platform. Members contain a mix of large and small enterprises from 45+ countries. There are currently over 180 companies that are part of this alliance including notable companies such as J.P. Morgan, Microsoft and Accenture.

Pros and Cons

Pros

- The team has a strong background in the blockchain space.

- There are thousands of developers around the world that build on top of Ethereum

- Ethereum had a good head start and is one of the oldest and most robust network.

- They have gained a mass network effect because of erc20 tokens

- Supported by Consensys which is a more than 1,000 person company that builds on top of Ethereum as well as consults companies and governments on Ethereum’s benefits.

Cons

- Transaction speed is still sluggish at 25 transactions per second. In 2017, the rise of popularity of the game CryptoKitties clogged the network.

- Although Ethereum’s plans are quite large, they have been delaying their roadmap for some time now especially with the release of ETH2.0 and it’s shift from PoW to PoS.

FAQ

Confirmation time

Blocks are mined every 10-12 seconds. As for transactions, it will depend on the amount of fees (in GWEI) you pay. It normally takes 5 to 10 minutes for an average GWEI to be processed although during peak network activity, it may take several hours if your fees are set to normal.

Transaction fees

Transaction fees vary depending on network activity. During peak activity, it will be more expensive to send transactions especially if you want to send it fast. But during normal times, transaction fees are between $0.018 and $0.03.

Halving dates

Unlike Bitcoin which is deflationary, Ether is an inflationary token meaning there is no cap in the amount of Ether. However, Ether also implements reduction of rewards to curb inflation of supply. There is no fix date or block number unlike Bitcoin’s halving which happens approximately every 4 years. Historically there have been 2 times Ether rewards were reduced. The first was in 2017 during the Byzantine Hard fork which adjusted block rewards from 5 to 3. The last was in February of 2019 when the reward was reduced from 3 to 2 eth. Reward reduction events are seen as positive for price since this reduces the sell pressure from miners and thus increases the price all else being equal.