USA Guide

USA Guide

Country overview In the past century, the United States has cemented itself as the top superpower in the world in many aspects from military to economy and most importantly in science and innovation. What helped the U.S. reach the peak was because it had a healthy ground for founders and companies to establish their businesses […]

Table of contents

Best United States Bitcoin Exchanges

Country overview

In the past century, the United States has cemented itself as the top superpower in the world in many aspects from military to economy and most importantly in science and innovation. What helped the U.S. reach the peak was because it had a healthy ground for founders and companies to establish their businesses which led to innovation flourishing in the country. One of the fields where the U.S. excelled at as was in cryptography which laid the foundation to cryptocurrencies such as Bitcoin. While nobody knows who the creator of Bitcoin, Satoshi Nakamoto is, some of the most respected cryptographers and cyperphunks who helped in the early days of Bitcoin are from the United States. This includes pioneers such as Nick Szabo and Hal Finney. Until today, the U.S. still has a major influence on Bitcoin and cryptocurrencies. Many countries still look up to the United State’s regulations on digital currencies.

In the United States, Bitcoin and cryptocurrencies have been given sporadic attention by both State and Federal governments. On the Federal level, several agencies such as the Securities and Exchange Commission (SEC) and Commodities and Futures Trading Commission (CFTC) have been involved with overseeing and regulating the cryptocurrency industry. On the state level, it can vary with some states being more embracing of the technology while others being more adverse to it. This has led to varying stands for cryptocurrencies. It will be easier to buy and sell in some while more difficult if not illegal in others. One example of a crypto friendly state is Wyoming which passed a bill exempting cryptocurrencies from property taxation. Other states that have been friendly towards cryptocurrencies include Ohio, Colorado, Texas, and California.

As for buying and selling cryptocurrencies, it will vary depending on the state. Exchanges that operate in the U.S. do not necessarily cover all states. The sale of cryptocurrencies are only regulated if it constitutes a sale under the Federal Law. As for derivatives contracts like futures, options or swaps, they are considered commodities and subject to the rules and regulations set by the CFTC under the Commodity Exchange Act.

As for the financial sector, multiple Bitcoin and crypto related products that have been introduced to the U.S. financial markets. The Chicago Mercantile Exchange, the world’s largest financial derivatives exchange, already offers a Bitcoin futures contract on its platform. Another popular product for institutional investors in the U.S. is the recently launched Bakkt Bitcoin Futures and Options contracts. Bakkt is owned by ICE, Intercontinental Exchange, which operates the New York Stock Exchange.

United States and Bitcoin Mining

The United States has seen its Bitcoin mining market share increase over the past years. This can be attributed to its relatively stable regulations. Investors that want to invest millions in a mining farm will want to make sure their investments will come into fruition. The regulatory environment ensures that once a mining firm gets its permits, it will be able to continue to operate for the foreseeable future. This is unlike in other countries such as eastern Europe or in China where a sudden new law can be passed essentially banning Bitcoin mining. With more and more companies reselling and distributing mining hardware in the United States, the country’s market share of hashpower has been increasing relatively fast as well. Several major mining pools are also based in the United states such as Elgius. As for mining regulations, Bitcoin mining was temporarily banned in New York. However, the ban was quickly lifted a couple of months after in March 2019 showing more acceptance to cryptocurrencies.

Legal Tender

While the Financial Crimes Enforcement Network (FinCEN) does not consider Bitcoin and cryptocurrencies to be legal tender, it does consider exchanges as money transmitters subject to their jurisdiction. Several agencies from both the Federal and State governments have been warning the public about the possible scams and the dangers of cryptocurrencies.

Exchanges

When it comes to exchanges, the United States is stricter than other countries in granting access. This means that there are fewer options for U.S. buyers compared to other countries. An example would be the case of Binance, the world’s largest crypto exchange. Binance used to operate in the U.S. offering its suite of global products to U.S. users. However, in 2019, Binance restricted access to the Binance Global website. For now, if U.S. users want to access Binance, they have to access a sister website called Binance.us which is also owned by Binance but has much fewer assets users can trade with. While this is the case for Binance, the U.S. also has home grown companies that have dominated the U.S. markets. This includes Coinbase and Gemini both of which are highly regulated exchanges but serve a broad U.S. audience.

Regulated Digital Token Offering

With the increased regulatory scrutiny in the U.S., most cryptocurrency projects do not offer their tokens to U.S. citizens. This is due to the strict securities law enforced in the U.S. However, it is not impossible. Blockstack has made a name for itself as being the first to hold a digital token offering that was fully regulated and approved by the SEC. This meant that accredited U.S. investors were allowed to take part in its ICO. Blockstack raised $23 million in the process. To date, the STX token remains to be the only cryptocurrency which adheres to the SEC’s regulation which includes annual reports. This shows that although it can be hard and expensive, it is not impossible to offer digital tokens fully regulated by U.S. laws.

Crypto Regulations in United States

Since there are still very few national laws that cover cryptocurrencies, most of the laws vary on a state by state basis. However, here are some notable regulations that are currently enforced in the U.S.

Crypto-currency Act of 2020

In March 9, Rep. Paul Gosar introduced a bill covering multiple cryptocurrency regulations. It is thought to be a top-to-bottom new law that could govern all crypto in the future proposing different federal agencies to oversee different aspects of the industry. This bill gives legitimacy to crypto assets because it sparks discussion about blockchain and cryptocurrencies in the United States.

New York’s Bitlicense

Bitlicense is the business license used for different cryptocurrency related businesses in New York. It is issued by the New York State Department of Financial Services (NYSDFS). It was first introduced back in 2014, making it one of the hallmark laws surrounding cryptocurrencies. One of the major points is that the NYSDFS oversees and approves every cryptocurrency offered within the state and to its residents. To date, 24 exchanges, bitcoin teller machine providers and other crypto companies have been granted the license. This includes major cryptocurrency firms such as Coinbase and Circle.

Buying Bitcoin and Cryptocurrencies in United States

Although the U.S. is strict when it comes to cryptocurrencies, buying it can be quite easy with the number of regulated cryptocurrency exchanges in the United States. Most of the major exchanges accept direct deposits in USD and have a direct Bitcoin USD pair. This means users will no longer need to convert USD to USDt, a USD backed cryptocurrency. Credit card and debit card options have also been made more available over the past year or two making buying Bitcoin as easy as shopping on Amazon. Coinbase remains to be one of the most popular choices for Americans. For everyday consumers, another easy option to buy Bitcoin is through Square’s popular Cash app. The Cash app has seen tremendous Bitcoin volume over the past few years with each quarter almost always surpassing the previous quarter’s volume. This shows increasing demand for Bitcoin and cryptocurrencies on the consumer front.

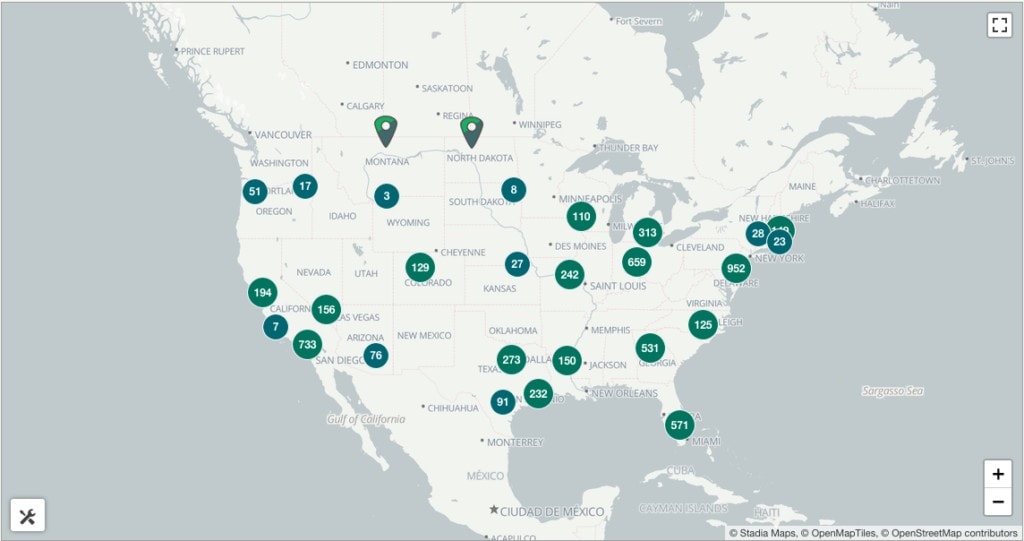

Bitcoin ATMs are also another option to get your hands on Bitcoin and other major cryptocurrencies. Almost every state has a Bitcoin ATM. A great benefit of buying through Bitcoin ATMs is that most will not require KYC therefore users can buy anonymously. On the downside, it charges more fees compared to cryptocurrency exchanges. Coin ATM Radar maps out the distribution of different Bitcoin ATM machines throughout the United States.

Spending Bitcoin in the United States

As Bitcoin’s popularity increases, more and more merchants have already started to accept Bitcoin and other cryptocurrencies as a form of payment for their goods and services. Some major retailers such as Microsoft and Overstock have already begun accepting Bitcoin as well.

One company that has helped accelerate Bitcoin’s adoption is Bitpay. It is a payment service provider focused on making Bitcoin easily acceptable by thousands of different merchants. In 2018, Bitpay processed over $1 Billion in total payments. It recently partnered with Poynt, a PoS service provider. The partnership opens 100,000 Poynt retailers to accept Bitcoin as a form of payment greatly boosting Bitcoin’s adoption. Another up and coming payment start up is called Flexa. They allow major retailers to accept cryptocurrencies in stores. It has partnered with Gemini, a crypto currency exchange, and also has signed up partner merchants such as Starbucks and Nordstrom. It is no doubt that cryptocurrencies are entering the mainstream in the U.S.

Exchange list

Buy Bitcoin By Country

In-depth guides on how to buy Bitcoin in your country using various payment methods.