What is Cardano?

Cardano claims to be a third generation blockchain. Before we get into that, we have to first define the first and second generation blockchain. Bitcoin is considered the first generation blockchain. It was the first to utilize and popularize blockchain. However it only works in the financial space as a form of digital sovereign money. Ethereum is considered the second generation blockchain. It allowed smart contracts to be created essentially allowing others to build decentralized applications on top of it. However, these first two are still plagued with recurring issues, mainly scalability. Bitcoin’s 7 transactions per second is not enough if it wants to replace digital money which trasacts magnitudes more. This was evidently seen during the 2017 bull run which clogged the bitcoin network. Ethereum has a higher TPS at 15-25 tps. However this is not enough if it wants commercial applications to run on top of it. During the peak of cryptokitties, a collectibles game built on top of ethereum, where it also clogged the network.

Cardano aims to build on all the lessons and mistakes from the previous two generations. It aims to create a more scalable solution that can be used in everyday uses. Cardano approaches the problem by creating a layered approach to building a distributed computing platform. In terms of development, cardano also takes a novel approach putting special emphasis on scientific methodology using peer reviewed papers.

Cardano is an open-source Proof-of-Stake (PoS) blockchain network that offers a dApp development platform, multi-asset supported ledger and verifiable smart contracts. The transaction ledger utilizes a modified version of UTXO to accommodate support for smart contracts.

Cardano was launched in 2017 after 2 years in development. It was built around peer review papers. It aims to solve the issue of scalability, network bandwidth and data storage. This was the brainchild of Charles Hoskinson who was one of the 8 original founders of Ethereum. His professional experiences include the founding of three crypto start-ups – Invictus Innovations, Ethereum and IOHK. He was also the founding chairman of the Bitcoin Foundation’s education committee and established the Cryptocurrency Research Group in 2013.

Cardano is supported by three main organizations: the Cardano Foundation, IOHK, and Emurgo. The Cardano Foundation’s mission is to standardize, protect and promote the Cardano protocol technology. It also aids in the training and development of the Cardano community. IOHK is a cryptocurrency research and development company that directly develops the Cardano platform. And lastly, Emurgo is the organization responsible in developing, supporting and integrating venture capital companies into Cardano’s decentralized blockchain ecosystem. Emurgo invests in startups directly and develops commercial partners who want to use blockchain technology.

Main Components of Cardano

Using a layered approach, Cardano is able to develop faster and more securely since each layer can be independently optimized for efficiency, scalability and performance. The two main layers are the Settlement Layer (SL) and Computation Layer (CL).

Settlement Layer (SL)

The settlement layer accounts for the value of transactions, such as the ADA currency and other user issued assets, done across the network. It supports two sets of scripting languages; one to move value and another to enhance overlay protocol support. The settlement layer also provides support for KMZ side chains which is a non-interactive means to securely transfer funds to the Computation layer or other supported blockchain protocols. Multiple types of signatures are supported, including quantum resistant signatures. What makes ADA truly scalable is that the more users join, the more the system’s capability increases.

Computation Layer (CL)

The second part of Cardano is its smart contract computing layer. It includes three main components: Plutus, Marlowe, and Marlowe Playground. “Plutus” is a custom written smart contract development language and execution platform. It is based on Haskell, a functional programming language. “Marlowe” is a high-level, domain-specific language (DSL) built on Plutus and it is made for non-programmers to write their own smart contracts. Financial and business experts with no technical knowledge can now use Cardano to create their own financial smart contracts. Lastly, Marlowe Playground, is an easy-to-use application-building platform. Marlowe and the Marlowe Playground work hand in hand to simplify the process of creating smart contracts for financial applications without deep programming skills.

How does Cardano Work?

Ouroborus Proof of Stake Algorithm

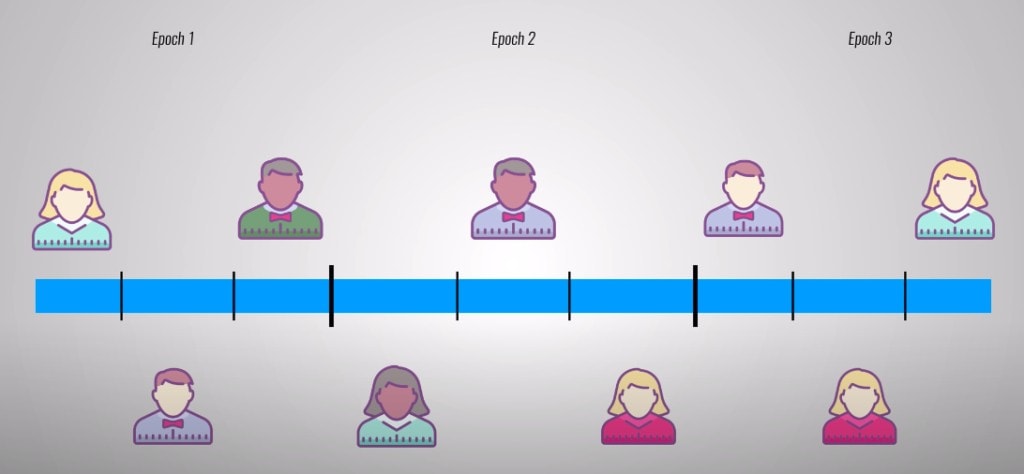

The Ouroboros Proof of Stake algorithm is designed to maximize the level of decentralization on the Cardano blockchain. Block creation is segmented into epochs and slots. Sets of leaders are selected at the beginning of each epoch. Each one is assigned the right to produce a block in a specific slot within each epoch. The slot leader is randomly chosen from a pool of stakeholders. A random number is generated by a multi-party computation among stakeholders in the previous epoch. The chances of winning in any given slot is proportional to the size of their stake. After they produce their assigned block, the block is linked to the previous block in the chain. When a leader fails to show up for their assigned block, they will have to be reelected again to be able to participate. Cardano is scalable because it can increase the slots for each epoch and also run multiple epochs in parallel.

Cardano’s 5 Step Evolution

Cardano has laid out its development phases and separated it into 5 stages: Byron, Shelley, Goguen, Basho and Voltaire.

- Byron – this is the initial stage after the network launch when improvements target core components and the SL layer is being prepared for decentralization.

- Shelley – this stage focuses on decentralization and will feature staking pools.

- Goguen – this stage will feature smart contracts, a universal language and a virtual machine.

- Basho – this stage focuses on improving security scalability and performance.

- Voltaire – In this final stage, Cardano aims to be a self sustaining ecosystem using a treasury model.

Key Metrics

| May 2020 | |

| Price of ADA | $0.047 |

| Circulating supply | 31,112,484,646 ADA |

| Max Supply | 45,000,000,000 ADA |

| Annual Staking Reward | 10.25% APY |

Cardano’s Timeline

January 2015 – Conception of Cardano and start of ADA’s presale

September 2017 – End of ADA’s presale

October 2017 – Initial Release of Cardano

Q2 2020 – Initial release of Cardano Shelley

Where can I buy ADA?

Auto generated

How to properly store ADA?

Since its mainnet launch, Cardano’s ADA tokens can only be stored on ADA wallets. Your ADA wallet will consist of 59 alphanumeric characters.

Hardware Wallets – auto generated

Online Wallets – auto generated

Cardano’s Partnerships

Even before the launch of the second phase, Cardano has already secured different partnerships to utilize the Cardano network and also help grow the Cardano ecosystem. Charles Hoskinson, Cardano’s CEO, recently announced the participation and collaboration of IOHK, within an EU consortium, composed by companies and universities. During the World Economic Forum in Davos, it also secured several partnerships. One of which is ScanTrust who will provide security solutions for supply chain traceability using Cardano’s blockchain. In addition, Gen Two AG also plans to launch a new financial product to the market using the Cardano blockchain.

Pros and Cons

Pros

- Robust scientific process for developing the Cardano blockchain

- Highly scalable architecture

- Highly experienced team with deep experience in the blockchain space

Cons

- Numerous delays in the launch of the main network and other milestones

- Cardano’s custom programming language can be a barrier to entry for new developers

- Issues about centralization

FAQ

Confirmation time

Blocks are produced approximately every 20 seconds.

Roadmap Update

Phase 2 of Cardano called Shelley is scheduled to be launched in May of 2020.

Transaction fees

Each transaction costs at least 0.155381 ADA, with an additional cost of 0.000043946 ADA per byte of transaction size.