Table of contents

Overview and History

FTX is one of the newest crypto exchanges in the space. FTX was incubated by Alameda Research, a top market maker and liquidity provider for different exchanges that handles around $1 billion in daily transaction volume. This is the reason why FTX has had industry-leading order books right from the very start. In less than a year, they already record one of the highest volumes in the space trading over $20 million in their spot exchange while their derivatives platform handles over $500 million daily. They have positioned themselves to be an exchange made by traders and made for traders and it has proven to be an untapped niche that they’ve successfully tapped and made an excellent product for.

FTX was founded by a diverse team of Wall Street and Silicon Valley alumni. Their CEO, Sam Bankman-Fried was previously a trader on Jane Street Capital’s international ETF desk, where he traded a variety of ETFs, futures, currencies, and equities and helped design the firm’s automated OTC trading system. Their CTO Gary Wang and COO Andy Croghan, bring decades of combined experience from leading organizations such as Optiver, Susquehanna, Google, and Facebook. FTX is owned by FTX Trading LTD, a company incorporated in Antigua and Barbuda.

FTX is also backed by several high profile industry players and venture capitalists. Binance, the world’s top cryptocurrency exchange, announced that they invested an undisclosed sum in FTX. Other notable investors include: Proof of Capital, a blockchain-focused fund launched by HTC’s chief decentralized officer Phil Chen, Greylock Capital’s Chris McCann; and 500 Startups partner Edith Yeung. Other investors include Consensus Lab, FBG, and Galois Capital. In March of 2020, FTX closed another funding round that valued the company at $1 Billion.

FTX Products

Indexes

One of FTX’s unique products are the different indexes they have created and offered. Instead of betting on just one cryptocurrency, why not bet on the index which usually represents a sector. Below are some examples of creative indexes created by FTX.

- EXCH: Index of different exchange tokens such as BNB, HT, OKB, LEO and GT.

- DRGN: Index of different chinese blockchain projects including prominent ones such as NEO, ONT, QTUM, TRX, VET, and ARPA.

- ALT: Index of major altcoins including ETH, EOS, XRP, BCH, BSV, and LTC.

- MID : Index of midcap coins such as XTZ, OKB, ATOM, VET, DOGE.

- SHIT: Index of several altcoins such as LSK, ICX, HBAR and ENJ,

- PRIV: Index of different privacy focused coins such as BEAM, DCR, GRIN and XVG.

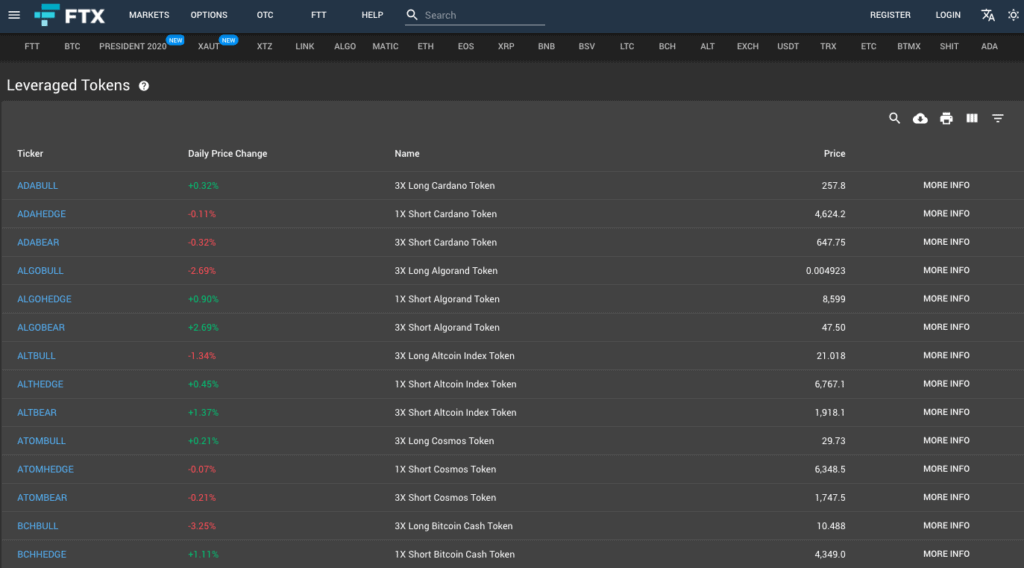

Leveraged Tokens

Leverage trading has become more and more popular in the recent months. This comes in different forms such as margin trading or futures trading. However, there is also a steep learning curve especially for beginners. FTX created leveraged tokens to allow users to buy just a single token to take advantage of different assets’s minor price movements. Leveraged tokens are also readjusted everyday so users will never be liquidated. They started offering BULL (3X Long), BEAR (3X Short), MOON (10X Long) and DOOM (10XShort) tokens. However, they have discontinued the MOON and DOOM tokens and have put their efforts on the BULL and BEAR tokens.

Each leveraged token owns a position in a futures contracts. The price of the token will tend to track the price of the underlying positions it holds. BULL tokens approximates 3x returns, and BEAR tokens approximate -3x returns. There is an approximation because it will rebalance once per day and whenever they get 4x levered. Because of the daily rebalancing, leveraged tokens will reduce risk when they lose and reinvest profits when they win.

Since these are erc-20 tokens, you can easily move them around. These leveraged tokens are slowly getting introduced to other exchanges as well including Bitmax. There are currently 96 different leveraged tokens which include top cryptocurrencies, such as BTC, ETH, XTZ and LINK, their index tokens, and even for gold.

MOVE contracts

FTX has entered the options space with its industry-first MOVE contracts. MOVE contracts are futures that expire to the net amount BTC moves in a time period, whether it goes up or down. MOVE contracts represent the absolute value of the amount a product moves in a period of time. So if a daily BTC moves $125 from the beginning to end of a day, the BTC-MOVE contract will expire to $125 whether BTC went up or down.

FTX offers daily, weekly, and quarterly MOVE contracts and is currently available exclusively for Bitcoin. Since these MOVE contracts are derivatives, you can long or short these contracts as well with leverage.

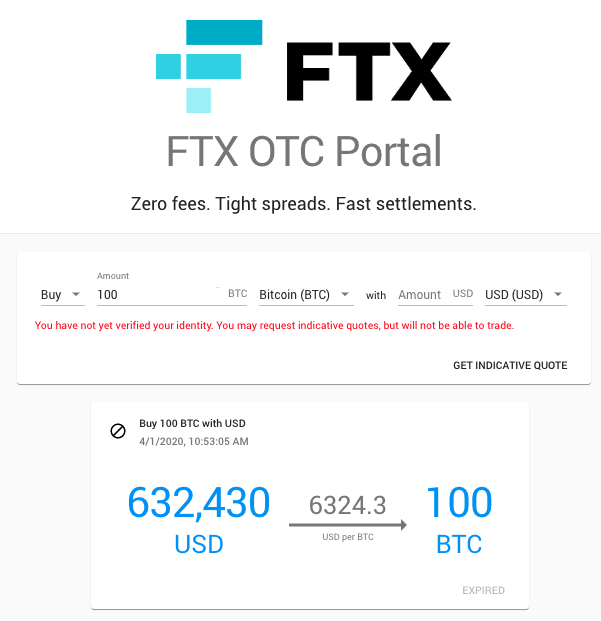

FTX OTC

FTX offers a 24/7 OTC portal which is powered by Alameda Research, the market making company behind FTX which trades hundreds of millions of dollars every day. You can receive quotes on over 20 coins instantly and trade them, accessing deep liquidity without any fees.

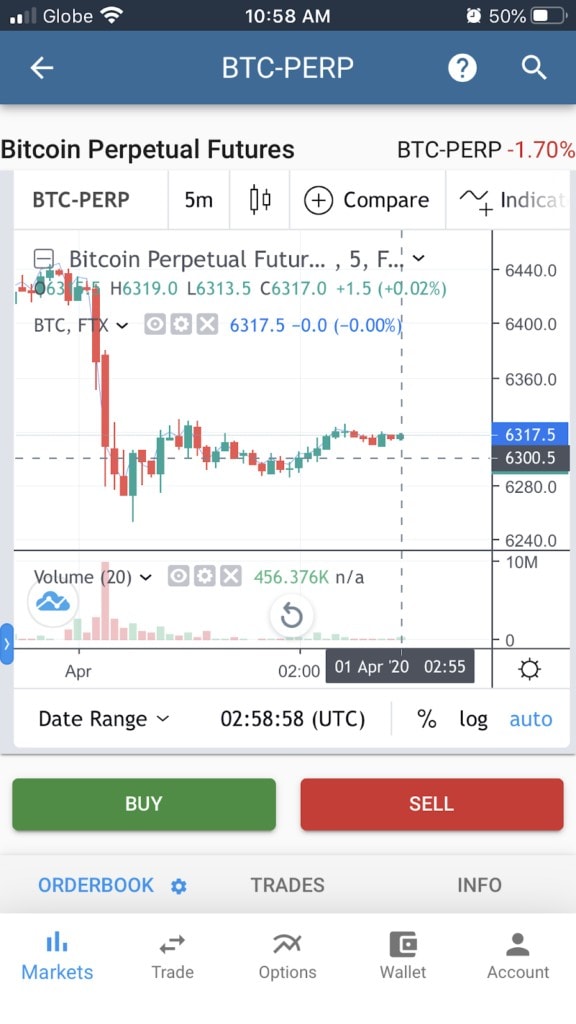

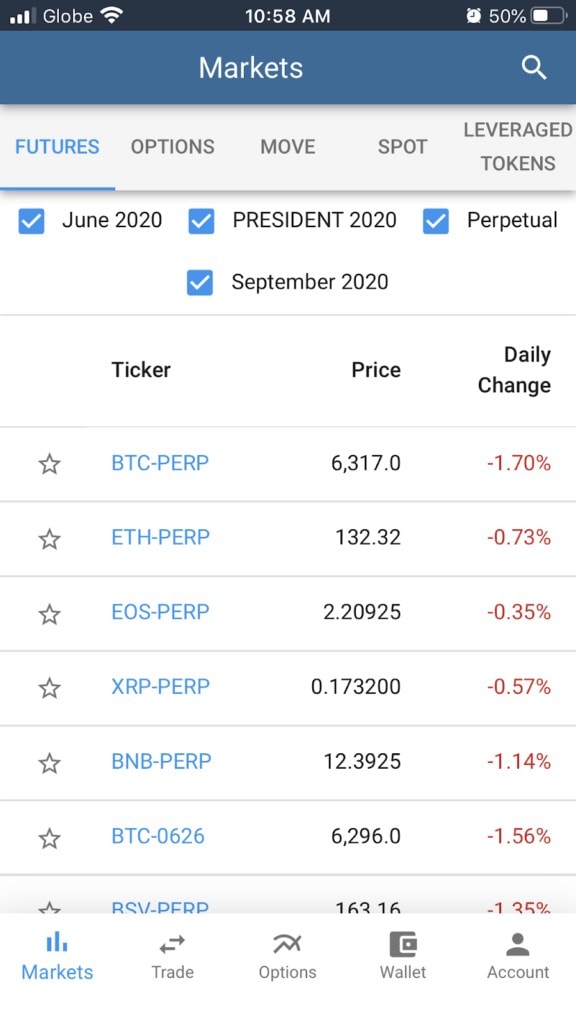

FTX Mobile App

From initial looks, the app looks very bare and stripped to the bones. However, it operates very smoothly and allows you to trade as if you were on your desktop. FTX’s mobile app allows traders to check their positions and trade even while on the go. Their app is available on both iOS and Android. You can trade all FTX products including spot, futures, perpetual swaps, options, MOVE contracts and leveraged tokens.

Their mobile charts still uses TradingView. You can access a lot of different functionalities that are available on TradingView including dozens of built in indicators. However, you won’t be able to draw while on mobile.

FTX Spot Exchange

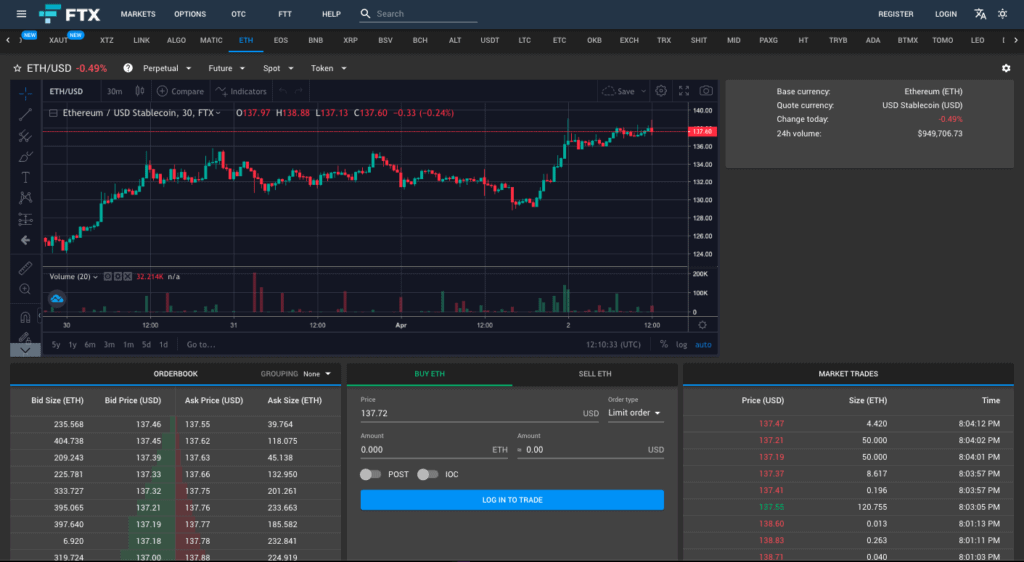

Unlike most exchanges, FTX’s spot exchange comprises a smaller portion of their total trade volume compared to their derivatives exchange. They offer very few tokens for their spot exchange which are currently limited to FTT (FTX’s token), BTC, XAUT (Gold), ETH, BNB, BCH, LTC, USDT, TRYB, BTMX, and PAXG.

As for the interface, it is the same for both spot and futures markets. The TradingView integrated charts are on the left while the order books, order options and market trades are at the bottom. FTX’s interface is actually customizable where you can move the different elements around to see what you like best. Another thing that you can’t find anywhere else is that the charts will display your pending orders as well as at which candles your orders executed at. This is really useful and why it’s hard not to look down on other exchange’s interface when you’re accustomed to trading on FTX. They also a wide range of order options such as: limit orders, market order, stop market, stop limit, trailing stop, take profit and take profit limit. A more detailed guide can be seen here: Advanced Order Types

FTX Leverage Trading

Leverage trading, FTX’s bread and butter. Leverage trading has become a growing trend in the space especially with more and more exchanges offering this service. Derivatives trading platforms allow users to trade derivatives of underlying assets. Users can buy more than their balance allows but with it also carries the risk of possible liquidation. In normal spot trading, your balance will never go to zero unless the underlying asset goes to zero. But with leverage trading offered by derivatives platforms, users can get liquidated depending on the leverage they use. Using a 10x leverage, a 10% move in asset can either double your holdings or bring it to zero.

Leverage trading is available for all derivatives including indexes. FTX also employs an advanced liquidation engine that significantly reduces the likelihood of clawbacks. They also have a liquidation fund in place.

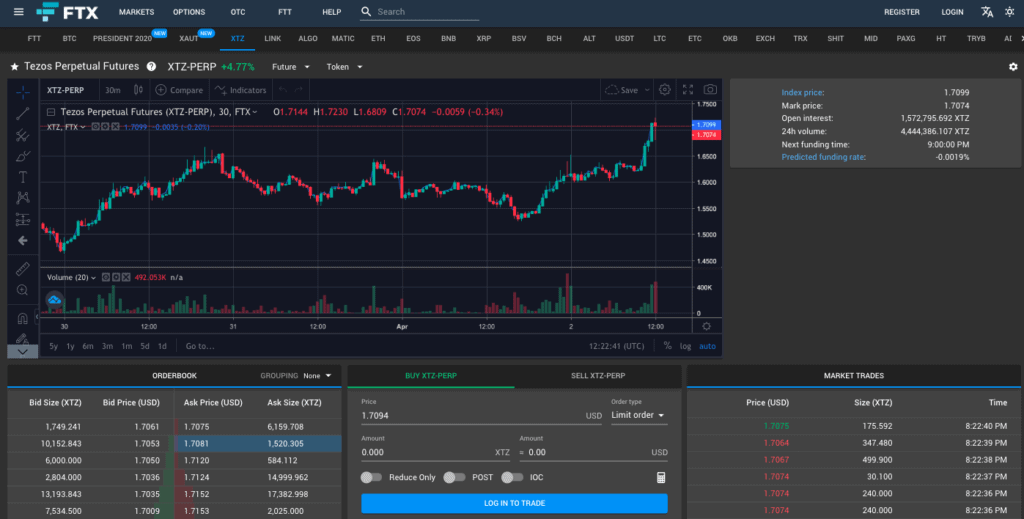

Perpetual Swaps

FTX Perpetual Swaps mimics the spot market price but since it is just a derivative of the actual market, price variations can vary but is often miniscule. The index price is taken from different exchanges to make sure that it reflects the general market price and is not affected by one exchange’s lack of liquidity. Traders can long or short a position to profit from the increase or decline of a digital asset’s price, or manage their investment risks by hedging.

One thing to note about perpetual swap contracts is that they do not have an expiry unlike traditional futures markets. There will be a funding mechanism that is used to anchor the perpetual swap prices to the spot price. This will be explained in the funding fee section below.

Funding Fee

One additional fee that is added for trading perpetual swaps is called funding fee. This is a fee added on top of the maker and taker fees. The funding fee essentially works as a mechanism to reach spot price equilibrium. When there are more buyers (long position) than sellers (short position), the funding fee is positive. This means those in a long position will pay the funding fee to short sellers. And if there are more short sellers, the funding fee is negative and short sellers pay those in long. You basically get rewarded for going against the majority.

Funding rate is seen at the stats section with the text “predicted funding rate”. You will also see the open interest and the funding settlement time.

Futures Contracts

Unlike perpetual swap contracts, futures contracts do have an expiry date. You can trade up to a max leverage of 100x. FTX offers quarterly futures contracts. For example, if you are trading the June contract (e.g. BTC-0626), you are trading the BTC contract that will expire at June 26. If you expect the BTC price to settle at $10,000, you can buy it now for 8,800 and receive the BTC upon expiration. For futures contract trading, you will not be charged funding fees which is an main advantage against perpetual swap contracts. Futures contracts often trade at a premium or discount depending on market sentiment. There are no funding fees for futures contracts

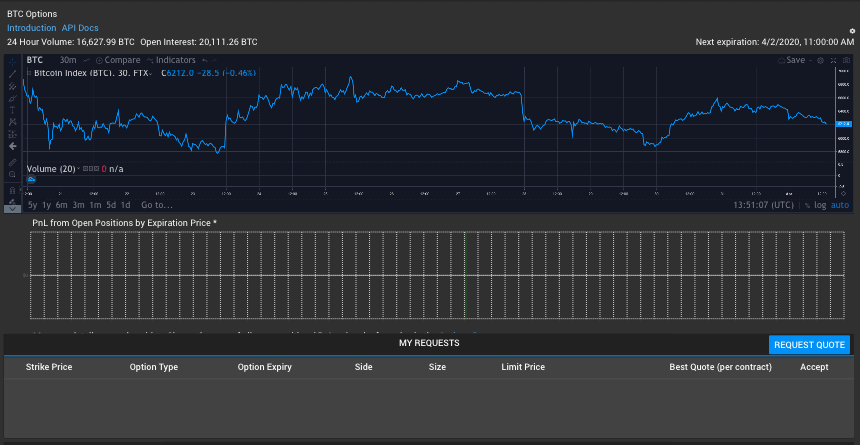

Options Trading

FTX launched their options trading market in January of 2020. At the time of writing, it’s still a new product having been available only for 3 months. Their options market is still a quote based system which means it’s much slower having to wait for counterparty quotes.

Options give contract holders the right to buy or sell an underlying asset on a fixed day in the future. This is a great way to hedge the value of your asset without necessarily selling it. It works like an insurance policy. The longer the insurance, the more you will have to pay for it. You can find more details about options trading in this link: FTX Options Explainer

Fees

Trading Fees

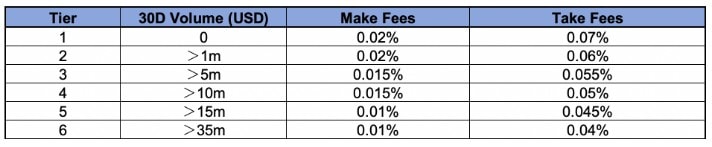

Compared to most exchanges, FTX’s fees are one of the lowest in the market. Their trading fees start at 0.02% maker fee and 0.07% taker fee. Since they offer tiered fees system, there are two ways to lower this fee even more. First, increase your 30 Day trading volume.

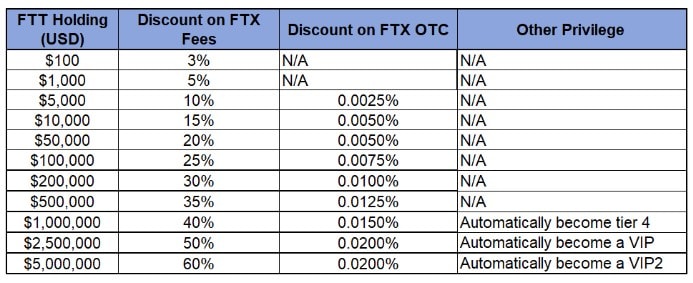

The second way to decrease the fees you pay is by holding their token FTT. The more FTT tokens you hold, the higher the discount you’ll get.

High Leverage Fees

When trading using 50x leverage and 100x leverage on trades, FTX will charge higher fees given there’s a higher chance of liquidation and slippage. Using leverage of 50x increases trading fees by 0.02%, and 100x or higher trading fees increases by 0.03%, which is paid to the insurance fund.

Deposit and Withdrawal Fees

FTX does not charge any deposit or withdrawal fees. While most exchanges do not charge deposit fees, it is a rare occurrence, if not the only, for an exchange to not charge withdrawal fees.

Leveraged Tokens Fees

FTX leveraged tokens have creation and redemption fees of 0.10%, and daily management fees of 0.03%. But if you are only trading them, these fees do not apply.

FTT (FTX Token)

Right after the launch of the exchange, FTX immediately launched their own exchange token called FTT which works as the backbone of the entire exchange. It has multiple use cases as explained by the team. Like most exchange tokens, the first use case is using it to get fee rebates. Even with already very competitive fees, having FTT helps you lower your fees even further as explained in the trading fees section. FTT can also be used as a collateral for your trades. And lastly, FTX will do Buy & Burn programs to decrease market supply which in turn increases the price of the token. The buying and burning will be done weekly. The money will come from the following activities.

- 33% of all fees generated on FTX markets.

- 10% of net additions to the insurance fund (‘Socialized Gains’)

- 5% of fees earned from other uses of the FTX platform

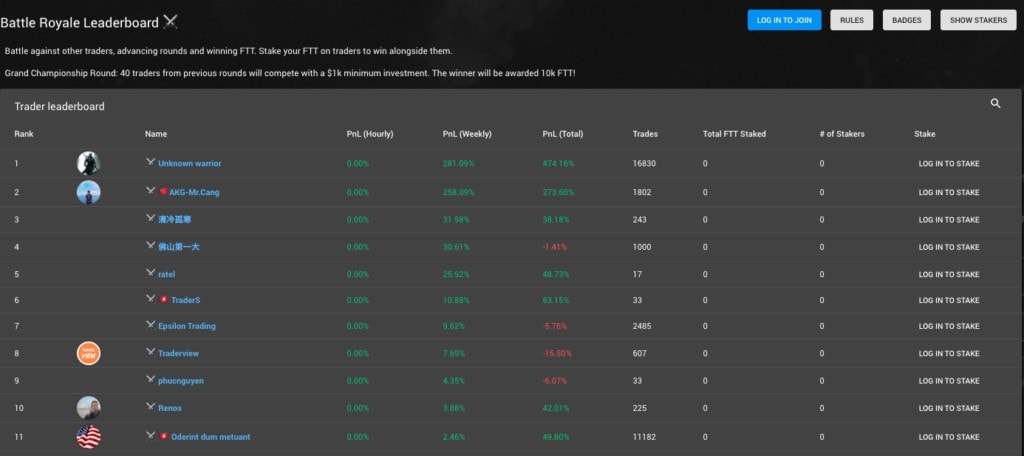

FTX Competitions

One of the main selling points when FTX started was that they would hold trading competitions every so often. They even let users create their own competitions. This definitely helped them get the attention of experienced traders who joined. Users can also stake FTT on their favorite traders and also get a share of the prize.

FTX Customer Support

Like most exchanges, FTX’s support is offered in two main ways, through their FAQs as well as through their ticketing system. Their FAQs are quite comprehensive and cover all topics from API integrations to KYC issues. If your question is more specific than those in the FAQ, you can send an email request to their support staff who will happily help you with your concerns.

Operation Security

FTX offers industry grade security on their platform. To date, FTX has never been hacked and that is why retail and institutional traders trust them. They also offer multiple ways for users to safeguard their assets be it from external threats (e.g. scammers) or even liquidations.

Sub Accounts – FTX allows users to create sub accounts. This removes the chance for your entire fund getting wiped out because of a single liquidation.

2FA – This has been a standard form of account protection for crypto exchanges. This involves using a separate device that generates a unique code or combination every few seconds. You will be asked to enter this upon signing in, making withdrawals, API creation and etc.

Withdrawal Password – FTX allows you to set up a withdrawal password which is specifically used only for withdrawals.

Read-Only password – This password allows another user to log in to your account that can only read. They cannot perform other actions such as putting an order, making withdrawals or even changing of settings.

Conclusion

FTX has identified and built a solid product for their target demographic, the professional traders. They are a very innovative team creating many firsts for the industry. It helps that their founders come from trading backgrounds as well. Liquidity is almost never an issue given that they are backed by Alameda Research. They have grown in popularity as well as in trading volume in a very short span of time. This shows that users love their product and that they trust the exchange.