Just a few months ago, before the pandemic struck and also in the month of March when Bitcoin crashed, many people envisioned Bitcoin as being an extremely volatile asset that had to be ventured into carefully and with a certain level of expertise. JP Morgan, a name everyone reckons with sound investment strategy also had been extremely skeptical about Bitcoin. But, JP Morgan and its team are singing a different tune now!

JP Morgan’s Global Markets Strategy group is now regarding Bitcoin as one of the best alternatives to gold and an investment tool for the millennials. It sees the emergence of Bitcoin as a strong value of storage assets believing that if the trend continues, it could lead to a doubling or a tripling in the price of the cryptocurrency.

Back in 2017, CEO Jamie Dimon’s perspective towards Bitcoin was extremely aggressive when he named Bitcoin as ‘fraud’. He even went to the extent of saying he would fire anyone who would be trading it and for being ‘stupid’. And now that the tables have turned with time and Bitcoin emerging as an all-powerful asset class, the organization has shifted its viewpoint 360-degrees. Not just this, a research note that was published on Friday also oriented their attention towards how sturdy it has become and reliable storage of value which they did not see back then.

There are many reasons as to why JP Morgan has experienced a sudden transition in its heart towards Bitcoin. The first and foremost being bigger enterprises investing in Bitcoin with long-term in mind. Square’s recent move to add $50 million of Bitcoin to its assets was a major boost Bitcoin received. PayPal’s decision to include Bitcoin in its offering to customers was again a major decision to be taken in favor of Bitcoin. The inclusion has led to a spurt of new-found positivity in Bitcoin and added a whole new dimension to its worth. Another big reason for the paradigm shift has been the emergence of a new-age millennial population in which Bitcoin is being chosen by the youth over gold.

The report added, “The older cohorts prefer gold, while the younger cohorts prefer Bitcoin as an ‘alternative’ currency.”

The fact that Bitcoin is now being embraced by the millennials is something that was on the cards but not that despite gold being one of the preferred metals to place bets on has taken over Bitcoin. The value of gold and Bitcoin ETFs are nearly equal, but when we talk about the total worth of yellow metal it is worth $2.6 trillion as compared to $240 billion for Bitcoin. The main reason for this is that large amounts of gold are in the form of bars and coins, and Gold also is one of the oldest investment zones explored by generations of people.

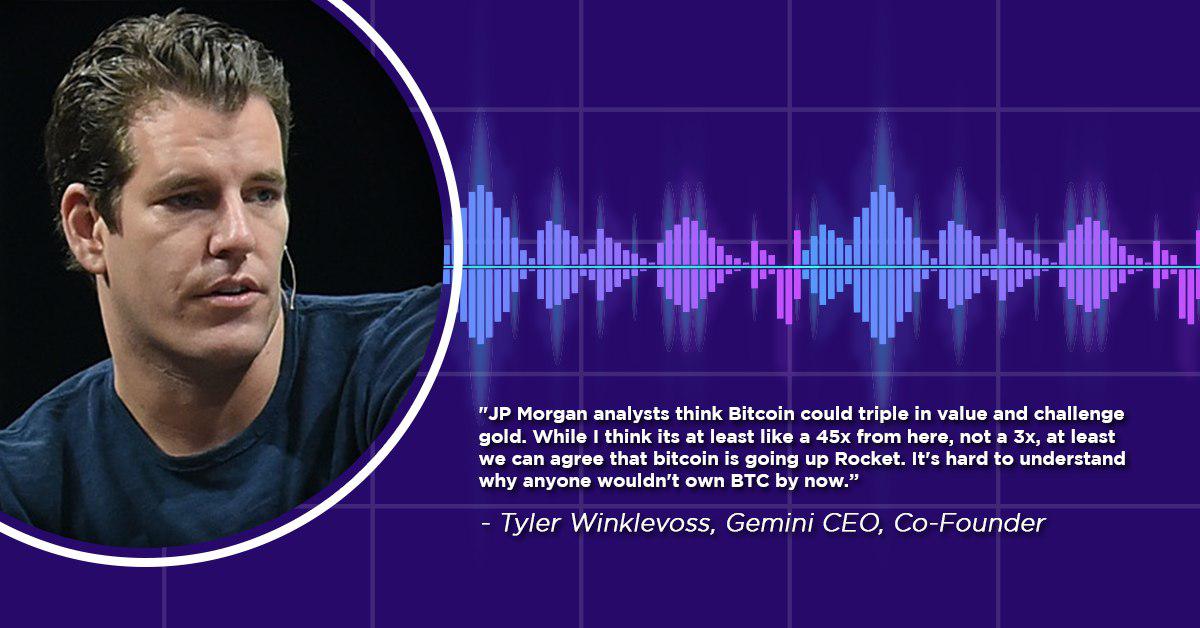

JP Morgan’s recommendation comes with a sign of warning as it feels that “for the near term, Bitcoin looks rather overbought and vulnerable to profit-taking we think.” It has predicted a 3times growth for it, while Tyler Winklevoss thinks otherwise. See the Tweet below:

Source: Twitter