Table of contents

Overview and History

Bitfinex operates one of the oldest yet still biggest and most liquid cryptocurrency exchanges in the market. Founded in 2012, Bitfinex was one of the pioneer crypto exchanges that still operate and have a large active user base to this day. They currently handle over $200 million in daily volume for their spot exchange with their BTC/USD pair accounting for more than 50% of this volume.

It was founded by Giancarlo Devasini and Raphael Nicolle and is operated by iFinex which is registered in Hong Kong with an office in Taipei. Bitfinex attracts both beginners and advanced traders alike because of its simple and yet powerful platform. It is also home to large institutional traders as well because of the deep liquidity they have especially in the spot market.

The company was also one of the first to provide access to peer-to-peer financing, an OTC market and margin trading for a wide selection of cryptocurrencies. Its peer to peer financing is one of the most used features by its millions of users.

Supported Countries

Bitfinex services almost the entirety of the world. However due to financial regulation that are based on each country’s jurisdiction, Bitfinex services are not available to users in the following countries:

- Bangladesh

- Bolivia

- Ecuador

- Kyrgyzstan

- United States

Main Spot Exchange

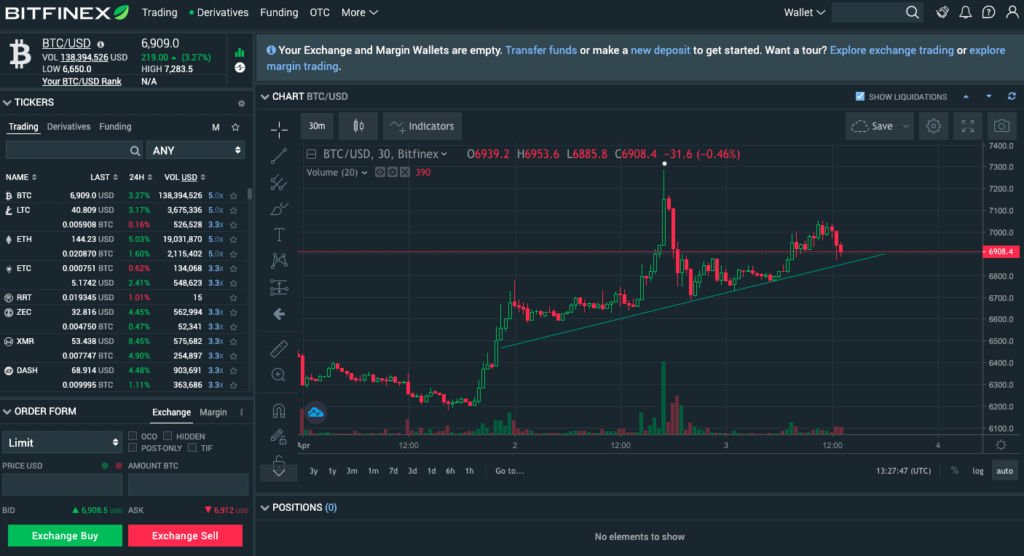

Little has changed in Bitfinex’ layout over the years. Why change it when it works? Bitfinex integrates TradingView charts which is almost a standard among crypto exchanges. The site loads fast and the chart is snappy. The different tickers are on the left side along with the order form. Order books and trade history can be found at the bottom.

Bitfinex offers more than the usual limit order and stop orders for it’s ordering options. They also offer stop limit, trailing stops, fill or kill, immediate or cancel, as well as scaled order options. This gives traders more flexibility when crafting their entry and exit strategy.

Leverage Trading

Leverage trading allows users to trade more than what their balance normally allows. They can use leverage to take advantage of small movements in the price of an asset and amplify its effect. Ofcourse, with the greater rewards also come greater risks.

Margin Trading

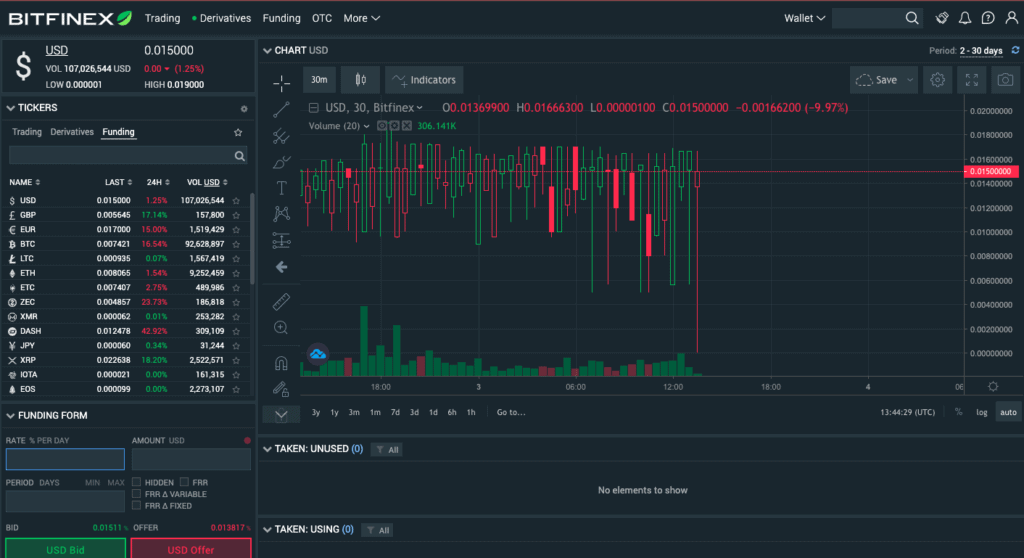

Margin trading allows you to borrow money from the exchange and use it to trade while using your available assets as a collateral. When you borrow, there will be a corresponding interest that must be paid. Unlike most exchanges where users borrow money for margin directly from the exchange, Bitfinex uses a peer to peer lending system. They have also turned this into a market in itself where you can lend money and offer what rate you would like to.

Perpetual Swaps

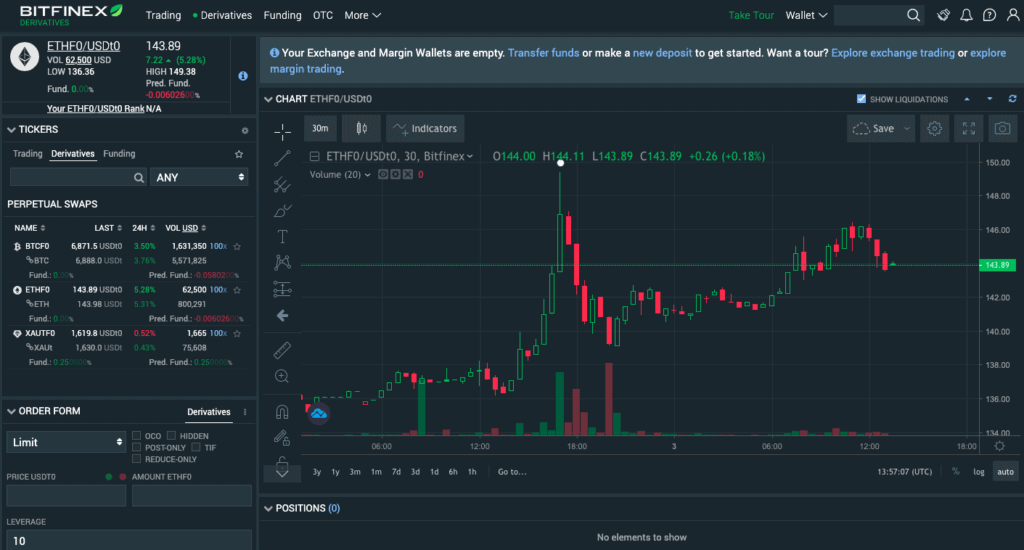

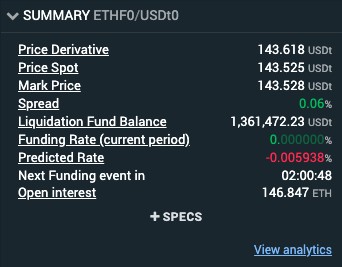

Currently, Perpetual Swap contracts are the only derivatives being offered by Bitfinex. Perpetual Swap is a crypto asset derivative product that mimics the spot market price. However, there are minimal differences between the index price and the mark price since this is just a derivative of an actual underlying asset. Traders can long or short a position to profit from the increase or decline of a digital asset’s price, or manage their investment risks by hedging. There will be a funding mechanism that is used to anchor the perpetual swap prices to the spot price. This will be explained in the Funding Fee section below. One thing to note about perpetual swap contracts is that they do not have an expiry date unlike futures markets.

Funding Fees

One additional fee that you must be wary of when trading Perpetual Swaps is the funding fee. This is a fee added on top of the maker and taker fees. The funding fee essentially works as a mechanism to reach spot price equilibrium. When there are more buyers (long position) than sellers (short position), the funding fee is positive. This means those in a long position will pay the funding fee to short sellers. And if there are more short sellers, the funding fee is negative and short sellers pay those in long. You basically get rewarded for going against the majority. This fee is calculated and deducted every 8 hours. It can be found on the summary section in the main trading screen.

Other Bitfinex Products

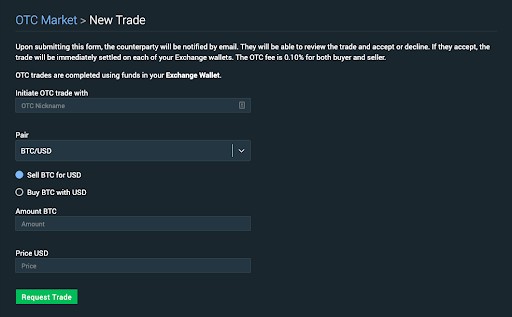

OTC Desk

Like most top tier crypto exchanges, BItfinex offers an OTC desk where users can buy and sell big blocks of orders without affecting the market price. Bitfinex will act as the middleman or escrow. Just enter the nickname of the account you want to deal with and the amount and rate you’d like to buy. Bitfinex charges a 0.1% fee on both sides of the trade.

Bitfinex Token Sales (IEO)

With 2019 touted as the year of IEOs, Bitfinex also launched their own token sale platform. It was originally named tokenix but was later renamed to Bitfinex Token Sales. An IEO is similar to an ICO, also known as an Initial Coin Offering. An ICO is the first time that a crypto token has been made available for sale to the public. This is akin to an IPO in traditional markets. What makes IEOs different is that instead of companies raising funds directly from users, companies transact via a trusted third-party exchange. This allows projects to leverage an exchange’s brand as well as user base.

Bitfinex’s first IEO was for Ampleforth (AMPL) which sold out in just under 11 seconds. After that, they had 2 more successful IEOs called ULTRA and DUSK network.

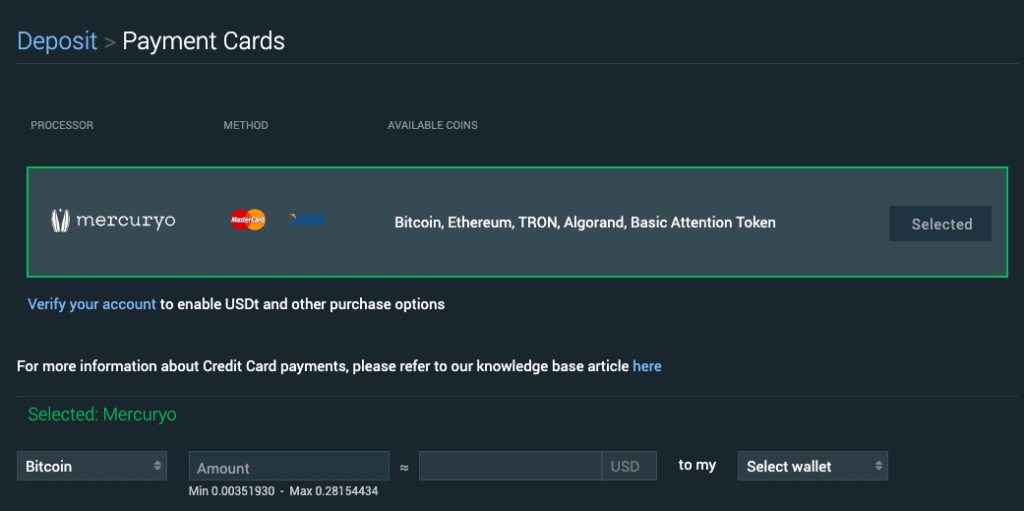

Fiat Gateways

Bitfinex allows traders to buy cryptocurrencies using third-party payment processors like Mercuryo. The coins purchased will automatically be sent to your Bitfinex wallet. You can now easily buy major crypto currencies like Bitcoin, Ethereum, TRON, and Algorandwith your credit card or debit card.

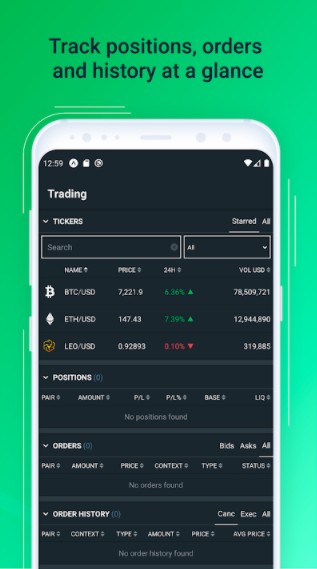

Bitfinex Mobile App

Their mobile app which was first launched in October 2018, which is available in both Android and iOS devices, allows you to stay updated, trade and check your transactions from your mobile phone. Similar to the website, the app also allows a customized platform through their preferences tab and users can get real time data though the notifications on execution and price alerts. Users get to create a new API key for added security by simply logging into the app and generating your own API key. This allows you to select custom based on the permissions you allow the mobile app.Once the API key is created, a QR code will be shown in your browser and you can scan this QR code to import the API key and login. After this setup then can you access the mobile app through a passcode. Other features include the exchange and margin trading, charts, margin funding, new deposits, last movements and price alerts. Existing orders can also be viewed, modified or canceled within the charts.

Trading Fees

Being one of the pioneers and established platforms in cryptocurrency, Bitfinex’ fees are at par with on-going market rates. They start at 0.1% for maker fees and 0.2% for taker fees. Like most exchanges, they also offer a tiered fees system to incentivize high volume trading among users. The more you trade, the lower your fees will be. At $7.5 Million, maker fees go down to zero making it free. Taker fees can go as low as 0.055% but will require $30 Billion worth of volume.

| EXECUTED IN THE LAST 30 DAYS (USD EQUIVALENT) | MAKER FEES | TAKER FEES | TAKER DISCOUNT LEO HOLDERS |

| Greater than $0.00 traded | 0.100% | 0.200% | up to -(25.000% + 6bps) |

| $500,000.00 or more traded | 0.080% | 0.200% | up to -(25.000% + 6bps) |

| $1,000,000.00 or more traded | 0.060% | 0.200% | up to -(25.000% + 6bps) |

| $2,500,000.00 or more traded | 0.040% | 0.200% | up to -(25.000% + 6bps) |

| $5,000,000.00 or more traded | 0.020% | 0.200% | up to -(25.000% + 6bps) |

| $7,500,000.00 or more traded | 0.000% | 0.200% | up to -(25.000% + 6bps) |

| $10,000,000.00 or more traded | 0.000% | 0.180% | up to -(25.000% + 6bps) |

| $15,000,000.00 or more traded | 0.000% | 0.160% | up to -(25.000% + 6bps) |

| $20,000,000.00 or more traded | 0.000% | 0.140% | up to -(25.000% + 6bps) |

| $25,000,000.00 or more traded | 0.000% | 0.120% | up to -(25.000% + 6bps) |

| $30,000,000.00 or more traded | 0.000% | 0.100% | up to -(25.000% + 6bps) |

| $300,000,000.00 or more traded | 0.000% | 0.090% | up to -(25.000% + 6bps) |

| $1,000,000,000.00 or more traded | 0.000% | 0.085% | up to -(25.000% + 6bps) |

| $3,000,000,000.00 or more traded | 0.000% | 0.075% | up to -(25.000% + 6bps) |

| $10,000,000,000.00 or more traded | 0.000% | 0.060% | up to -(25.000% + 6bps) |

| $30,000,000,000.00 or more traded | 0.000% | 0.055% | up to -(25.000% + 6bps) |

Another way to lessen fees is by holding a certain amount of their exchange token called LEO. The table below breaks down the different level requirements and associated discounts.

| Level 1 | Level 2 | Level 3 | |

| Level requirement | 1 USDt LEO equiv. | 5000 USDt LEO equiv. | 10000 USDt LEO equiv. |

| Crypto-to-Crypto | -15.000% (Taker fees) | -25.000% (Taker fees) | -(25.000% + up to 6bps) (Taker fees) |

| Crypto-to-Stablecoin | -15.000% (Taker fees) | -25.000% (Taker fees) | -(25.000% + up to 6bps) (Taker fees) |

| Crypto-to-Fiat | – | – | -(10.000% + up to 6bps) (Taker fees) |

| Crypto-Derivatives | – | – | -(up to 2bps) (Taker fees) |

Other fees

As for deposits and withdrawals, all deposits are free while withdrawals incur different fees that vary based on the cryptocurrency you are withdrawing. Major cryptocurrencies like BTC, ETH and USDT (Omni) will have fees of 0.0004 BTC, 0.00135 ETH and 5 USDT respectively.

Bitfinex and Tether

Tether, which is the most used stablecoin in the market, is owned by Tether limited which is a subsidiary of Bitfinex. The concept behind Tether is that for every USDT (USD Tether token), there is a U.S. dollar backing it up in its reserve with cash or cash equivalents. It currently has a market cap of $6 Billion which means that there should be $6 Billion in USD in its reserves. However, there are controversies behind tether that they do not hold that dollar equivalent. The last audit they did was in 2018 with assets of just around $2 Billion. It would be good to see regular audits especially with the growing market cap of tether. Tether is currently available in 3 different blockchain networks, ERC20, OMNI and TRX.

Tether has also recently released a gold backed token called Tether Gold which aims to mimic the price of gold in the market.

LEO token

UNUS SED LEO is the exchange token for Bitfinex and all other iFinex companies including ETHfinex and EOSfinex. They raised $1 Billion in 2019. Like most exchange tokens, LEO supports 2 main use cases. The first is used to decrease the trading fees. As users hold more LEO, their trading fees will decrease accordingly based on a tiered system. Second, Bitfinex will perform LEO buybacks from the market and burn this using 27% of their revenues. This is much higher than other exchanges that normally burn around 20% of fees collected. To date, they have burned 18 million tokens out of the 1 Billion tokens. All LEO burn transactions can be seen here: iFinex’s Unus Sed LEO transparency report

Bitfinex Customer Support

Support service is available 24/7 for Bitfinex but it only allows support tickets via email and response rate takes up 12 hours or sometimes more depending on the complexity of the issue. Users may also refer to the knowledge base section of the site for basic inquiries. Bitfinex also ensures its corporate accounts and professional traders are granted Tier One customer support where support tickets are expedited.

Operation Security

Bitfinex offers a wide range of features to help users guard their accounts and wallets. Here are some of the steps they take and offer to help you protect your account.

2FA – This has been a standard form of account protection for most crypto exchanges. As for Bitfinex, it is required to start trading. This involves using a separate device that generates a unique code or combination every few seconds. You will be asked to enter this code upon signing in. Google Authenticator and Authy are 2 popular apps that offer this.

Advanced Withdrawal Settings – You have the option to lock withdrawals for 24 hours if a new IP was detected. You can also set a custom withdrawal phrase which will be displayed on the confirmation email. This proves the authenticity of withdrawal emails. You can also whitelist withdrawal addresses.

Session Settings – Bitfinex offers different session related features

Keep Session Alive – pings you every 10 minutes to keep the session alive otherwise it will log out your current session.

Send Email on Log in – needs email verification for each log in.

Detect IP address change – where if an IP address changes on any request, all sessions will be logged out. This prevents session hijacking.

Email verifications – Whenever you would like to withdraw funds, an email will be sent to your email address for you to confirm if this transaction is legitimate.

Hot and Cold Wallets – This is a standard procedure that separates revolving funds (hot wallet) and most user funds (cold wallet). The cold wallet is disconnected from the internet so it is less likely to be hacked. It is akin to banks not having all of their money locked in a giant safe. They only hold what they expect to be transacted that day.

Bitfinex’ doesn’t have a squeaky clean hack history. They suffered from a hacking incident in August of 2016. They reported that 119,756 bitcoins were stolen which at that time amounted to $66 million and was one of the biggest Bitcoin hacks then.

Afterwards, Bitfinex brought about a more stringent security system. At present, Bitfinex now stores 99.5% of its clients’ funds in cold storage and only 0.5% are kept in hot wallets to provide liquidity needed for the exchange. Moreover for logins and withdrawals, traders are now required with a two-level authentication process. These are the two-factor authentication and the second layer is the Universal 2nd Factor that requires a security key. They’ve also implemented strict data privacy practices with employees internally. Lastly, the site’s systems and data are reviewed periodically in order to constantly check on the platform’s efficiency and performance.

Conclusion

Bitfinex is one of the pioneers in the crypto exchange space. Despite a big setback due to the 2016 hack, Bitfinex has managed to gain back the market support and users’ trust through paying back the losses of its users. The company has implemented more stringent practices to secure the company. To date, Bitfinex still stands as one of the most significant exchanges in the cryptocurrency system with the largest volume. Being the oldest platforms for cryptocurrency trading, Bitfinex was able to succeed in narrowing down their specific users which are the professional traders but at the same time was able to provide a custom and user friendly dashboard. They also offer great liquidity especially for the BTC/USD pair which is one of the things institutional players look for the most.