Bitcoin continues its rally, even climbing for a while to $16000, a value it had not reached since January 2018. In the last 4 weeks, the price of Bitcoin has risen by more than 30%.

At the end of October, Bitcoin’s transaction costs were rising sharply. The network is suffering from its worst congestion in almost three years. And the reason is simple: the value of the cryptocurrency is soaring.

The first cryptocurrency in capitalization is now at its highest level in 33 months. Bitcoin hadn’t passed such a milestone since January 2018.

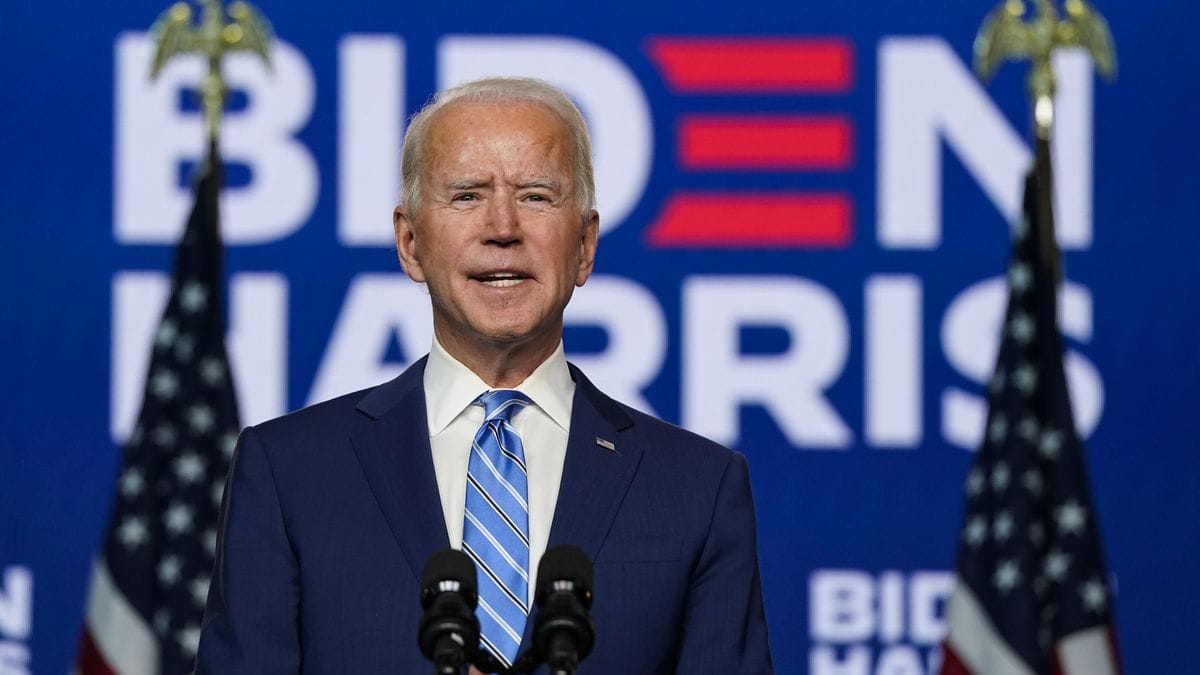

The US presidential election is a source of volatility for Bitcoin, but as of now the results have been quite positive. Despite a small correction on Saturday, Bitcoin is now up to mid $15,000, a price that has been unexpected by even the most bullish of analysts in such a short timeframe.

According to CoinDesk’s Bitcoin Price Index, the digital currency has gained more than 101% since the beginning of the year. But Bitcoin’s appreciation has been even more tangible over the last 4 weeks with an increase of almost 40%.

Inflation and low interest rates favourable to Bitcoin

The results of the U.S. elections are likely to have an impact on whether or not the cryptocurrency rally continues. The Fed’s stimulus measures are also eagerly awaited. However, these will not be known until after the election. We can reasonably expect the president-elect Joe Biden to push for these measures.

“We may not know what a post-election stimulus package might look like, but investors continue to believe that the Fed will continue to print money at a pace that favors the limited supply of Bitcoin,” commented one trader at CoinDesk.

The U.S. central bank is expected to continue buying bonds to increase liquidity. The combination of inflation above 2% and low-interest rates thus favors Bitcoin as a store of value that has benefitted also from increased institutional investment in the last few weeks.