With over $400 million in Bitcoin, MicroStrategy wants to change its status in cryptocurrency. The firm is looking to recruit blockchain experts to launch data-based Bitcoin services.

The software company’s adventure in the Bitcoin universe continues. The surge of cryptocurrency on the market gives its leaders ideas. MicroStrategy already owns more than 38,000 Bitcoin, acquired for approximately $11,600.

With a crypto asset now worth $18,500, the company is already realizing a very significant capital gain. But it is now considering launching business intelligence services around Bitcoin.

A wealth of information to be extracted from the Bitcoin blockchain

MicroStrategy’s core business is to provide data-driven software or business intelligence to its enterprise customers. MicroStrategy now plans to apply this expertise to Bitcoin. As a result, the company is looking to recruit new experts.

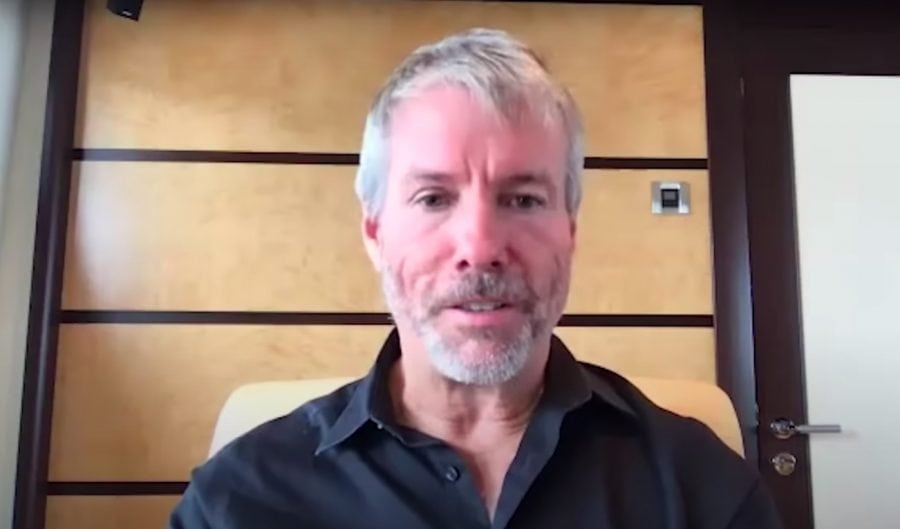

MicroStrategy is looking to hire blockchain specialists to help it design data services for the Bitcoin blockchain. MicroStrategy’s CEO, Michael Saylor, presented his ambitions in this area to investors on November 16.

“There’s a whole universe of possibilities in terms of information that is exploding, all around this unique type of information about Bitcoin that we can extract from the blockchain,” said Saylor. “And we’re going to explore it all,” he added.

But the publisher is still only at the thinking stage. What is certain at this point in time is MicroStrategy’s desire to move from being a Bitcoin investor to being a solution provider for this market.

“We don’t yet have a single thing we’re sure would make sense to market,” Michael Saylor acknowledges to investors. However, the resources invested to do so demonstrate the company’s interest in this data market.

“We are actively seeking to identify and recruit talented individuals with blockchain expertise who would like to join us on this journey,” says Tim Lang, CTO of the publisher.

CEO Michael Saylor reconfirms his commitment to Bitcoin. In addition to his company’s $425 million investment, the CEO personally owns more than 17,000 Bitcoins.

For the boss, no other investment, especially gold and raw materials, can compete with cryptocurrency. Thus, Bitcoin stands out as the best guarantee or coverage in the world in comparison, he insisted.

“Bitcoin, if it’s not a hundred times better than gold, it’s a million times better than gold, and there’s nothing like it,” he concluded to justify these various investments in favor of Bitcoin.